17. What are Basis and Basis Risk?

This is a comprehensive educational module suited for learners at ATS Academy, covering not only the definitions and formulas but also real-world applications, step-by-step hedging examples, market conditions, and strategic implications. Perfect for both beginners and intermediate-level learners of derivatives.

Introduction to Basis

In futures markets, the basis is a vital concept that connects the spot market (actual asset prices) with the futures market (derivatives). Understanding how this relationship behaves is key for both hedgers and arbitrageurs.

What is Basis?

Formula:

Basis = Spot Price – Futures Price

It shows the difference between the current price of the underlying asset (spot) and the price of its corresponding futures contract.

Example:

- Spot Price of Nifty: ₹22,150

- Nifty Futures Price: ₹22,250

- Basis = ₹22,150 – ₹22,250 = –₹100

In this case, the basis is negative, meaning the futures contract is trading at a premium over the spot price. This is typical in markets with a positive cost of carry.

When is Basis Positive or Negative?

| Market Condition | Spot vs Futures | Basis | Explanation |

|---|---|---|---|

What is Basis Risk?

Basis risk is the risk that the basis will change unexpectedly, reducing the effectiveness of a hedge.

Even if a futures position is perfectly sized, if the relationship between spot and futures prices (i.e., the basis) moves unpredictably, the hedge may not fully protect against losses.

Why Does Basis Risk Occur?

Basis risk arises due to changes in the components that affect the pricing of futures:

| Factor | Impact on Basis |

|---|---|

Real-World Example of Basis and Basis Risk

Scenario:

You are a portfolio manager with ₹1 crore in stocks. To protect against a market decline, you sell Nifty Futures.

-

On Day 1:

- Nifty Spot = ₹22,000

- Nifty Futures = ₹22,100

- Basis = –₹100

-

On Day 20 (just before expiry):

- Nifty Spot = ₹21,600

- Nifty Futures = ₹21,580

- Basis = +₹20

Observation:

Even though the market fell (which your hedge was meant to protect against), the basis changed from –₹100 to +₹20. This movement in the basis results in basis risk and causes the hedge to be less effective.

How Basis Risk Affects Hedgers

| Action | Expected Outcome | What Happens with Basis Risk |

|---|---|---|

Basis risk is particularly important for businesses using futures to hedge real economic exposures (e.g., farmers, manufacturers, exporters).

Basis in Commodity and Currency Markets

Commodity Futures Example (Gold):

- Spot Gold = ₹60,000

- Gold Futures (1-month) = ₹60,600

- Basis = –₹600

Basis is negative (contango). If global rates change or if inflation expectations drop, basis can narrow or even flip (to backwardation), affecting a gold hedger’s outcome.

Currency Futures Example (USD-INR):

- Spot USD-INR = ₹83.00

- Futures USD-INR = ₹83.30

- Basis = –₹0.30

If the RBI intervenes or US interest rates change sharply, the basis can fluctuate rapidly, causing risk to importers/exporters using futures to hedge.

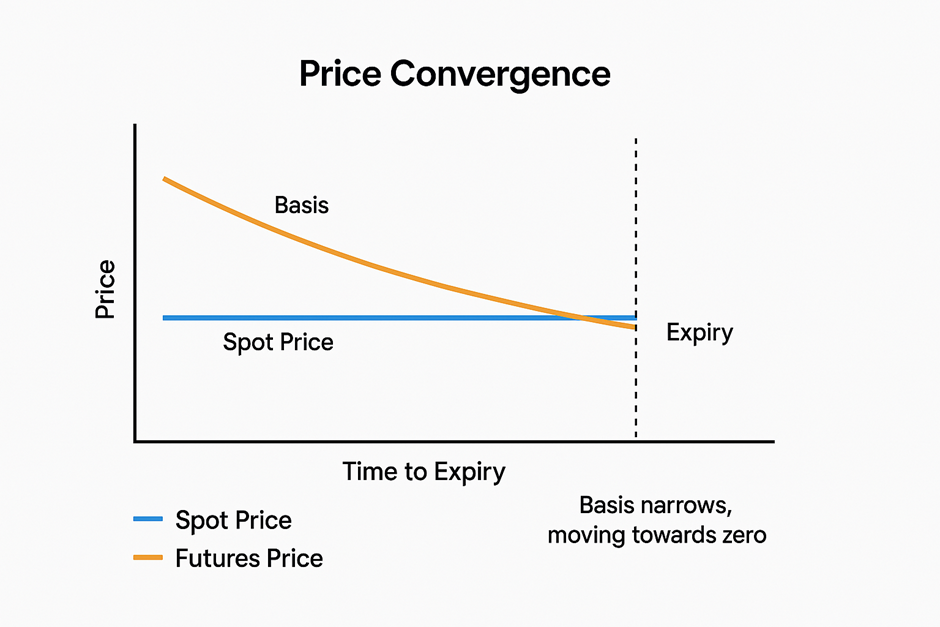

Price Convergence at Expiry

As the futures contract nears expiry, the futures price converges to the spot price because:

- There is little or no time left for cost of carry to apply.

- Arbitrage opportunities are quickly exploited.

- Futures must settle at or near the spot price on expiry.

Therefore, the basis moves towards zero.

Graphical Representation (Description):

- Spot price is flat or gradually moving.

- Futures price starts above spot (in contango) and slopes down towards the spot as expiry nears.

- Basis narrows, moving towards zero.

This demonstrates price convergence and how basis risk decreases closer to expiry.

Summary: Basis vs Basis Risk

| Term | Definition |

|---|---|

Key Takeaways

- Basis is a core concept that connects the spot and futures markets.

- It reflects the cost of carry and market expectations.

- Basis risk occurs when changes in the basis reduce hedge effectiveness.

- For hedgers, managing basis risk is as important as choosing the right contract.

- As expiry nears, basis typically converges to zero, reducing the risk.