HINDUSTAN PETROLEUM CORPORATION LIMITED

Hindustan Petroleum Corporation Limited - Company Profile

Hindustan Petroleum Corporation Limited (HPCL) a Government of India undertaking and a Fortune 500 company, is a major integrated oil refining and marketing company in India. It is a Mega Public Sector Undertaking (PSU) with Navaratna status.

Hindustan Petroleum Corporation Limited (HPCL) accounts for about 20% of the market share in India among the PSUs. Hindustan Petroleum Corporation Limited operates with 2 refineries producing a wide variety of petroleum fuels & specialties, one at Mumbai (West Coast) having a capacity of 6.5 Million Metric Tonnes Per Annum (MMTPA) and the other in Vishakapatnam (East Coast) with a capacity of 8.3 MMTPA. HPCL also holds an equity stake of 16.95% in Mangalore Refinery & Petrochemicals Limited (MRPL), a state-of-the-art refinery at Mangalore with a capacity of 9 MMTPA. In addition, HPCL, in collaboration with M/s Mittal Energy Investment Ltd. has set up a 9 MMTPA refinery at Bathinda, in the state of Punjab, as a Joint venture.

Hindustan Petroleum Corporation Limited (HPCL) owns the country's largest Lube Refinery with a capacity of 335,000 Metric Tonnes which amounts to 40% of the national capacity of Lube Oil production. Presently Hindustan Petroleum Corporation Limited (HPCL) produces over 300+ grades of Lubes, Specialities and Greases.

Hindustan Petroleum Corporation Limited - STOCK INFORMATION

|

STOCK PRICE |

572.30 |

|

TARGET PRICE |

580-595 |

|

SECTOR |

REFINERIES |

|

SYMBOL (AT NSE) |

HINDPETRO |

|

ISIN |

INE094A01015 |

|

FACE VALUE (IN RS.) |

10.00 |

|

BSE CODE |

500104 |

Hindustan Petroleum Corporation Limited - STOCK FUNDAMENTALS

|

MARKET CAP |

19,379.64 |

|

BOOK VALUE |

443.31 |

|

EPS - (TTM) (IN RS. CR.) |

95.69 |

|

P/E |

5.98 |

|

INDUSTRY P/E |

14.38 |

Hindustan Petroleum Corporation Limited - INVESTMENT RATIONALE

The government’s move to announce a cut in diesel prices by Rs 3.4 per litre and deregulate diesel prices comes at the right time when there has been a sharp decline in crude oil prices. Diesel prices will be market determined at both retail and refinery gate level for all consumers. The move to deregulate diesel prices will lead to a decline in crude oil gross under-recoveries, with only kerosene and LPG prices under the regulatory regime. The gross under-recoveries are now expected to decline from Rs 139869 crore in FY14 to Rs 83,326.5 crore in FY16E. ONGC, Oil India and PSU downstream companies would be the key beneficiaries and may see a reduction in their net subsidy burden, going forward.

We expect more reforms from the government on the subsidy sharing mechanism, wherein lower subsidy burden needs to be set for upstream and downstream companies. We expect the decision on the subsidy sharing mechanism to come sooner than later, given the strong government and political sensitivity of the decision being the least. We expect net oil realisation for ONGC at $44.1/bbl, $45.5/bbl and $57.5/bbl for FY15E, FY16E and FY17E and for Oil India at $50.9/bbl, $53/bbl and $65/bbl for FY15E, FY16E and FY17E, respectively. OMCs also stand to benefit if they are able to increase their diesel marketing margins by Rs 0.5 per litre.

