Equitas Small Finance Bank Limited Research Report

|

Market Price |

Recommendation |

Target |

Time Horizon |

|

71.50 |

Buy |

92 |

1-Year |

Equitas Small Finance Bank Limited - Q3FY2023 REVIEW

Equitas Small Finance Bank Limited reported net revenue of ₹1,063.34 crores for the quarter ended December 31, 2022, compared to ₹901.15 crores for December 30, 2021. Profit After Tax was ₹170.13 crores for the quarter ended December 31, 2022, compared to ₹108.11 crores during the corresponding quarter of the previous year, respectively.

STOCK DATA

|

52 Week H/L |

37.45/73.40 |

|

Market Cap (crores) |

14,616 |

|

Face Value (₹) |

10.00 |

|

Book Value |

33.91 |

|

EPS TTM |

2.40 |

|

NSE Code |

EQUITASBNK |

Equitas Small Finance Bank Limited - OVERVIEW

-

The National Company Law Tribunal has approved the merger of Equitas Holdings Limited and Equitas Small Finance Bank, the small finance lender announced on January 17, 2023. The approved Scheme, as authorized by the respective Boards of EHL and ESFBL, was submitted with the ROC on February 01, 2023, by EHL, and on February 02, 2023, by ESFBL. As a result, the Scheme went into effect on February 2, 2023.

-

Equitas Small Finance Bank Limited has been assigned A1+ by India Ratings and Research Agency.

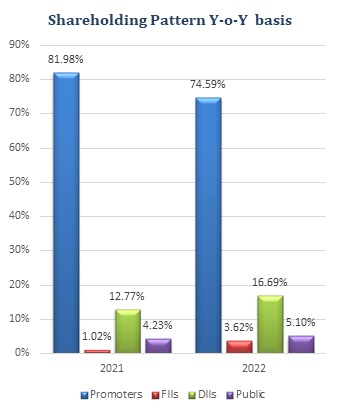

SHAREHOLDING PATTERN (%)

|

|

June-22 |

Sep-22 |

Dec-22 |

|

Promoter |

74.52 |

74.50 |

74.48 |

|

Public |

5.80 |

5.86 |

6.09 |

|

FII |

4.09 |

4.26 |

4.08 |

|

DII |

15.59 |

15.36 |

15.34 |

Equitas Small Finance Bank Limited - BENCHMARK COMPARISON

Beta: 0.61 |

Alpha: 12 |

Risk Reward Ratio: 1.50 |

Margin of Safety: 22% |

BUSINESS

-

On June 21, 1993, Equitas Small Finance Bank Ltd was established. Equitas Bank is one of India's major small financing banks. Being a new-age bank in one of the world's fastest developing economies, it provides a wide range of products and services to fulfill the needs of its clients, who include people with limited access to traditional financing channels, Micro Small and Medium Businesses (MSMEs), and corporations.

-

Equitas Holdings Ltd, the holding company of Equitas SFB, began operations in the microfinance sector in 2007. In 2011, it expanded into automobile and house financing, and in 2013, it joined the Small Business Loans market. In September 2015, the firm gained preliminary clearance to become an SFB. It received a scheduled commercial bank license in September 2016 and began operating as Equitas SFB.

-

The company's product offering comprises asset products advanced to unserved and underserved clients primarily in semi-urban and rural areas, as well as liability products in the form of deposits sourced from mass and mass-affluent customers in urban and semi-urban areas.

-

Company has categorized its asset products into (i) small business loans; (ii) microfinance; (iii) vehicle finance loans; (iv) MSE finance (v) loans to corporates; and (vi) other loans. Categorization is largely determined by customer profile, type of security, and end-use.

-

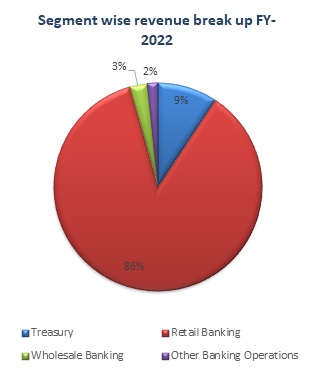

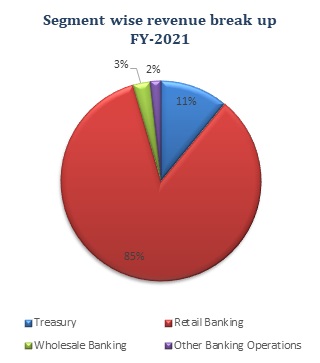

Following are the business segment of the company:

-

Treasury:

-

It encompasses all investment portfolios, profit/loss on investment sales, PSLC fees, profit/loss on foreign currency transactions, stocks, derivatives income, and money market activities. This segment's expenditures include interest on money borrowed from both external and internal sources, as well as depreciation/amortisation of premium on HTM category investments.

