LIC HOUSING FINANCE LIMITED

LIC Housing Finance Limited - Company Profile

LIC Housing Finance Limited provides loans for the purchase, construction, and renovation of houses/flats to individuals, corporate bodies, builders, and co-operative housing societies primarily in India. As of March 31, 2013, it operated a network of 188 offices in India, and representative offices in Dubai and Kuwait. In addition, the Company also distributes its products through branches of its subsidiary LICHFL Financial Services Ltd.

LIC Housing Finance Ltd was promoted by Life Insurance Corporation of India in 1989 and a public issue was made in 1994. It launched its maiden GDR offering in 2004. The Company enjoys the highest rating from CRISIL & CARE indicating highest safety with regard to the ability to service interest and repay principal. For FY 2013, the Company sanctioned and disbursed loans totaling Rs 26,477 Cr. & Rs 24,358 Cr. respectively, registering a growth of 20 % & 22 % respectively over the previous year

For FY 2014, the Company’s total income from operations grew by 20.30 % to Rs. 9,214.71 Cr. as against Rs. 7,659.60 Cr. in FY 2013. For the same period, net profit went up by 25.37 % to Rs. 1,321.41 Cr. as against Rs. 1,054.00 Cr. in FY 2013.

LIC Housing Finance Limited - STOCK INFORMATION

|

STOCK PRICE |

467.60 |

|

TARGET PRICE |

480-490 |

|

SECTOR |

FINANCE-HOUSING |

|

SYMBOL (AT NSE) |

LICHSGFIN |

|

ISIN |

INE115A01026 |

|

FACE VALUE (IN RS.) |

2.00 |

|

BSE CODE |

500253 |

LIC Housing Finance Limited - STOCK FUNDAMENTALS

|

MARKET CAP |

23,565.24 |

|

BOOK VALUE |

149.26 |

|

EPS - (TTM) (IN RS. CR.) |

26.95 |

|

P/E |

17.33 |

|

INDUSTRY P/ESHAREHOLDING PATTERN |

29.77 |

LIC Housing Finance Limited - INVESTMENT RATIONALE

Key fundamentals supporting the stock should be strong growth in individual housing loans coupled with build-up of project/LAP book which should lead to some margin improvement. Interest rate declines will likely get passed on; however could be beneficial for loan growth which should accelerate back to 20%+ levels.

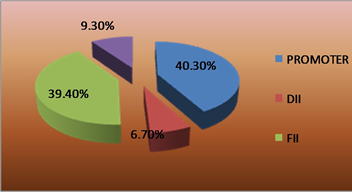

SHAREHOLDING PATTERN

OUTLOOK AND VALUATION

Management has guided for loan traction of 20% ahead. We have factored in 19% CAGR in credit over FY14-16E vs. 17% earlier. We have raised our FY15E NIM estimate to 2.35% from 2.3% earlier owing to declining trajectory in money market rates. We believe NIM improvement is the key catalyst for the stock to get re-rated higher. Accordingly, our PAT estimates increases to 19.7% CAGR to Rs 1887 crore over FY14-16E from 17.5% earlier. Recommend Buy with TP of Rs 480-490 Levels.

RESULTS (Quarterly )(Rs CR.)

|

|

SEP' 14 |

JUN' 14 |

MAR' 14 |

DEC' 13 |

SEP' 13 |

|

Sales |

2,627.57 |

2,509.13 |

2,443.31 |

2,342.70 |

2,246.51 |

|

Operat- ing profit |

2,552.26 |

2,432.52 |

2,363.08 |

2,278.70 |

2,140.05 |

|

Interest |

2,064.27 |

1,976.36 |

1,874.29 |

1,854.30 |

1,770.31 |

|

Gross profit |

519.11 |

490.61 |

523.43 |

458.07 |

425.65 |

|

EPS (Rs) |

6.76 |

6.39 |

7.33 |

6.47 |

6.14 |

TECHNICAL VIEW

LIC HOUSING FINANCE LTD is looking strong on charts. We advise to buy around 460-470 with stoploss of 448 for the targets of 480-490 levels. RSI is also showing upside momentum in it on daily charts

|

SYMBOL |

VALUE |

ACTION |

|

RSI(14) |

77.504 |

OVERBOUGHT |

|

STOCH(9,6) |

76.885 |

BUY |

|

STOCHRSI(14) |

93.206 |

OVERBOUGHT |

|

MACD(12,26) |

20.780 |

BUY |

|

ADX(14) |

40.348 |

BUY |

|

WILLIAMS %R |

-1.092 |

OVERBOUGHT |

|

CCI(14) |

112.6587 |

BUY |

|

ATR(14) |

32.6857 |

HIGH VOLATILITY |

|

HIGH/LOWS(14) |

66.1678 |

BUY |

|

ULTIMATE OSCILLATOR |

68.975 |

BUY |

|

ROC |

48.623 |

BUY |

|

BULL/BEAR POWER()13 |

80.6420 |

BUY |

|

BUY: 8 SELL:0 NEUTRAL: 3 |

SUMMARY : STRONG BUY |

|

Our Other Recommendation for Next Week

|

SCRIP |

ACTION |

CMP |

ENTRY |

SL |

TGT |

TIME FRAME |

|

UNION BANK |

BUY |

241.85 |

237-240 |

233 |

244-250 |

ONE WEEK |

|

IDEA |

BUY |

160.70 |

158-160 |

155 |

165-170 |

ONE WEEK |

|

TVS MOTOR |

SELL |

268.00 |

270-274 |

279 |

264-258 |

ONE WEEK |

|

ELDER PHARMA |

BUY |

150.00 |

145-150 |

133 |

160-172 |

ONE WEEK |

|

ASIAN PAINTS |

BUY |

780.05 |

775-780 |

765 |

790-800 |

ONE WEEK |

Performance of Previous Week

|

SCRIP |

LOT |

ACTION |

ENTRY |

SL |

TGT |

P&L |

REMARK |

CLOSE/LOW/HIGH |

|

CANARA BANK |

1000 |

BUY |

440-445 |

425 |

460-475 |

18000.00 |

NEAR TGT |

451.65 / 458.80 |

|

UNION BANK |

1000 |

BUY |

230-235 |

230 |

242-248 |

7000.00 |

FIRST TGT HIT |

241.85 / 245.80 |

|

RCOM |

2000 |

SELL |

83-85 |

88 |

81-78 |

4000.00 |

FIRST TGT HIT |

102.25 / 105.20 |

|

VOLTAS |

1000 |

SELL |

244-246 |

250 |

234-224 |

10000.00 |

FIRST TGT HIT |

247.20 / 234.00 |

|

ALLAHABAD BANK |

2000 |

BUY |

128-130 |

125 |

134-138 |

12000.00 |

FIRST TGT HIT |

132.75 / 136.95 |

|

ARVIND |

1000 |

BUY |

277- 280 |

274 |

284-288 |

8000.00 |

BOTH TGT HIT |

283.75 / 291.45 |

|

NET PROFIT |

|

|

|

|

|

59000.00 |

|

|

Post a Comment

|

DISCLAIMER |

This report is only for the information of our customers. Recommendations, opinions, or suggestions are given with the understanding that readers acting on this information assume all risks involved. The information provided herein is not to be construed as an offer to buy or sell securities of any kind. ATS and/or its group companies do not as assume any responsibility or liability resulting from the use of such information.