HINDUSTAN UNILEVER LIMITED

Hindustan Unilever Limited - Company Profile

Incorporated in the year 1933, Hindustan Unilever Limited (HUL) is a Fast Moving Consumer Goods (FMCG) company. Hindustan Unilever Limited (HUL) has a diversified presence in the FMCG sector with more than 35 brands spanning 20 distinct categories including soaps and detergents, shampoos, skin care, toothpastes, and packaged foods. British-Dutch company Unilever PLC and its Affiliates are the promoters of HUL and own 52.5 % shares in the Company (On 30 April 2013, Unilever PLC announced plans to increase its stake in the Company to 75 % by way of an open offer).

Over the years, Hindustan Unilever Limited (HUL) has grown substantially by acquiring landmark brands and has managed to maintain its dominant market position in various categories. Hindustan Unilever Limited (HUL) portfolio includes leading household brands including Lux, Lifebuoy, Surf Excel, Rin, Wheel, Fair & Lovely, Pond’s, Vaseline, and Lakme.

Hindustan Unilever Limited - STOCK INFORMATION

|

STOCK PRICE |

758.95 |

|

TARGET PRICE |

780-790 |

|

SECTOR |

PERSONAL CARE |

|

SYMBOL (AT NSE) |

HINDUNILVR |

|

ISIN |

INE030A01027 |

|

FACE VALUE (IN RS.) |

1.00 |

|

BSE CODE |

500696 |

Hindustan Unilever Limited - STOCK FUNDAMENTALS

|

MARKET CAP |

163,945.15 |

|

BOOK VALUE |

15.15 |

|

EPS - (TTM) (IN RS. CR.) |

18.05 |

|

P/E |

41.99 |

|

INDUSTRY P/E |

40.74 |

Hindustan Unilever Limited - INVESTMENT RATIONALE

Being the country’s largest FMCG player, Hindustan Unilever Limited (HUL) volume growth has decelerated in line with the economic downturn. Volume growth has declined from ~13% (FY11) and ~9% (FY12) to ~4% in FY14. The slowdown is largely on the back of a slowdown in urban discretionary demand with rural growth remaining healthy. Going ahead, we believe volume growth would remain muted until FY15E led by the slower revival in GDP growth and persistently high food inflation. However, we believe that as the economy revives and growth gains traction Hindustan Unilever Limited (HUL) strong portfolio of brands across segments would aide the company’s volume growth back to 6-7% annually.

Hindustan Unilever Limited (HUL) PP (~29% of revenues, ~46% of PBIT in FY14) growth at 14.8% CAGR (FY09-13) has been largely led by volumes fol- lowing lower penetration of oral, hair & skin care products in India and HUL’s strengthening presence across these segments led by its strong brands, Fair & Lovely, Ponds, Lakme, Clinic Plus, Close-Up, etc. However, following the slowdown in discretionary demand, increasing competition in PP segment and rejig in Hindustan Unilever Limited (HUL) largest PP brand (Fair & Lovely)

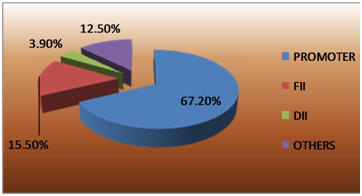

SHAREHOLDING PATTERN

OUTLOOK&VALUTION

Axis Bank We expect the near term slowdown to keep Hindustan Unilever Limited (HUL) growth moderate until H1FY15. However, with a revival in urban demand and strong brands in growing aspirational segments, we believe HUL is strongly placed to capture the booming consumer demand. We value the stock at 35x FY16E EPS of 21.6 arriving at a target price of 780-790 levels.