-

-

Corporate / Wholesale Banking:

-

It covers all advances to trusts, partnership firms, corporations, and statutory entities not covered by 'Retail Banking'

-

-

Retail Banking:

-

It comprises retail client loans and deposits, as well as sector earnings and costs.

-

-

Other Banking Operations:

-

It encompasses any operations that are not covered by Treasury, Corporate / Wholesale Banking, or Retail Banking.

-

-

-

Out of the total revenue, 9% has been generated from Treasury operations, 3% from wholesale Banking, 86% from Retail Banking and 2% from Other Banking Operations in FY 2022 compared to 11%, 3%, 85%, 2% in FY 2021, respectively.

Equitas Small Finance Bank Limited - SWOT ANALYSIS

STRENGTH

-

Customer Centric Organization.

-

Among the largest SFB in India.

-

Well-diversified asset product portfolio.

-

Strong retail liability portfolio with a strategic distribution network.

WEAKNESS

-

Inherent geographic concentration.

-

Increase in cost-to-income ratio.

OPPORTUNITIES

-

Decrease in NPA in recent results.

-

Adoption of new technology.

-

Decrease in Provision in recent results.

-

Trading near a 52-week high.

THREAT

-

Increasing in competition in the financial sector.

-

Ongoing uneven circumstances globally (e.g., Inflation).

SMALL FINANCE BANK INDUSTRY ANALYSIS

-

Small Finance Banks (SFBs) are still a modest participant in the banking sector, with a market share of 1.14% in advances and 0.71% in deposits as of March 31, 2022, but their successful deposit mobilisation and outreach to the underbanked have helped them raise their share.

-

SFBs have dramatically expanded their credit deposit ratio, achieved significant loan book diversity, and experienced significant growth in advances by placing a major emphasis on liabilities franchise. It is projected that the non-microfinance portfolio's share will increase considerably over the course of the medium to long term.

-

The advances book of SFBs increased at a pace of roughly 40% as compared to private sector banks, which expanded at a CAGR of 18% for the four years ending March 31, 2022.

-

The industry's growth rate is predicted to exceed that of FY22 if capitalisation rises. SFB capital raising surged in Q2FY23 and is expected to continue.

-

What is Small Finance Bank:

-

Small Finance Banks are a special kind of bank that the RBI established with the help of the Government of India in order to promote financial inclusion by primarily offering fundamental banking services to underserved and underrepresented groups, such as unorganised businesses, small and marginal farmers, micro and small industries, and small business units.

-

Like conventional commercial banks, these banks are able to conduct all standard banking activities, including lending and receiving deposits.

-

SFBs are subject to stringent regulations. The priority sector must get at least 75% of the money that are borrowed.

-

In addition, the lending portfolio should consist of at least 50% loans under Rs. 25 lakhs. In response to the declaration made during the Union Budget for the fiscal year 2014–15, the RBI published the Small Finance Bank regulations in November 2014.

-

On November 24, 2014, just 10 of the 72 firms from diverse sectors who applied for the licence actually received it.

-

-

SFBs are establishing the benchmark for microloans to self-employed people with insufficient credit histories to assess their creditworthine. The group of minor financing banks accounts for 1% of the total assets of the Schedule Commercial Banks (SFBs).

-

Throughout the course of the four quarters of 2021–2022, the total deposits and credit of SFBs rose by 32.7% and 23.1%, respectively.

-

While the rate of growth for term deposits was 15.7% (y-o-y) in March 2022, the rate of growth for CASA deposits has been aggressively increased by SFBs, rising from 18.4% in March 2019 to 33.9% in March 2022.

-

From a low foundation, the substantial balance sheet expansion of SFBs has sparked worries about asset quality. Although it is below the top of September 2021, its reconstructed standard advances portfolio is still higher than it was before the epidemic.

-

The concentration of SFB in particular client categories and geographical regions has an impact on these trends. Its CRAR in March 2022, albeit higher than the larger group of SCBs, is still a respectable 19.3%. Gross non-performing assets (NPAs) of SFBs were 5% at the end of March 2022, down from above 6% in September 2021. Meanwhile, their net NPAs decreased from 2.2% in March 2022 to 3.0% in September 2021.

