BHARAT PETROLEUM CORPORATION

Bharat Petroleum Corporation Limited - COMPANY PROFILE

Incorporated in 1952, Bharat Petroleum Corporation Limited is an Indian state-controlled oil and gas company. The Company was formerly known as Bharat Refineries Limited and changed to its current name 1977. The Company is engage in the refining of crude oil and marketing of petroleum products, as well as exploration and production of hydrocarbons. Bharat Petroleum Corporation Limited (BPCL) offers liquefied petroleum gas (LPG), naphtha, motor spirit, aviation turbine fuel, kerosene oil, high speed diesel, light diesel oil, and mineral turpentine oil; and furnace oil and lubricants.

The Company’s marketing network includes depots, aviation service stations, retail outlets, LPG bottling plants, and LPG distributors. Bharat Petroleum Corporation Limited (BPCL) has interests in 26 exploration blocks, which include 11 blocks located in India; and 15 blocks located in Australia, East Timor, Indonesia, United Kingdom, Mozambique, and Brazil.

Bharat Petroleum Corporation Limited - STOCK INFORMATION

|

STOCK PRICE |

745.85 |

|

TARGET PRICE |

775-785 |

|

SECTOR |

REFINERIES |

|

SYMBOL (AT NSE) |

BPCL |

|

ISIN |

INE029A01011 |

|

FACE VALUE (IN RS.) |

10.00 |

|

BSE CODE |

500547 |

Bharat Petroleum Corporation Limited - STOCK FUNDAMENTALS

|

MARKET CAP |

53931.24 |

|

BOOK VALUE |

269.11 |

|

EPS - (TTM) (IN RS. CR.) |

64.44 |

|

P/E |

11.57 |

|

INDUSTRY P/E |

13.79 |

INVESTMENT RATIONALE

The company’s Likely increase in marketing margins to drive earnings: We expect OMCs earnings growth from (a) fall in working capital, (b) increase in marketing margin (like petrol) and (c) shift to import parity pricing in the long term. Likely Bina refinery IPO in 1-2 years could help unlock value for BPCL. Bharat Petroleum Corporation Limited (BPCL) has 49% stake in the ~Rs114b Bina refinery, which has a capacity of 6mmtpa (expansion under consideration). BPCL's E&P portfolio is likely to add substantial value as it completes its appraisal program and gives out the resource/reserve numbers. BPCL’s gross debt has reduced sharply by INR62b (30%) led by lower working capital loan due to monthly diesel price hikes. Bharat Petroleum Corporation Limited (BPCL) is yet to receive INR15b subsidy compensation from the govt. and has oil bonds of INR50b on its balance sheet. We estimate BPCL’s return ratios to remain strong with FY16 RoE of 19%.

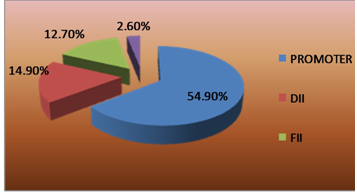

SHAREHOLDING PATTERN

OUTLOOK AND VALUATION

Diesel price hikes and eventual deregulation in Oct-14 is expected to result in 52% reduction in under recoveries by FY16 v/s FY14 to INR674b. For OMC’s, earnings growth benefit is already seen from reduction in interest cost and now expect to be driven by higher marketing margin in diesel (similar to petrol). We model additional diesel margin of INR0.5/ltr in FY16/FY17. The stock trades at 12.5x FY16E EPS of INR61.4 and 1.3x FY16E BV (adjusted for investments). Bharat Petroleum Corporation Limited (BPCL) is our top pick among OMCs for its E&P potential.

