Ambuja Cements Ltd.

Ambuja Cements Ltd.

|

Current price |

242.00 |

|

Sector |

Cement |

|

No of shares |

1549988086 |

|

52 week high |

286.85 |

|

52 week low |

192.35 |

|

BSE Sensex |

27490.59 |

|

Nifty |

8331.95 |

|

Average Volume |

1669019 |

|

BSE Code |

500425 |

|

NSE Symbol |

AMBUJACEM |

Ambuja Cements Ltd - Company Overview

Ambuja Cements Ltd, a part of Holcim, is an India-based cement manufacturing company. Holcim is a supplier of cement and aggregates (crushed stone, gravel and sand). Its activities include the manufacture and distribution of cement, and the production, processing and distribution of aggregates, ready-mix concrete and asphalt. It also offers consulting, research, trading, engineering and other services. The Company has five integrated cement manufacturing plants and eight cement grinding units. Ambuja Cements Ltd cement capacity is approximately 28.75 million tons. The Company manufactures Portland Pozollana cement and ordinary Portland cement. Ambuja Cements operates in cementitious materials segment. The Company’s subsidiaries include M.G.T. Cements (Private) Limited, Chemical Limes Mundwa (Private) Limited, Kakinada Cements Limited, Dirk India (Private) Limited, Dirk Pozzocrete (MP) Private Limited and Dang Cement Industries (Private) Limited.

Ambuja Cements Ltd was formerly known as Gujarat Ambuja Cements Ltd. and changed its name to Ambuja Cements Limited in April 2007. The company was incorporated in 1981 and is headquartered in Mumbai, India. Ambuja Cements Limited is a subsidiary of Holderind Investments Limited. It is the first Indian cement manufacturer having a captive port with three terminals along the country's western coastline to facilitate timely, cost effective and environmentally cleaner shipments of bulk cement to its customer. The company has its own fleet of ships.

Ambuja Cements is the most profitable cement company in India, and the lowest cost producer of cement in the world. One of the major reasons that Ambuja Cements is the lowest cost producer of cement in the world is its emphasis on efficiency. Power consists over 40% of the production cost of cement. Ambuja Cements Ltd improved efficiency of its kilns to get more output for less power. Thereafter Ambuja Cements set up a captive power plant at a substantially lower cost than the national grid. Ambuja Cements sourced a cheaper and higher quality coal from South Africa, and a better furnace oil from the Middle East. As a result, today, the company is in a position to sell its excess power to the local state government.

Share Holding Pattern

|

Category |

No. of Shares |

Percentage |

|

Other Companies |

5,496,157 |

0.35 |

|

Foreign Promoters |

780,308,553 |

50.34 |

|

Foreign Institutions |

471,312,822 |

30.41 |

|

Financial Institutions |

135,719,665 |

8.76 |

|

General Public |

96,856,010 |

6.25 |

|

Foreign - NRI |

13,740,196 |

0.89 |

|

NBFC and Mutual Funds |

12,989,826 |

0.84 |

|

Others |

1,402,994 |

0.09 |

|

Foreign - OCB |

12,870 |

0.00 |

|

Foreign Industries |

3,850 |

0.00 |

Ambuja Cements Ltd - Financial Details

-

Market Cap (Rs Cr) – 36824.39

-

Company P/E (x) – 23.80

-

Industry P/E (x) – 32.36

-

Book Value (Rs) – 65.16

-

Price / BV (x) – 3.64

-

Dividend (%) – 250 %

-

EPS (TTM) – 8.35

-

Dividend Yield (%) – 2.11 %

-

Face Value (Rs) – 2

Industry Overview

India's cement industry is a vital part of its economy, providing employment to more than a million people, directly or indirectly. Ever since it was deregulated in 1982, the Indian cement industry has attracted huge investments, from both Indian and foreign investors, making it the second largest in the world. The industry is currently in a turnaround phase, trying to achieve global standards in production, safety, and energy-efficiency. India has a lot of potential for development in the infrastructure and construction sector and the cement sector is expected to largely benefit from it. Some of the recent major government initiatives such as development of 100 smart cities are expected to provide a major boost to the sector. The cement market in India is expected to grow at a compound annual growth rate (CAGR) of 8.96 percent during the period 2014-2019. In India, the housing sector is the biggest demand driver of cement, accounting for about 67 percent of the total consumption. The other major consumers of cement include infrastructure at 13 percent, commercial construction at 11 percent and industrial construction at nine percent. To meet the rise in demand, cement companies are expected to add 56 million tonnes (MT) capacity over the next three years. The cement capacity in India may register a growth of eight percent by next year end to 395 MT from the current level of 366 MT. It may increase further to 421 MT by the end of 2017. The country's per capita consumption stands at around 190 kg.

