16. What is a Moving Average?

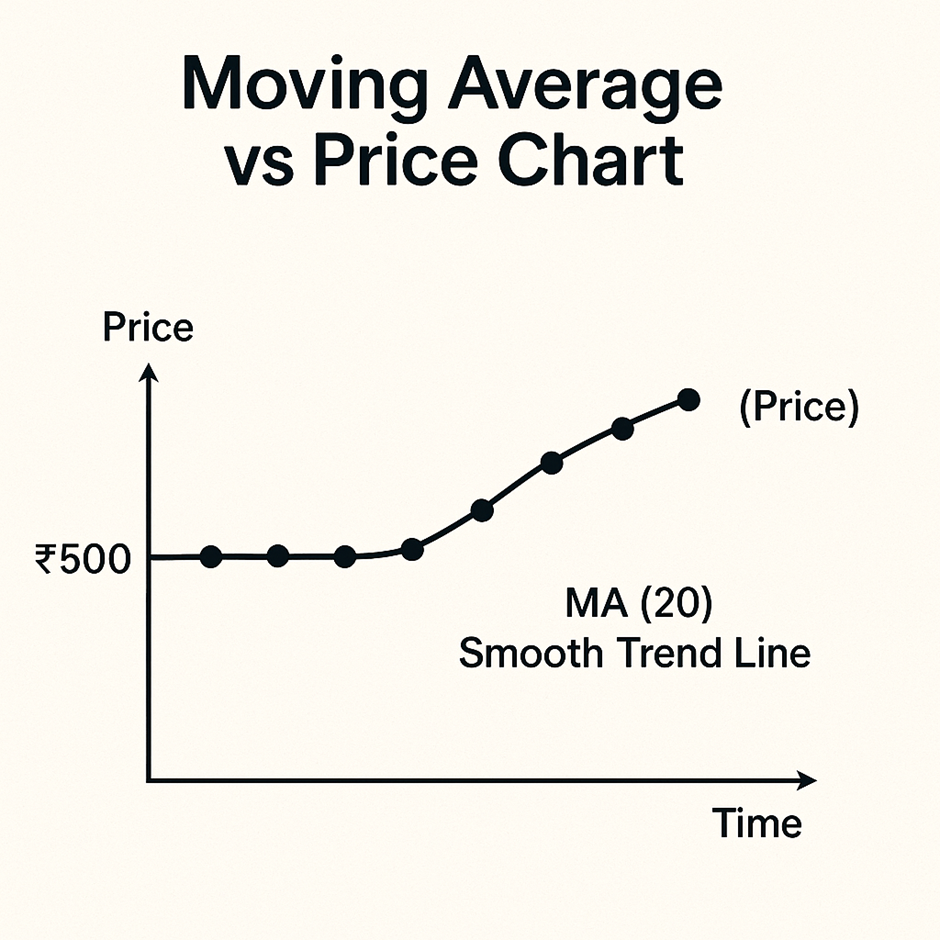

A Moving Average (MA) is one of the most essential tools in technical analysis. It helps traders and investors identify the overall trend of a stock by smoothing out price fluctuations over a specific time period.

“It filters out the market noise and reveals the real trend beneath all the daily price ups and downs.”

Rather than reacting to unpredictable daily movements, a moving average gives a clearer view of momentum — whether the market is trending up, down, or sideways.

How Does a Moving Average Work?

A moving average calculates the average price of a stock over a set number of periods (e.g., 10, 20, 50, 100, 200 days) and updates it as each new period passes. This produces a smooth line on the chart, highlighting the trend.

Why “moving”?

- The average recalculates with each new candle

- The line moves forward in time to reflect the latest prices

Types of Moving Averages

1. Simple Moving Average (SMA)

- Averages all closing prices equally over the period

- Example: 10-day SMA = (Sum of last 10 closing prices) ÷ 10

- Best for long-term trend tracking

2. Exponential Moving Average (EMA)

- Gives more weight to recent prices, making it more responsive

- Ideal for short-term trades or quick market reactions

- Popular among intraday and swing traders

Why Use Moving Averages?

| Purpose | Benefit |

|---|---|

Trend Signals from Moving Averages

Bullish Signal:

- Price above MA → uptrend / positive momentum

- Example: Nifty trades above 50-day EMA → buyers in control

Bearish Signal:

- Price below MA → downtrend / negative momentum

- Example: Tata Motors closes below 200-day SMA → potential bearish trend

Popular Strategy: Moving Average Crossovers

A crossover occurs when one MA crosses another — signaling potential trend changes.

| Crossover Type | Meaning |

|---|---|

These crossovers are commonly used on daily and weekly charts by long-term traders.

Real-World Example: MA in Action

- Stock: Infosys Ltd

- 50-day EMA: ₹1,350

- Current price: ₹1,410

- The stock has been bouncing off the EMA for 3 weeks

Interpretation:

- 50 EMA acts as dynamic support

- Trend remains bullish as long as price stays above the moving average

Best Moving Averages by Trading Style

| Trader Type | Popular MA Settings |

|---|---|

Simplified Chart

Limitations of Moving Averages

- Lagging indicator: based on past prices → signals come after price moves

- Sideways markets: may give false signals

- Should not be used in isolation — combine with volume, RSI, or price action

Key Takeaways

- Moving Average = trend-following indicator that smooths price data

- Helps identify trend direction, confirm signals, and set support/resistance

- Two major types: SMA (simple) and EMA (exponential)

- Strategies: crossovers, price positioning, bounce setups

- Works best in trending markets, and should be combined with other indicators