AXIS BANK LIMITED

Axis Bank - Company Profile

Axis Bank was first of the new private banks in India to start operations after the Government of India allowed new banks to be established in the private sector. The Bank has been promoted by the largest financial institutions of the country, UTI, LIC, GIC and its subsidiaries. Axis Bank along with its eight subsidiaries and associates is engaged in providing a wide range of banking and financial services in retail banking, corporate banking, and treasury operations. The Bank had a distribution network encompassing 2,402 domestic branches and extension counters and 12,922 ATMs situated in 1,636 cities and towns, compared to 1,947 domestic branches and extension counters, and 11,245 ATMs situated in 1,363 cities and towns last year. Axis Bank also has over- seas offices in Singapore, Hong Kong, Shanghai, Colombo, Dubai and Abu Dhabi.

Axis Bank - STOCK INFORMATION

|

STOCK PRICE |

403.00 |

|

TARGET PRICE |

412-424 |

|

SECTOR |

BANK |

|

SYMBOL (AT NSE) |

AXISBANK |

|

ISIN |

INE238A01034 |

|

FACE VALUE (IN RS.) |

2.00 |

|

BSE CODE |

532215 |

Axis Bank - STOCK FUNDAMENTALS

|

MARKET CAP |

94,855.70 |

|

BOOK VALUE |

810.56 |

|

EPS - (TTM) (IN RS. CR.) |

27.44 |

|

P/E |

14.65 |

|

INDUSTRY P/E |

18.16 |

Axis Bank - INVESTMENT RATIONALE

Axis Bank Ltd has announced the following results for the quarter ended September 30, 2014. The Unaudited Standalone results for the Quarter ended September 30, 2014.Axis Bank posted a net profit of Rs. 16.11 billion for the quarter ended September 30, 2014 as compared to Rs. 13.62 billion for the quarter ended September 30, 2013. Total Income has increased from Rs. 93.75 billion for the quarter ended September 30, 2013 to Rs. 105.5 billion for the quarter ended September 30, 2014. focus on raising the CASA ratio and reducing dependence on wholesale funds, the bank has been able to narrow the gap vis-à-vis its peers (ICICI Bank, HDFC Bank) in terms of liability franchise. This should help sustain the net interest margin at healthy levels going ahead. With gross NPAs of 1.3%, the asset quality of the bank remains among the best in the system. The provision coverage of about 80% further adds to the comfort on the bank’s asset quality. The strategy of diversifying the loan book in favor of the retail segment is shaping well as retail loans constitute over 30% of its loan book.

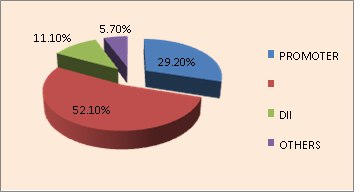

SHAREHOLDING PATTERN

RESULTS (Quarterly )(Rs CR.)

|

|

Sep 14 |

Jun' 13 |

Mar’14 |

Dec' 13 |

Sep’ 13 |

|

Sales |

8,602.36 |

8,289.42 |

7,965.23 |

7,789.13 |

7,608.99 |

|

Operating profit |

6,292.20 |

5,796.94 |

5,328.56 |

5,573.24 |

4,968.54 |

|

Interest |

5,077.51 |

4,978.93 |

4,799.48 |

4,805.12 |

4,672.32 |

|

Gross profit |

3,162.30 |

2,895.66 |

3,247.71 |

2,615.03 |

2,749.80 |

|

EPS (Rs) |

6.83 |

7.07 |

7.84 |

6.84 |

5.81 |

OUTLOOK&VALUTION

Axis Bank is among the best capitalised bank and is likely to benefit from a recovery in the economy. An increase in investment activity will boost its fee income and add to its profitability. Considering high visibility of the earnings growth and the healthy asset quality, the stock trades at a reasonable valuation 1.9x FY2016E book value. We have a Buy rating on it with a one year price target of Rs. 475 and weekly target 412- 424 levels

TECHNICAL VIEW

AXIS BANK has closed above 10 day EMA . We advise to buy around 400-405 with stoploss of 392 for the targets of 412-424 levels. RSI is also showing upside momentum in it on weekly charts.

|

SYMBOL |

VALUE |

ACTION |

|

RSI(14) |

63.438 |

BUY |

|

STOCH(9,6) |

71.585 |

BUY |

|

STOCHRSI(14) |

51.622 |

NEUTRAL |

|

MACD(12,26) |

63.250 |

BUY |

|

ADX(14) |

42.523 |

BUY |

|

WILLIAMS %R |

-22.695 |

BUY |

|

CCI(14) |

95.2060 |

BUY |

|

ATR(14) |

3.4821 |

LESS VOLATILITY |

|

HIGH/LOWS(14) |

1.2071 |

BUY |

|

ULTIMATE OSCILLATOR |

58.703 |

BUY |

|

ROC |

0.803 |

BUY |

|

BULL/BEAR POWER()13 |

5.0300 |

BUY |

|

BUY: 10 SELL:0 NEUTRAL: 1 |

SUMMARY : STRONG BUY |

|

Our Other Recommendation for Next Week

|

SCRIP |

ACTION |

CMP |

ENTRY |

SL |

TGT |

TIME FRAME |

|

IDEA |

BUY |

154.8 |

152-154 |

146 |

158-162 |

ONE WEEK |

|

ZEE ENT |

BUY |

322.1 |

320-322 |

315 |

326-332 |

ONE WEEK |

|

BANK BARODA |

BUY |

871.9 |

870-875 |

860 |

885-895 |

ONE WEEK |

|

ORIENT BANK |

BUY |

247.75 |

245-248 |

240 |

254-260 |

ONE WEEK |

|

ICICI BANK |

BUY |

1506.5 |

1500-1510 |

1480 |

1535-1550 |

ONE WEEK |

Performance of Previous Week

|

SCRIP |

LOT |

ACTION |

ENTRY |

SL |

TGT |

P&L |

REMARK |

CLOSE/LOW/HIGH |

|

ASIAN PAINT |

500 |

BUY |

650-660 |

630 |

675-695 |

-10000.00 |

SL HIT |

642.30 / 625.35 |

|

RECL |

1000 |

BUY |

250-252 |

245 |

256-262 |

12000.00 |

BOTH TGT HIT |

260.10 / 264.40 |

|

HCL TECH |

250 |

BUY |

1740-1750 |

1710 |

1770-1790 |

-7500.00 |

SL HIT |

1507.90 / 1769.00 |

|

M&M FINANCE |

1000 |

BUY |

282-285 |

276 |

292-298 |

-4000.00 |

BELOW COST |

278.85 / 286.65 |

|

BAJAJ ELECTRI- CALS |

1000 |

BUY |

272-278 |

260 |

288-296 |

13000.00 |

FIRST TGT HIT |

277.65 / 292.50 |

|

INFOSYS |

125 |

BUY |

3850-3875 |

3790 |

3920-3960 |

11250.00 |

BOTH TGT HIT |

3870.00 / 3962.00 |

|

NET PROFIT |

|

|

|

|

|

14750.00 |

|

|

Post a Comment

|

DISCLAIMER |

This report is only for the information of our customers. Recommendations, opinions, or suggestions are given with the understanding that readers acting on this information assume all risks involved. The information provided herein is not to be construed as an offer to buy or sell securities of any kind. ATS and/or its group companies do not as assume any responsibility or liability resulting from the use of such information.