4. What Does the Net Profit Margin Indicate?

The Net Profit Margin is one of the most important profitability indicators. It tells you how much of every rupee of revenue a company actually keeps as profit after covering all expenses—including cost of goods sold, operating costs, interest, and taxes.

In other words, this ratio answers a fundamental question:

"After paying for everything—materials, salaries, rent, debt, and taxes—how much profit does the company actually keep?"

Net Profit Margin: The Formula

Net Profit Margin (%) = (Net Profit / Revenue) × 100

- Net Profit (also called net income or bottom line): The final figure on the income statement after all expenses.

- Revenue: The total income generated from the sale of goods or services before any expenses are deducted.

What Does It Show?

The Net Profit Margin measures the efficiency of a business in converting revenue into actual profit. It reflects the company's capability to control costs across production, operations, financing, and taxation.

Key Insights from Net Profit Margin

| Range | Meaning |

|---|---|

Example Calculation

Let’s consider a company:

- Revenue: ₹2,00,00,000

- Net Profit: ₹20,00,000

Net Profit Margin = (20,00,000 / 2,00,00,000) × 100 = 10%

This means the company keeps ₹10 as profit from every ₹100 it earns in sales.

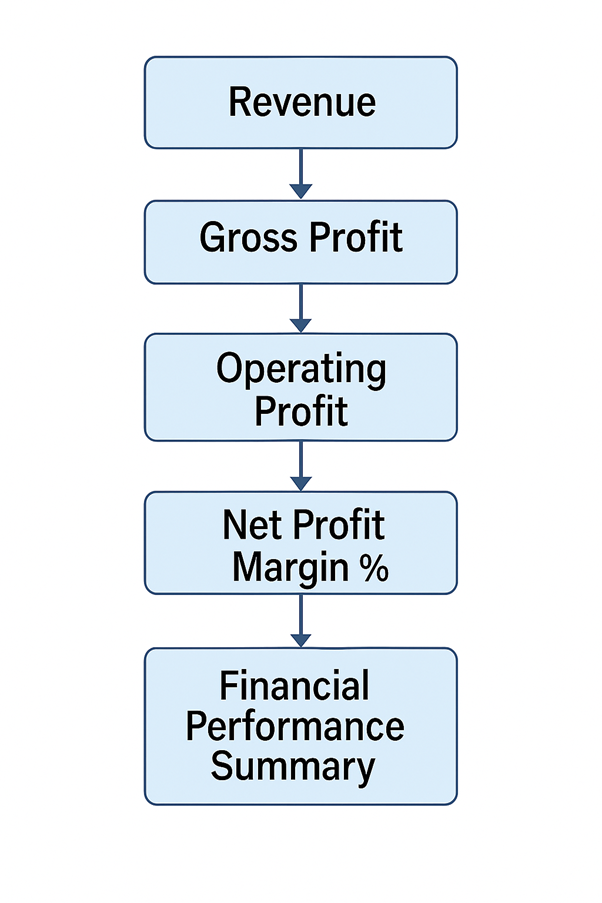

Net Profit Margin in the Context of the Income Statement

Industry Example: Comparing 3 Companies

| Company | Revenue (₹ Cr) | Net Profit (₹ Cr) | Net Profit Margin (%) | Industry |

|---|---|---|---|---|

Interpretation:

- ITC has a significantly higher net margin due to its high-margin tobacco business.

- HUL and Britannia, despite strong sales, operate in lower-margin consumer segments.

Factors Influencing Net Profit Margin

| Factor | Positive Impact | Negative Impact |

|---|---|---|

Real-World Investor Uses

-

Comparing Companies:

An investor comparing two companies with similar revenues can use net margin to identify the more profitable one. -

Tracking Performance Over Time:

If a company’s margin improves YoY, it may be controlling costs better or increasing pricing power. -

Valuation and Stock Screening:

Consistently high margins may indicate a competitive moat or strong brand.

Example: Stock Decision Based on Margin

Let’s say you're comparing two companies:

| Metric | Company A | Company B |

|---|---|---|

Even though both have equal revenue, Company A is more profitable, keeping over twice the profit as Company B.

Benefits of Using Net Profit Margin

| Benefit | Why It Matters |

|---|---|

Limitations of Net Profit Margin

| Limitation | Explanation |

|---|---|

Key Takeaways

- Net Profit Margin = ultimate profitability metric

- Indicates how much revenue turns into actual profit after all expenses

- High margins imply operational efficiency and pricing power

- Should be tracked over time and compared against industry peers

- Use alongside other ratios for a complete financial picture