A total of 188 large cement plants together account for 97 percent of the total installed capacity in the country, while 365 small plants account for the rest. Of these large cement plants, 77 are located in the states of Andhra Pradesh, Rajasthan and Tamil Nadu. The Indian cement industry is dominated by a few companies. The top 20 cement companies account for almost 70 percent of the total cement production of the country. The eastern states of India along with the border states will be the newer and virgin markets for cement companies and will contribute to their bottom line in future. In the next 10 years, India will become the main exporter of clinker and gray cement to the Middle East, Africa, and other developing nations of the world. A large number of foreign players are also expected to enter the cement sector in the next 10 years, owing to the profit margins, constant demand, and right valuation.

Balance Sheet

|

|

Dec '14 |

Dec '13 |

Dec '12 |

Dec '11 |

Dec '10 |

|

Sources Of Funds |

|

|

|

|

|

|

Total Share Capital |

309.95 |

309.17 |

308.44 |

306.87 |

305.97 |

|

Equity Share Capital |

309.95 |

309.17 |

308.44 |

306.87 |

305.97 |

|

Share Application Money |

0.00 |

0.00 |

0.00 |

0.01 |

1.34 |

|

Reserves |

9,793.38 |

9,176.37 |

8,496.62 |

7,762.56 |

7,022.79 |

|

Networth |

10,103.33 |

9,485.54 |

8,805.06 |

8,069.44 |

7,330.10 |

|

Secured Loans |

5.86 |

5.86 |

0.00 |

0.00 |

0.00 |

|

Unsecured Loans |

13.23 |

23.29 |

34.63 |

42.80 |

65.03 |

|

Total Debt |

19.09 |

29.15 |

34.63 |

42.80 |

65.03 |

|

Total Liabilities |

10,122.42 |

9,514.69 |

8,839.69 |

8,112.24 |

7,395.13 |

|

Application Of Funds |

|

|

|

|

|

|

Gross Block |

11,362.17 |

10,759.31 |

10,116.82 |

9,636.89 |

8,778.82 |

|

Less: Accum. Depreciation |

5,135.06 |

4,696.78 |

4,254.45 |

3,450.43 |

3,151.07 |

|

Net Block |

6,227.11 |

6,062.53 |

5,862.37 |

6,186.46 |

5,627.75 |

|

Capital Work in Progress |

690.17 |

694.88 |

520.12 |

486.82 |

930.70 |

|

Investments |

2,172.73 |

1,788.45 |

1,655.84 |

864.31 |

625.95 |

|

Inventories |

888.39 |

933.94 |

983.93 |

924.97 |

901.86 |

|

Sundry Debtors |

227.98 |

231.51 |

213.37 |

240.85 |

128.18 |

|

Cash and Bank Balance |

2,458.12 |

2,341.09 |

2,253.72 |

2,069.08 |

198.40 |

|

Total Current Assets |

3,574.49 |

3,506.54 |

3,451.02 |

3,234.90 |

1,228.44 |

|

Loans and Advances |

1,236.35 |

912.19 |

935.33 |

769.35 |

422.61 |

|

Fixed Deposits |

0.00 |

0.00 |

0.00 |

0.00 |

1,549.77 |

|

Total CA, Loans & Advances |

4,810.84 |

4,418.73 |

4,386.35 |

4,004.25 |

3,200.82 |

|

Current Liabilities |

2,569.64 |

2,348.81 |

2,143.57 |

2,238.35 |

1,893.98 |

|

Provisions |

1,208.79 |

1,101.09 |

1,441.42 |

1,191.25 |

1,096.57 |

|

Total CL & Provisions |

3,778.43 |

3,449.90 |

3,584.99 |

3,429.60 |

2,990.55 |

|

Net Current Assets |

1,032.41 |

968.83 |

801.36 |

574.65 |

210.27 |

|

Miscellaneous Expenses |

0.00 |

0.00 |

0.00 |

0.00 |

0.46 |