-

In the third quarter ending December 2022, the net profit of listed microfinance institutions (MFIs) and MFI subsidiaries of listed enterprises more than quadrupled year on year (YoY) to ₹508 crores.

-

As compared to YoY growth, the sequential rate of net profit growth was slower. It was 16.7% more than the ₹435 crores reported in the second quarter that ended September 2022. (Q2FY23). Interest income increased by 25% year on year to ₹2,414 crore, and it increased 9.7% sequentially from ₹2,201 crore in the second quarter ended September 2022. (Q2FY23). The increase in loan offtake, higher rates, and improved recovery all aided MFIs in increasing interest revenue. Finance expenses increased as well, albeit at a slower rate than interest revenue. Finance expenditures increased 12.9% year on year to Rs 939 crore and 12.7% sequentially from ₹833 crore in Q2FY23.

Equitas Small Finance Bank Limited - FINANCIAL OVERVIEW

QUARTERLY SUMMARY

|

Quarterly (INR in crores) |

Dec-22 |

Sep-22 |

Jun-22 |

Mar-22 |

Dec-21 |

|

Interest Income |

1,063 |

1,002 |

940 |

896 |

901 |

|

Interest Expended |

416 |

393 |

360 |

343 |

360 |

|

|

|

|

|

|

|

|

Net Interest Income |

647 |

610 |

581 |

552 |

541 |

|

|

|

|

|

|

|

|

Other Income |

153 |

145 |

133 |

148 |

134 |

|

Total Income |

800 |

755 |

714 |

701 |

675 |

|

|

|

|

|

|

|

|

Employee Cost |

292 |

275 |

226 |

209 |

240 |

|

Other Expenses |

229 |

237 |

220 |

208 |

210 |

|

Provision and Contingencies |

50 |

90 |

142 |

123 |

78 |

|

EBT |

229 |

152 |

127 |

161 |

146 |

|

Tax Expenses |

59 |

36 |

30 |

41 |

38 |

|

PAT |

170 |

116 |

97 |

120 |

108 |

Equitas Small Finance Bank Limited - PROFIT AND LOSS STATEMENT (₹ in Crores)

|

|

Mar-20 |

Mar-21 |

Mar-22 |

|

Interest income |

2,645.44 |

3,194.41 |

3,459.67 |

|

Interest Expended |

1,150.14 |

1,396.45 |

1,421.13 |

|

|

|

|

|

|

Net Income |

1,495.31 |

1,797.96 |

2,038.54 |

|

|

|

|

|

|

Other income |

282.35 |

418.05 |

537.56 |

|

Total income |

1,777.66 |

2,216.02 |

2,576.09 |

|

|

|

|

|

|

Other expenses |

1,180.08 |

1,329.43 |

1,704.15 |

|

Provision and Contingencies |

353.94 |

502.36 |

591.22 |

|

|

|

|

|

|

PAT |

243.64 |

384.22 |

280.73 |

|

|

|

|

|

|

EPS |

|

|

|

|

Basic |

2.39 |

3.53 |

2.43 |

|

Diluted |

2.39 |

3.49 |

2.40 |

|

Number of shares |

|

|

|

|

Basic |

102.05 |

108.95 |

115.55 |

|

Diluted |

102.05 |

110.14 |

117.07 |

Equitas Small Finance Bank Limited - Balance Sheet (₹ in Crores)

|

|

Mar-20 |

Mar-21 |

Mar-22 |

|

CAPITAL AND LIABILITIES: |

|

|

|

|

Capital |

1,053.40 |

1,139.28 |

1,252.03 |

|

Reserves and Surplus |

1,690.75 |

2,257.06 |

2,994.14 |

|

Deposits |

10,788.41 |

16,391.97 |

18,950.80 |

|

Borrowings |

5,134.87 |

4,165.32 |

2,616.40 |

|

Other Liabilities |

628.12 |

754.84 |

1,138.53 |

|

Total |

19,295.55 |

24,708.47 |

26,951.90 |

|

|

|

|

|

|

ASSETS: |

|

|

|

|

Cash and Balances with Reserve Bank of India |

380.86 |

514.81 |

956.99 |

|

Balances with Banks and Money at Call and Short Notice |

2,155.98 |

2,863.90 |

1,175.52 |

|

Investments |

2,342.51 |

3,705.17 |

4,449.85 |

|

Advances |

13,728.24 |

16,848.19 |

19,374.21 |

|

Fixed Assets |

212.77 |

185.05 |

200.44 |

|

Other Assets |

475.19 |

591.36 |

794.88 |

|

Total |

19,295.55 |

24,708.47 |

26,951.90 |

Equitas Small Finance Bank Limited - Cash Flow Statement (₹ in Millions)

