What is Inflation and how Inflation impact on stock market

What is Inflation?

We all know Inflation means a general rise in the prices of products. In simple terms, Inflation is the rate at which prices are rising. So, Inflation measures how much the prices have gone up.

Explaining how Inflation affects the purchasing power of a currency:

Prices are going up means – The purchasing power of money has gone down. Thus, if Inflation is 5%, then the Value of Rs.100/- today will become Rs.95/- in the future.

So, to purchase a product worth Rs.100/- today, you need Rs.105/- in the future. And your 100 Rs will effectively be Rs.95/-. Thus, it’s essential to understand that if the money generates returns not more than Inflation, then the money is losing its value.

Is inflation necessary? Impact of Inflation on stock markets?

Is Inflation bad for the economy?

Suppose your income is Rs.10 lakhs per annum; don’t you expect your income should grow next year? Yes, you will.

In the same way, every business expects a rise in prices year on year so that its profits increase at a certain phase of growth, which indicates a booming economy where the income of the consumer rises, the cost of the raw material rises, prices of the products rise, profits of the business grow, resulting in good returns from equity investments.

Thus, Inflation is not completely an evil that destroys the economy until the demand and supply are balanced.

Explaining the negative impact of Inflation on stock markets:

Now, we know how Inflation benefits equity investments, but what if Inflation changes its pace of growth?

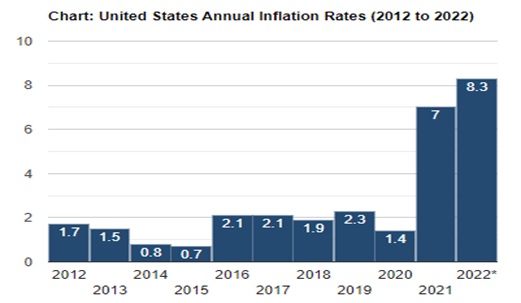

Here before proceeding further, let us check the below chart.

From 2012 to 2020, Inflation was more or less stable hovering between .7% to 2.3% Dow Jones also performed well in this period rising from 12700 in Jan 2012 to 28500 in Dec 2019 giving a CAGR of 10.6% almost which is a very good return for a developed country; after Covid-19, i.e., in 2021, the Inflation in the USA jumped from 1.4% to 7%. After the Russia – Ukraine war, Inflation again went up to 8.3% consequence of which Dow jones plunged almost 20% from its high and the Nasdaq 30%.

Now let us understand what happens to equity investments in such scenarios:

Now Inflation has gone up; businesses have to beat the Inflation, or else they won’t make any returns on their investments. Thus, practically there exists a situation where the future prices of the products are uncertain; consequently, speculation begins and causes a highly volatile environment in the stock markets, Until the market participants believe the government will control Inflation.

What investor should do during rising inflation scenarios?

Always understand central banks and governments constantly keep a check on Inflation. Maintaining balanced Inflation is the primary expectation from the governments and central banks. During these periods, we should look for attractively valued fundamentally strong stocks to invest in which can pass on the increase in the cost of raw materials to its consumers.

What led to inflation in 2022?

Quantitative easing: In the US massive money printing was done during covid and they increased their balance sheet from 4.5 trillion dollars to 9 trillion dollars, as a result, there was a massive supply of money in the US and similarly in other parts of the world. Hence, there was an over-supply of money and there was a hike in demand and in- addition there was a supply-side constraint due to the Russia-Ukraine war and covid wave in China.

How will inflation be tackled and the after-effects of it?

When inflation is high then governing bodies of respective countries like RBI in India will start increasing repo rates, and interest rates which will kill the demand. As a result of this, the sales will decline of the company and the borrowing cost of the company will shoot up due to an increase in interest rates. So, with subsiding revenue and increased borrowing costs, the profitability of the company will be hammered. Which will adversely affect the stock prices as it is dependent on the profitability of the company.

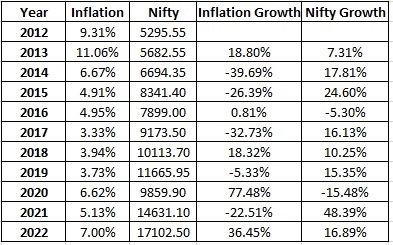

How has the Indian market performed in the last decade in comparison to inflation?

One can see in 2013 inflation grew very much so nifty gave a less return but when the inflation is growing at a moderate level, then the market also performs positively, as u can see between 2013-2021 wherein inflation was under control market gave a fantastic return except for 2016 the reason being demonetization and 2020 due to covid, the problem occurs only when the inflation spikes up suddenly.

Post a Comment

|

DISCLAIMER |

This report is only for the information of our customers. Recommendations, opinions, or suggestions are given with the understanding that readers acting on this information assume all risks involved. The information provided herein is not to be construed as an offer to buy or sell securities of any kind. ATS and/or its group companies do not as assume any responsibility or liability resulting from the use of such information.