|

Total Assets |

10,122.42 |

9,514.69 |

8,839.69 |

8,112.24 |

7,395.13 |

|

Contingent Liabilities |

2,264.89 |

2,310.02 |

1,362.30 |

571.54 |

754.38 |

|

Book Value (Rs) |

65.19 |

61.36 |

57.09 |

52.59 |

47.90 |

Profit and Loss Account

|

|

Dec '14 |

Dec '13 |

Dec '12 |

Dec '11 |

Dec '10 |

|

Income |

|

|

|

|

|

|

Sales Turnover |

9,978.12 |

9,160.35 |

9,730.30 |

8,554.26 |

8,286.20 |

|

Excise Duty |

0.00 |

0.00 |

0.00 |

0.00 |

914.68 |

|

Net Sales |

9,978.12 |

9,160.35 |

9,730.30 |

8,554.26 |

7,371.52 |

|

Other Income |

428.98 |

418.44 |

69.74 |

223.62 |

214.58 |

|

Stock Adjustments |

-15.91 |

-118.33 |

200.83 |

-57.00 |

54.28 |

|

Total Income |

10,391.19 |

9,460.46 |

10,000.87 |

8,720.88 |

7,640.38 |

|

Expenditure |

|

|

|

|

|

|

Raw Materials |

1,565.20 |

1,361.36 |

1,337.38 |

1,170.06 |

1,475.20 |

|

Power & Fuel Cost |

2,265.22 |

2,062.92 |

2,329.07 |

2,001.37 |

1,697.34 |

|

Employee Cost |

581.58 |

502.41 |

478.51 |

433.20 |

344.91 |

|

Other Manufacturing Expenses |

0.00 |

0.00 |

0.00 |

0.00 |

227.03 |

|

Selling and Admin Expenses |

0.00 |

0.00 |

0.00 |

0.00 |

1,633.14 |

|

Miscellaneous Expenses |

3,621.77 |

3,464.50 |

3,313.20 |

2,915.60 |

199.42 |

|

Total Expenses |

8,033.77 |

7,391.19 |

7,458.16 |

6,520.23 |

5,565.68 |

|

Operating Profit |

1,928.44 |

1,650.83 |

2,472.97 |

1,977.03 |

1,860.12 |

|

PBDIT |

2,357.42 |

2,069.27 |

2,542.71 |

2,200.65 |

2,074.70 |

|

Interest |

64.48 |

65.08 |

75.66 |

52.63 |

48.69 |

|

PBDT |

2,292.94 |

2,004.19 |

2,467.05 |

2,148.02 |

2,026.01 |

|

Depreciation |

509.53 |

490.07 |

565.22 |

445.15 |

387.19 |

|

Profit Before Tax |

1,783.41 |

1,514.12 |

1,901.83 |

1,702.87 |

1,638.21 |

|

Extra-ordinary items |

0.00 |

0.00 |

0.00 |

0.00 |

64.22 |

|

PBT (Post Extra-ord Items) |

1,783.41 |

1,514.12 |

1,901.83 |

1,702.87 |

1,702.43 |

|

Tax |

287.05 |

219.55 |

604.77 |

474.01 |

435.55 |

|

Reported Net Profit |

1,496.36 |

1,294.57 |

1,297.06 |

1,228.86 |

1,263.61 |

|

Total Value Addition |

6,468.57 |

6,029.83 |

6,120.78 |

5,350.17 |

4,090.48 |

|

Equity Dividend |

774.61 |

556.34 |

554.80 |

490.69 |

397.22 |

|

Corporate Dividend Tax |

146.51 |

94.55 |

90.00 |

79.60 |

65.27 |

|

Per share data (annualised) |

|

|

|

|

|

|

Shares in issue (lakhs) |

15,497.46 |

15,458.60 |

15,421.84 |

15,343.69 |

15,298.59 |

|

Earning Per Share (Rs) |

9.66 |

8.37 |

8.41 |

8.01 |

8.26 |

|

Equity Dividend (%) |

250.00 |

180.00 |

180.00 |

160.00 |

130.00 |

Dividend and Bonus History

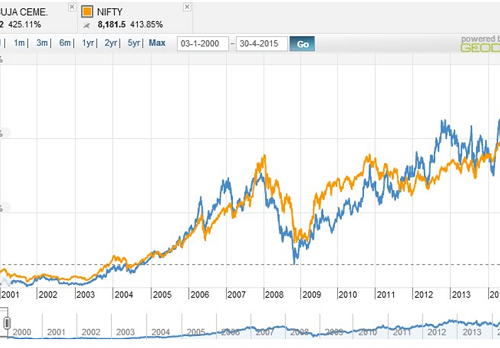

Index and Company Price Movement Comparison

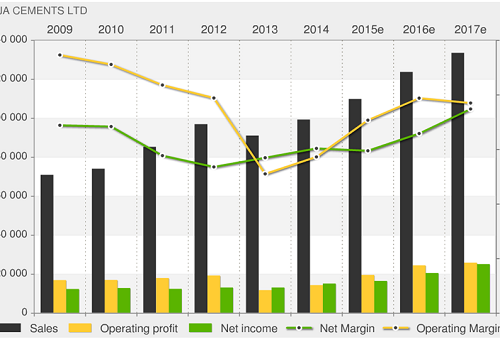

Company Forecast

Technical Indicators

|

Name |

Value |

Action |

|

RSI(14) |

56.331 |

Buy |

|

STOCH(9,6) |

62.822 |

Buy |

|

STOCHRSI(14) |

75.322 |

Overbought |

|

MACD(12,26) |

0.740 |

Buy |

|

ADX(14) |

32.955 |

Buy |

|

Williams %R |