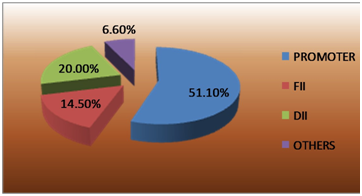

Hindustan Petroleum Corporation Limited - SHAREHOLDING PATTERN

RESULTS (Quarterly )(Rs CR.)

|

|

Jun 14 |

Mar' 14 |

Dec’13 |

Sep' 13 |

Jun’ 13 |

|

Sales |

59,215.78 |

64,192.29 |

55,454.99 |

51,860.1 |

51,763.8 |

|

Operating profit |

589.84 |

5,938.48 |

-930.71 |

1,014.21 |

-687.88 |

|

Interest |

589.84 |

5,938.48 |

-930.71 |

1,014.21 |

-687.88 |

|

Gross profit |

658.18 |

6,070.30 |

-1,177.36 |

861.49 |

-950.48 |

|

EPS (Rs) |

1.36 |

136.11 |

-51.20 |

9.42 |

-43.13 |

TECHNICAL VIEW

HIND PETRO is looking strong on charts. We advise to buy around 550-560 with stoploss of 530 for the targets of 580-595 levels. RSI is also showing upside momentum in it on weekly charts.

|

SYMBOL |

VALUE |

ACTION |

|

RSI(14) |

71.036 |

BUY |

|

STOCH(9,6) |

69.105 |

BUY |

|

STOCHRSI(14) |

40.701 |

SELL |

|

MACD(12,26) |

-15.830 |

SELL |

|

ADX(14) |

48.510 |

BUY |

|

WILLIAMS %R |

-26.641 |

BUY |

|

CCI(14) |

102.6628 |

BUY |

|

ATR(14) |

5.9643 |

HIGH VOLATILITY |

|

HIGH/LOWS(14) |

11.2679 |

BUY |

|

ULTIMATE OSCILLATOR |

58.182 |

BUY |

|

ROC |

3.864 |

BUY |

|

BULL/BEAR POWER()13 |

21.3820 |

BUY |

|

BUY: 09 SELL:2 NEUTRAL: 0 |

SUMMARY : STRONG BUY |

|

Our Other Recommendation for Next Week

|

SCRIP |

ACTION |

CMP |

ENTRY |

SL |

TGT |

TIME FRAME |

|

TATA COMM |

BUY |

430.35 |

425-430 |

417 |

439-445 |

ONE WEEK |

|

LUPIN |

BUY |

1429.85 |

1400-1420 |

1375 |

1450-1480 |

ONE WEEK |

|

BHEL |

SELL |

246.95 |

246-250 |

259 |

242-234 |

ONE WEEK |

|

UCO BANK |

SELL |

83.55 |

85-87 |

90 |

82-80 |

ONE WEEK |

|

SUNPHARMA |

BUY |

895.75 |

880-890 |

858 |

915-935 |

ONE WEEK |

Performance of Previous Week

|

SCRIP |

LOT |

ACTION |

ENTRY |

SL |

TGT |

P&L |

REMARK |

CLOSE/LOW/HIGH |

|

CANARA BANK |

1000 |

BUY |

400-408 |

385 |

419-440 |

18000.00 |

NEAR TGT |

406.25 / 418.40 |

|

REL INFRA |

500 |

BUY |

620-640 |

600 |

655-675 |

7500.00 |

FIRST TGT HIT |

633.50 / 660.60 |

|

TATA STEEL |

500 |

BUY |

490-500 |

475 |

510-525 |

-7500.00 |

SL HIT |

474.15 / 497.40 |

|

BHARAT FORGE |

1000 |

BUY |

805-815 |

790 |

830-850 |

40000.00 |

BOTH TGT HIT |

841.45 / 857.00 |

|

L&T |

250 |

BUY |

1640-1670 |

1600 |

1695-1740 |

10000.00 |

FIRST TGT HIT |

1659.05 / 1696.85 |

|

HINDALCO |

2000 |

BUY |

162-165 |

156 |

170-175 |

-12000.00 |

SL HIT |

157.10 / 166.95 |

|

NET PROFIT |

|

|

|

|

|

56000.00 |

|

|

Post a Comment

|

DISCLAIMER |

This report is only for the information of our customers. Recommendations, opinions, or suggestions are given with the understanding that readers acting on this information assume all risks involved. The information provided herein is not to be construed as an offer to buy or sell securities of any kind. ATS and/or its group companies do not as assume any responsibility or liability resulting from the use of such information.