2. How Does a Futures Contract Work?

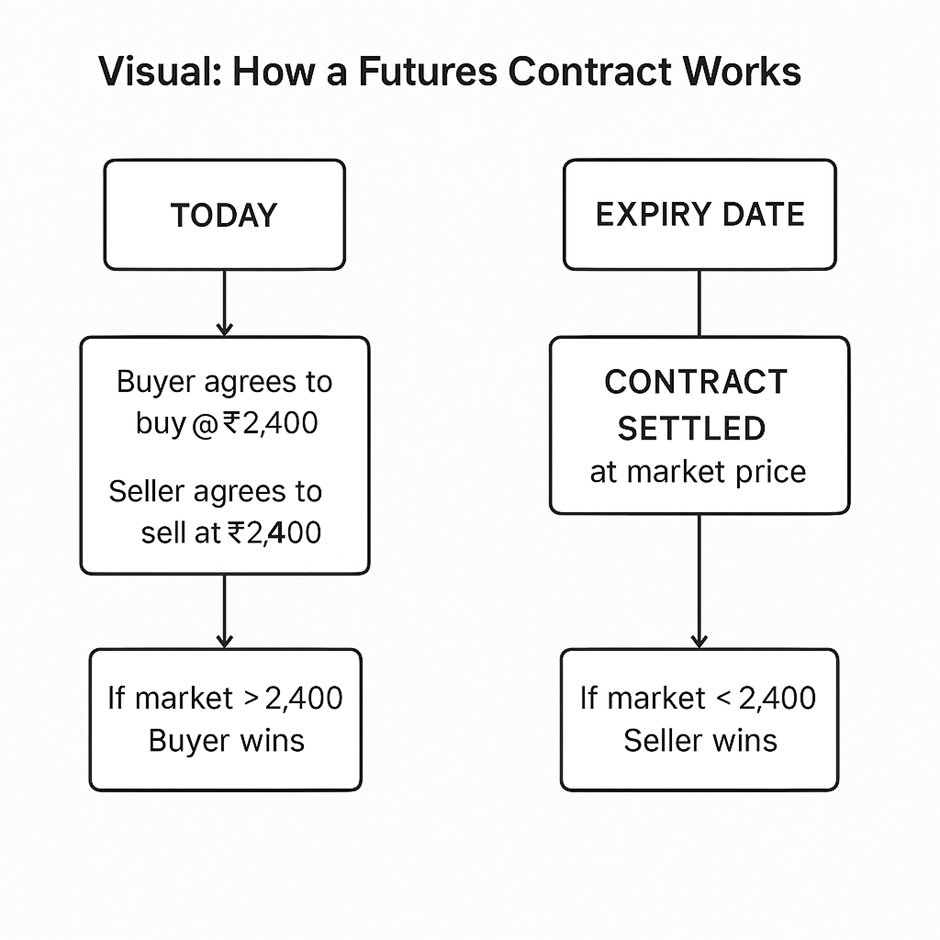

A futures contract is a standardized legal agreement between two parties to buy or sell an asset at a predetermined price on a specified future date.

Unlike spot trading where the transaction happens immediately, in futures trading, the contract locks in the price today, but the actual exchange of money and (if applicable) the asset happens on the contract's expiry date.

These contracts are traded on regulated exchanges (like NSE or MCX in India) and are governed by the clearing corporation that guarantees the trade.

Why Is It Called a “Futures” Contract?

Because you agree to transact in the future—but you’re fixing the price today.

Whether the price moves up or down, both parties are legally obligated to settle the contract on or before expiry.

Who Participates in the Contract?

| Role | Belief/Intention | Outcome if Price Rises | Outcome if Price Falls |

|---|---|---|---|

Both parties agree on:

- The asset to be traded

- The price

- The contract size (lot size)

- The expiry date

Standard Features of a Futures Contract

| Term | Explanation |

|---|---|

Step-by-Step Example

- Reliance stock is trading at ₹2,400 today

- Trader A expects the price to go up

- Trader B expects the price to go down

- They enter into a futures contract at ₹2,400

- Lot size = 250 shares

Scenario 1: Price at Expiry = ₹2,500

- Trader A (Buyer): Profit = (2,500 – 2,400) × 250 = ₹25,000

- Trader B (Seller): Loss = ₹25,000

Scenario 2: Price at Expiry = ₹2,300

- Trader A: Loss = (2,400 – 2,300) × 250 = ₹25,000

- Trader B: Profit = ₹25,000

The profit/loss depends entirely on the difference between the agreed price and the market price at expiry.

What Happens Before Expiry?

- Traders can exit the position before expiry by entering an opposite trade (squaring off).

- Or they can roll over to the next month’s contract.

Key Advantages of Futures Contracts

- Leverage: Small capital can control a large position.

- Flexibility: Can profit in both rising and falling markets.

- Hedging: Helps protect portfolios or business revenues from adverse price moves.

- Transparency: Exchange-traded contracts reduce counterparty risk.

Key Takeaways

- A futures contract is a legal obligation to buy/sell an asset at a fixed price on a future date.

- These contracts are ideal for both speculators and hedgers.

- They are standardized, transparent, and require only margin to trade.

- Profit or loss is settled based on the price difference at expiry or whenever the position is exited.