-40.230 |

Buy |

|

CCI(14) |

57.3596 |

Buy |

|

ATR(14) |

1.6643 |

Less Volatility |

|

Highs/Lows(14) |

0.6143 |

Buy |

|

Ultimate Oscillator |

59.720 |

Buy |

|

ROC |

-1.064 |

Sell |

|

Bull/Bear Power(13) |

2.7740 |

Buy |

Important Ratios (YoY)

-

PBIT – 13.63 v/s 12.14

-

RoCE – 18.25 v/s 16.33

-

RoE – 14.87 v/s 12.96

-

Net Profit Margin – 14.37 v/s 13.55

-

Inventory Turnover – 11.23 v/s 9.81

-

D/E Ratio – Nil

-

Interest Cover – 28.66 v/s 23.88

-

Current Ratio – 1.27 v/s 1.28

-

Reserves – 9793.38 cr v/s 9176.37 cr

-

PAT – 1496.36 cr v/s 1294.57 cr

-

Total assets – 10122.42 cr v/s 9514.69 cr

-

Net sales – 9978.12 cr v/s 9160.35 cr

-

Book Value – 65.19 v/s 61.36

Simple Moving Average

|

Days |

BSE |

NSE |

|

30 |

249.57 |

249.76 |

|

50 |

256.10 |

256.27 |

|

150 |

237.21 |

237.33 |

|

200 |

231.38 |

231.48 |

Investment Rationalize

-

Ambuja Cements Ltd, is the most profitable and third largest cement company in India, which is owned by Holcim Ltd. and it is the lowest cost producer of cement in the world.

-

Ambuja Cements (ACL) is a debt free company with good dividend payout history with a good marketing and distribution network with more than 8700 dealers and 29000 retailers all across India.

-

Government initiative of “Make in India” and improvements in real estate and construction industry will act as a trigger to the growth of the company. Having manufacturing facilities across will help to reduce the logistics expenses to a minimal level.

-

Ambuja Cements Ltd (ACL) have an attractive financial ratios with a very positive cash flow with help of successful business and manufacturing model.

-

With the picking up of demand for the products ACL will be able to utilize the installed capacity to the fullest and work in progress for expanding manufacturing capacity to the fullest.

-

Having Holcim Ltd. as promoter help s the company to reduce the material cost and having power generation facility inside plants will help the company to reduce costs as well as improving profits margins.

-

Governmental initiative to build smart cities across India, Budget homes plans, construction of industrial corridors and emphasis of development in North East India, will provide a big business potential to the ACL.

-

Potential merger of Ambuja Cements and Acc and income from subsidiaries M.G.T. Cements (Private) Limited, Chemical Limes Mundwa Limited, Kakinada Cements Limited, Dirk India Limited, Dirk Pozzocrete (MP) Private Limited and Dang Cement Industries Limited will act a game changer for the company.

Post a Comment

|

DISCLAIMER |

This report is only for the information of our customers. Recommendations, opinions, or suggestions are given with the understanding that readers acting on this information assume all risks involved. The information provided herein is not to be construed as an offer to buy or sell securities of any kind. ATS and/or its group companies do not as assume any responsibility or liability resulting from the use of such information.