|

|

Mar-20 |

Mar-21 |

Mar-22 |

|

Net Profit Before Tax |

466.24 |

10.20 |

-550.36 |

|

Net Cash from Operating Activities |

439.62 |

2,043.94 |

159.46 |

|

Net Cash Used for Investing Activities |

-71.73 |

-42.80 |

-89.09 |

|

Net Cash From (Used For) Financing Activities |

908.28 |

-1,153.91 |

-1,316.57 |

|

Net Increase in Cash and Cash Equivalents |

1,276.17 |

847.23 |

-1,246.20 |

|

Cash And Cash Equivalents at The Beginning of the Year |

1,255.32 |

2,531.48 |

3,378.71 |

|

Cash And Cash Equivalents at The End of the Year |

2,531.48 |

3,378.71 |

2,132.51 |

Equitas Small Finance Bank Limited - Ratio Analysis

|

|

Mar-20 |

Mar-21 |

Mar-22 |

|

Net Interest Income |

8.53% |

8.17% |

7.89% |

|

Gross NPA |

2.72% |

3.59% |

4.06% |

|

Net NPA |

1.51% |

1.52% |

2.37% |

|

Provision Coverage Ratio |

45.22% |

58.59% |

42.73% |

|

Capital Adequacy Ratio |

20.00% |

24.18% |

25.16% |

|

CASA Ratio |

20.46% |

34.24% |

52.00% |

|

ROA |

1.39% |

1.70% |

1.10% |

|

ROE |

9.84% |

12.70% |

7.75% |

|

Cost to Income Ratio |

44.61% |

41.62% |

49.26% |

Equitas Small Finance Bank Limited - Technical Analysis

-

Stock is in upward trend on monthly and weekly charts, with a support level of ₹60 and a resistance level of ₹66.

-

At current prices, one may buy more of this stock.

Concall (Q3FY2023)

-

Advances at the bank increased by 27% year on year and 9% quarter on quarter. Their quarterly payments increased 68% year on year to INR 4,797 crores. This is the greatest amount ever disbursed in a quarter. Substantial disbursement was seen across all product divisions, with the bank's flagship product, SBL, recording a 73% increase in disbursement year on year.

-

Equitas is still in high demand across all categories. For Q3FY2023, disbursements in innovative products such as affordable house loans, used vehicle loans, and merchant overdrafts totaled 12%. Small company loans, the bank's hallmark product, continue to be the bank's main business, accounting for 37% of advances.

-

The car financing industry has recovered substantially, owing to the increase in CVs. Generally, operator economics are solid, with freight demand maintaining strong and return load availability improving. Collection efficiency has remained consistent and has returned to pre-pandemic levels. Management has observed a rise in used car pricing, as evidenced by a decrease in loss on the sale of repossessed automobiles. The loss on sale of confiscated automobiles fell from 48% in the fourth quarter of fiscal year 22 to 31% in the third quarter of fiscal year 23.

-

The cheap house lending sector, which began in Gujarat and Maharashtra, has now spread into the southern states of TN, AP, TL, and Karnataka. The bank is presently present in five states. In terms of affordable housing, ICRA forecasts portfolio growth of 10% to 12% for fiscal year FY '23.

-

Microfinance collection efficiency has grown to 99.5% from 98.9% in the preceding quarter. Collection efficiencies for small company loans and auto credit have also increased significantly. Small company loans were 99.6% and car finance was 97.9%, up from 99.3% and 97%, respectively, in the preceding quarter.

-

Net interest income was INR 647 crores, up from INR 541 crores in the same quarter the previous year, representing a 20% increase year on year. Other income was INR 127 crores, up from INR 95 crores in the same quarter previous year, representing a 34% increase year on year. Net income increased by 22% year on year to INR 774 crores for the quarter, up from INR 636 crores in the same quarter previous year. Total operational expenditure was INR 495 crores, up from INR 411 crores in the same quarter last year, representing a 20% increase year on year.