RESULTS (Quarterly )(Rs CR.)

|

|

Jun 14 |

Mar' 14 |

Dec’13 |

Sep' 13 |

Jun’ 13 |

|

Sales |

7,716.34 |

7,094.10 |

7,223.35 |

6,892.64 |

6,809.04 |

|

Operating profit |

1,316.54 |

1,077.55 |

1,226.80 |

1,085.31 |

1,085.60 |

|

Interest |

6.25 |

5.33 |

18.20 |

6.28 |

1,256.13 |

|

Gross profit |

1,512.40 |

1,222.85 |

1,351.26 |

1,230.02 |

1,256.13 |

|

EPS (Rs) |

4.89 |

4.03 |

4.91 |

4.23 |

4.71 |

TECHNICAL VIEW

Hindustan Unilever Limited (HUL) is looking strong on charts. We advise to buy around 750-760 with stoploss of 730 for the targets of 780- 790 levels. RSI is also showing upside momentum in it on weekly charts.

|

SYMBOL |

VALUE |

ACTION |

|

RSI(14) |

65.817 |

BUY |

|

STOCH(9,6) |

83.489 |

OVERBOUGHT |

|

STOCHRSI(14) |

55.221 |

BUY |

|

MACD(12,26) |

-9.910 |

SELL |

|

ADX(14) |

30.260 |

BUY |

|

WILLIAMS %R |

-5.977 |

OVERBOUGHT |

|

CCI(14) |

129.3379 |

BUY |

|

ATR(14) |

4.3250 |

LESS VOLATILITY |

|

HIGH/LOWS(14) |

3.7964 |

BUY |

|

ULTIMATE OSCILLATOR |

70.783 |

OVERBOUGHT |

|

ROC |

2.790 |

BUY |

|

BULL/BEAR POWER()13 |

10.5760 |

BUY |

|

BUY: 07 SELL:1 NEUTRAL: 3 |

SUMMARY : STRONG BUY |

|

Our Other Recommendation for Next Week

|

SCRIP |

ACTION |

CMP |

ENTRY |

SL |

TGT |

TIME FRAME |

|

TATA MOTORS |

BUY |

514.60 |

510-510 |

500 |

525-540 |

ONE WEEK |

|

HDFC |

BUY |

1033.00 |

1020-1040 |

1000 |

1065-1085 |

ONE WEEK |

|

BAJAJ AUTO |

BUY |

2539.65 |

2520-2540 |

2480 |

2580-2620 |

ONE WEEK |

|

EXIDE IND |

BUY |

158.50 |

155-158 |

152 |

162-164 |

ONE WEEK |

|

JINDAL STEEL |

BUY |

165.95 |

162-165 |

157 |

172-178 |

ONE WEEK |

Performance of Previous Week

|

SCRIP |

LOT |

ACTION |

ENTRY |

SL |

TGT |

P&L |

REMARK |

CLOSE/LOW/HIGH |

|

AXIS BANK |

1250 |

BUY |

400-405 |

392 |

412-424 |

0.00 |

NOT OPEN |

424.50 / 410.70 |

|

IDEA |

2000 |

BUY |

152-154 |

146 |

158-162 |

0.00 |

NOT OPEN |

160.70 / 155.65 |

|

ZEE ENT |

1000 |

BUY |

320-322 |

315 |

326-332 |

12000.00 |

BOTH TGT HIT |

338.50 / 345.45 |

|

BANK BARODA |

500 |

BUY |

870-875 |

860 |

885-895 |

12500.00 |

BOTH TGT HIT |

885.10 / 899.00 |

|

ORIENT BANK |

2000 |

BUY |

245-248 |

240 |

254-260 |

0.00 |

NOT OPEN |

263.85 / 252.25 |

|

ICICI BANK |

250 |

BUY |

1500-1510 |

1480 |

1535-1550 |

0.00 |

NOT OPEN |

1572.80 / 1525.05 |

|

NET PROFIT |

|

|

|

|

|

24500.00 |

|

|

Post a Comment

|

DISCLAIMER |

This report is only for the information of our customers. Recommendations, opinions, or suggestions are given with the understanding that readers acting on this information assume all risks involved. The information provided herein is not to be construed as an offer to buy or sell securities of any kind. ATS and/or its group companies do not as assume any responsibility or liability resulting from the use of such information.