ITC LIMITED

Indian Tobacco Company Limited - Company Profile

Indian Tobacco Company Limited was incorporated on 24 August 1910 under the name of Imperial Tobacco Company of India Limited and its name was changed to ITC Limited in 1974. The Company is rated among world's most reputable companies by Forbes magazine and among India’s most valuable companies by Business Today.

The Company employs over 31,000 people at more than 60 locations across India and has a diversified presence in FMCG (Cigarettes, food, retail, personal care, education and stationary), Hotels, Paperboards & Specialty Papers, Packaging, Agri-Business, and Information Technology.

A majority of ITC Limited revenue comes from cigarette sales where the Company is the market leader with 80% total cigarette market share. ITC Limited popular cigarette brands include Insignia, India Kings, Lucky Strike, Classic, Gold Flake, Navy Cut, Players, Scissors, Capstan, Berkeley, Bristol, Flake, Silk Cut and Duke & Royal.

Over the last few years however, the Company has been expanding rapidly in the FMCG (non-cigarette), retailing and hotel space. Some of the brands in this space includes: Aashirvaad, Sunfeast, Bingo!, Yippee!, Candyman, mint-o, Fiama Di Wills, Vivel, Engage, Classmate, Wills Lifestyle, John Players Mangaldeep and Aim.

Indian Tobacco Company Limited - STOCK INFORMATION

|

STOCK PRICE |

373.75 |

|

TARGET PRICE |

380-395 |

|

SECTOR |

FMCG |

|

SYMBOL (AT NSE) |

ITC |

|

ISIN |

INE154A01025 |

|

FACE VALUE (IN RS.) |

1.00 |

|

BSE CODE |

500875 |

Indian Tobacco Company Limited - STOCK FUNDAMENTALS

|

MARKET CAP |

298754.20 |

|

BOOK VALUE |

32.89 |

|

EPS - (TTM) (IN RS. CR.) |

11.91 |

|

P/E |

31.36 |

|

INDUSTRY P/ESHAREHOLDING PATTERN |

35.56 |

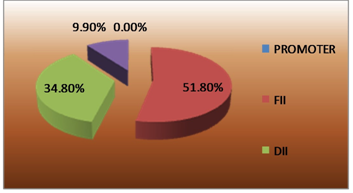

SHAREHOLDING PATTERN

INVESTMENT RATIONALE

ITC Limited plans to stimulate the distribution strategy for its FMCG business by increasing its direct reach to ~1 lakh villages in India. These 1 lakh villages account for ~80% of rural consumption. This initiative depicts ITC’s aggressive approach towards growing its FMCG business, which currently ac- counts for ~25% of its net sales (FY14) in comparison to ~16% in FY08. ITC’s growth from the segment has been phenomenal at ~22% CAGR in FY08-14.

OUTLOOK AND VALUATION

With the FMCG sector witnessing a continuous slowdown in volumes (ITC’s volume growth has dipped from 16-18% until Q4FY12 to 5-7% in Q2FY15), this initiative would be a shot in the arm for ITC. Further, we believe that with continuous regulatory pressure and belligerent price hikes in cigarettes, ITC would be far more aggressive in growing its FMCG business. We have modeled revenue CAGR of 16.5% from FY14- 17E clocking revenues of 12850 crore by FY17E.

RESULTS (Quarterly )(Rs CR.)