Recommendation Rationale

-

Diversified Product Portfolio:

-

Equitas' total advances were INR249 billion at Q3FYE23 (FY22: INR206 billion), with a well-diversified portfolio of products including small company loans (37%), auto financing (25%), and microfinance (18%); the firm had been engaged in these categories even before it became a bank in 2016. Corporate loans (mostly NBFCs; 3%), medium-sized firms (5%), and others (1%) are among the emerging groups.

-

Equitas' loan book grew at a CAGR of 24% from FY17 to FY22 and 22% from FY17 to FY23 (annualised); growth has been most aggressive in the secured categories during the last three to four years. The bank expects to expand by 30%-35% year on year in FY23, matching pre-COVID-19 levels. Unsecured lending, mostly through microfinance loans, is expected to account for 10%-15% of overall advances in the medium-to-long term

-

-

Expansion Plan and Experienced Management:

-

Equitas has grown a presence in India throughout the years, with the bank operating in over 18 states and union territories through 901 banking branches and 20,005 employees as of December 31, 2022.

-

According to a BSE filing on December 23, 2022, PN Vasudevan, managing director, and chief executive officer, has elected to stay in his current post against the board's recommendations, despite the bank's announcement that it was seeking his replacement in May 2022. Vasudevan's tenure is expected to be extended for another three years, beginning in July 2023, subject to RBI and shareholder approval.

-

-

Adequate Capitalisation:

-

In Q3FY23, Equitas maintained a satisfactory tier 1 capital ratio of 23.74% (FY22: 24.53%; FY21: 23.23%). In FY22, the bank raised INR5.5 billion in equity through qualifying institutional placement. Additionally, until Q3FY23, the bank achieved a net profit of INR3.89 billion (FY22: INR2.8 billion; FY21: INR3.8 billion), increasing its net value to INR46.40 billion (INR42.46 billion; INR33.96 billion). Adequate levels of capitalisation and pre-provision operating profitability buffers (1HFY23: 3.4%; FY22: 3.4%; FY21: 4%) might provide a cushion against credit costs, which are projected to rise due to lending to a lower-yielding borrower profile.

-

-

Improving Financial and Asset Quality:

-

Equitas Gross NPA and NPA stood at 3.46% & 1.73% in Q3FY2023, compared to 4.39% & 2.38% in Q3FY2022. The GNPA and NPA have been consistently reducing from the past five quarters. ROA and ROE stood at 2.21% & 14.94% in Q3FY2023.

-

Valuation

-

Equitas Small Finance Bank Limited’s Net Interest Income has grown at 24% CAGR for FY2018-2022.

-

There was a de-growth in the profit of the company in the years 2022 which was impacted due covid-19 and increase in operating expense. we further expected net profit will improve in FY2023.

-

The company’s ROE and ROA are 7.75% & 1.10% for FY2022.

-

Based on the firm's current performance, we estimate that the company might generate higher Net Interest Income for the following FY 2023, compared to the preceding year.

-

To project income for the fiscal years 2023–2027, we used data from the previous five years (2018–2022).

Equitas Small Finance Bank Limited - Estimated Income Statement (₹ in Crores)

|

|

Mar-23 |

Mar-24 |

Mar-25 |

Mar-26 |

Mar-27 |

|

|

2023-E |

2024-E |

2025-E |

2026-E |

2027-E |

|

Interest income |

4,013 |

4,655 |

5,400 |

6,264 |

7,266 |

|

Interest Expended |

1,521 |

1,627 |

1,741 |

1,863 |

1,993 |

|

Net Interest Income |

2,493 |

3,028 |

3,659 |

4,401 |

5,273 |

|

|

|

|

|

|

|

|

Other income |

591 |

650 |

715 |

787 |

866 |

|

Total income |

3,084 |

3,679 |

4,375 |

5,188 |

6,139 |

|

|

|

|

|

|

|

|

Other expenses |

1,966 |

2,281 |

2,646 |

3,069 |

3,561 |

|

Provision and Contingencies |

602 |

698 |

810 |

940 |

1,090 |

|

PAT |

515 |

699 |

919 |

1,179 |

1,488 |

Disclaimer: This report is only for the information of our customer Recommendations, opinions, or suggestions are given with the understanding that readers acting on this information assume all risks involved. The information provided herein is not to be construed as an offer to buy or sell securities of any kind.

Post a Comment

|

DISCLAIMER |

This report is only for the information of our customers. Recommendations, opinions, or suggestions are given with the understanding that readers acting on this information assume all risks involved. The information provided herein is not to be construed as an offer to buy or sell securities of any kind. ATS and/or its group companies do not as assume any responsibility or liability resulting from the use of such information.