RESULTS (Quarterly )(Rs CR.)

|

|

SEP' 14 |

JUN' 14 |

MAR' 14 |

DEC' 13 |

SEP' 13 |

|

Sales |

62,025.16 |

66,790.22 |

74,771.96 |

64,767.62 |

61,784.51 |

|

Operating profit |

1,117.57 |

1,520.14 |

6,357.73 |

-915.82 |

1,707.73 |

|

Interest |

129.16 |

194.81 |

204.84 |

304.53 |

324.39 |

|

Gross profit |

1,243.53 |

2,348.57 |

6,575.64 |

-969.55 |

1,840.15 |

|

EPS (Rs) |

6.42 |

16.82 |

56.26 |

-15.06 |

12.88 |

Bharat Petroleum Corporation Limited - TECHNICAL VIEW

Bharat Petroleum Corporation Limited (BPCL) LTD is looking strong on charts. We advise to buy around 750-760 with stoploss of 730 for the targets of 775- 785 levels. RSI is also showing upside momentum in it on weekly charts.

|

SYMBOL |

VALUE |

ACTION |

|

RSI(14) |

68.207 |

BUY |

|

STOCH(9,6) |

70.772 |

BUY |

|

STOCHRSI(14) |

57.195 |

BUY |

|

MACD(12,26) |

26.300 |

BUY |

|

ADX(14) |

43.118 |

BUY |

|

WILLIAMS %R |

-19.795 |

OVERBOUGHT |

|

CCI(14) |

125.8490 |

BUY |

|

ATR(14) |

48.1893 |

LESS VOLATILITY |

|

HIGH/LOWS(14) |

29.2857 |

BUY |

|

ULTIMATE OSCILLATOR |

55.384 |

BUY |

|

ROC |

11.049 |

BUY |

|

BULL/BEAR POWER()13 |

97.1420 |

BUY |

|

BUY: 10 SELL:0 NEUTRAL: 1 |

SUMMARY : STRONG BUY |

Our Other Recommendation for Next Week

|

SCRIP |

ACTION |

CMP |

ENTRY |

SL |

TGT |

TIME FRAME |

|

IDEA |

SELL |

159.40 |

160-162 |

165 |

155-150 |

ONE WEEK |

|

PFC |

BUY |

311.80 |

308-312 |

302 |

318-324 |

ONE WEEK |

|

BANK OF INDIA |

BUY |

290.80 |

285-290 |

278 |

296-304 |

ONE WEEK |

|

UCO BANK |

BUY |

89.00 |

87-89 |

85 |

92-95 |

ONE WEEK |

|

BANK BARODA |

BUY |

1096.60 |

1080-1100 |

1060 |

1120-1140 |

ONE WEEK |

Performance of Previous Week

|

SCRIP |

LOT |

ACTION |

ENTRY |

SL |

TGT |

P&L |

REMARK |

CLOSE/LOW/HIGH |

|

KTK BANK |

|

BUY |

140-145 |

134 |

150-160 |

16000.00 |

NEAR TGT |

145.55 / 148.85 |

|

ADANI PORT |

|

BUY |

295-298 |

292 |

304-309 |

0.00 |

NEAR COST |

262.05 / 261.00 |

|

LUPIN |

|

BUY |

1425-1450 |

1400 |

1480-1490 |

15000.00 |

TGT HIT |

969.55 / 984.75 |

|

VOLTAS |

|

BUY |

270-272 |

266 |

276-280 |

0.00 |

NEAR COST |

45.95 / 44.75 |

|

HINDALCO |

|

BUY |

155-158 |

150 |

162-165 |

16000.00 |

BOTH TGT HIT |

174.70 / 176.40 |

|

ADANI ENT |

|

BUY |

485- 490 |

475 |

500-510 |

8000.00 |

FIRST TGT HIT |

152.45 / 153.45 |

|

NET PROFIT |

|

|

|

|

|

55000.00 |

|

|

Post a Comment

|

DISCLAIMER |

This report is only for the information of our customers. Recommendations, opinions, or suggestions are given with the understanding that readers acting on this information assume all risks involved. The information provided herein is not to be construed as an offer to buy or sell securities of any kind. ATS and/or its group companies do not as assume any responsibility or liability resulting from the use of such information.