|

|

DEC' 14 |

SEP' 14 |

JUN' 14 |

MAR 14 |

DEC' 13 |

|

Sales |

8,942.59 |

9,023.74 |

9,248.29 |

9,238.52 |

8,726.85 |

|

Operat- ing profit |

3,464.20 |

3,488.65 |

3,277.59 |

3,203.39 |

3,284.30 |

|

Interest |

8.37 |

18.39 |

15.15 |

9.53 |

9.14 |

|

Gross profit |

4,037.82 |

3,826.48 |

3,496.99 |

3,460.57 |

3,666.22 |

|

EPS (Rs) |

3.30 |

3.04 |

2.75 |

2.86 |

3.01 |

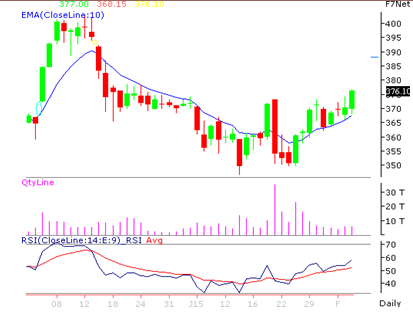

Indian Tobacco Company Limited - TECHNICAL VIEW

ITC Limited is looking strong on charts. We advise to buy around 370-375 with stop loss of 360 for the targets of 380-395 levels. RSI is also showing upside momentum in it on daily charts.

|

SYMBOL |

VALUE |

ACTION |

|

RSI(14) |

63.426 |

BUY |

|

STOCH(9,6) |

66.681 |

BUY |

|

STOCHRSI(14) |

100.00 |

OVERBOUGHT |

|

MACD(12,26) |

2.840 |

BUY |

|

ADX(14) |

21.836 |

BUY |

|

WILLIAMS %R |

-3.860 |

OVERBOUGHT |

|

CCI(14) |

186.9371 |

BUY |

|

ATR(14) |

3.8571 |

LESS VOLATILITY |

|

HIGH/LOWS(14) |

4.8179 |

BUY |

|

ULTIMATE OSCILLATOR |

59.235 |

BUY |

|

ROC |

1.938 |

BUY |

|

BULL/BEAR POWER()13 |

11.8500 |

BUY |

|

BUY: 9 SELL:0 NEUTRAL: 2 |

SUMMARY : STRONG BUY |

Our Other Recommendation for Next Week

|

SCRIP |

ACTION |

CMP |

ENTRY |

SL |

TGT |

TIME FRAME |

|

BANK OF INDIA |

SELL |

248.45 |

250-255 |

265 |

240-225 |

ONE WEEK |

|

UNION BANK |

SELL |

191.6 |

190-195 |

200 |

185-180 |

ONE WEEK |

|

PFC |

BUY |

281.15 |

278-282 |

274 |

286-290 |

ONE WEEK |

|

GLENMARK |

BUY |

742.6 |

740-750 |

720 |

770-790 |

ONE WEEK |

|

MOTHERSON SUMI |

SELL |

430.8 |

430-440 |

450 |

420-405 |

ONE WEEK |

Performance of Previous Week

|

SCRIP |

LOT |

ACTION |

ENTRY |

SL |

TGT |

P&L |

REMARK |

CLOSE/LOW/HIGH |

|

RELINFRA |

500 |

BUY |

500-510 |

480 |

525-540 |

7500.00 |

FIRST TGT HIT |

460.75 / 526.00 |

|

HINDUSTAN CONS. |

8000 |

BUY |

32-35 |

28 |

37- 40 |

16000.00 |

FIRST TGT HIT |

32.30 / 37.80 |

|

ADANI ENT |

500 |

BUY |

615-625 |

605 |

635-650 |

10000.00 |

FIRST TGT HIT |

631.70 / 667.70 |

|

HDIL |

4000 |

BUY |

107-110 |

105 |

114-118 |

16000.00 |

FIRST TGT HIT |

115.15 / 116.00 |

|

JP ASSOCIATES |

8000 |

BUY |

28-30 |

26 |

32-35 |

-16000.00 |

SL TRG |

25.90 / 29.60 |

|

ALLAHABAD BANK |

2000 |

SELL |

118-120 |

125 |

112-105 |

23800.00 |

FIRST TGT HIT |

110.10 / 106.10 |

|

NET PROFIT |

|

|

|

|

|

57300.00 |

|

|

Post a Comment

|

DISCLAIMER |

This report is only for the information of our customers. Recommendations, opinions, or suggestions are given with the understanding that readers acting on this information assume all risks involved. The information provided herein is not to be construed as an offer to buy or sell securities of any kind. ATS and/or its group companies do not as assume any responsibility or liability resulting from the use of such information.