RELIANCE INFRASTRUCTURE LIMITED

Reliance Infrastructure Limited - Company Profile

Incorporated in 1929, Reliance Infrastructure Limited is India's largest infrastructure company and develops road projects, highways, metro rails, airports and speciality real estate through various Special Purpose Vehicles (SPVs). In addition, Reliance Infra has a presence across the entire value chain of power business (i.e. generation, transmission, distribution, and trading) and operates coal, wind, thermal, and combined cycle power generation projects.

Reliance Infra generates 941 Mega Watt (MW) of electricity from its power stations located in Maharashtra, Andhra Pradesh, Kerala, Karnataka, and Goa and dis- tributes power to 61.5 lacs consumers in Mumbai and Delhi. The Company is developing 2 cement plants of 5 million tons each in Maharashtra and Madhya Pradesh. The Company currently is developing two metro rail projects in Mumbai; awarded eleven road projects with total length of 1,000 kms; operating and maintaining five airports in Maharashtra and developing 2 cement plants of 5 million tons each in Maharashtra and Madhya Pradesh.

For FY 2014, the Company’s total income from operations fall by 14.96 % to Rs. 19,033.68 Cr. as against Rs. 22,381.55 Cr. in FY 2013. For the same period, net profit went down by 20.03 % to Rs. 1,566.44 Cr. as against Rs. 1,958.70 Cr. in FY 2013.

Reliance Infrastructure is likely to cross USD 7 billion- markover the medium term, as investment in the infrastructure sector emerges key to the sustenance of GDP growth in the country. Reliance infrastructure has invited bids from Indian as well as foreign companies to procure 1,500 MW of power to meet demand for its Mumbai distribution licence area. It has emerged as the highest bidder to develop and operate five non-metro airports in Maharashtra. RIL has a 45% stake in Reliance Power and through the associate company route will continue to participate in the Indian power story. How- ever, as of date Reliance Power only has about 600 MW under operation.

Reliance Infrastructure Limited - STOCK INFORMATION

|

STOCK PRICE |

528.25 |

|

TARGET PRICE |

505-470 |

|

SECTOR |

POWER |

|

SYMBOL (AT NSE) |

RELINFRA |

|

ISIN |

INE036A01016 |

|

FACE VALUE (IN RS.) |

10.00 |

|

BSE CODE |

500390 |

Reliance Infrastructure Limited - STOCK FUNDAMENTALS

|

MARKET CAP |

13,892.45 |

|

BOOK VALUE |

809.64 |

|

EPS - (TTM) (IN RS. CR.) |

58.76 |

|

P/E |

8.99 |

|

INDUSTRY P/ESHAREHOLDING PATTERN |

13.69 |

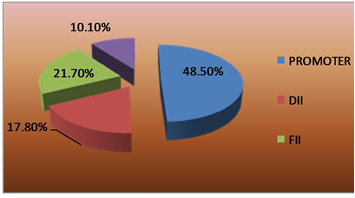

Reliance Infrastructure Limited - SHAREHOLDING PATTERN

RESULTS (Quarterly )(Rs CR.)

|

|

SEP' 14 |

JUN' 14 |

MAR' 14 |

DEC' 13 |

SEP' 13 |

|

Sales |

2,467.06 |

2,535.90 |

2,709.90 |

2,536.29 |

2,831.80 |

|

Operat- ing profit |

481.05 |

430.53 |

478.96 |

514.92 |

476.78 |

|

Interest |

353.96 |

334.31 |

303.39 |

244.03 |

231.62 |

|

Gross profit |

528.34 |

491.72 |

482.92 |

573.56 |

545.51 |

|

EPS (Rs) |

13.56 |

12.24 |

19.03 |

14.00 |

13.15 |

Reliance Infrastructure Limited - TECHNICAL VIEW

RELIANCE INFRA is looking weak on charts. We advise to sell around 530-550 with stoploss of 580 for the targets of 505-470 levels. RSI is also showing downside momentum in it on weekly charts.

|

SYMBOL |

VALUE |

ACTION |

|

RSI(14) |

29.015 |

BUY |

|

STOCH(9,6) |

33.205 |

BUY |

|

STOCHRSI(14) |

25.195 |

OVERBOUGHT |

|

MACD(12,26) |

-19.900 |

SELL |

|

ADX(14) |

35.565 |

BUY |

|

WILLIAMS %R |

-87.557 |

OVERBOUGHT |

|

CCI(14) |

-195.2883 |

BUY |

|

ATR(14) |

6.2464 |

LESS VOLATILITY |

|

HIGH/LOWS(14) |

-12.2000 |

BUY |

|

ULTIMATE OSCILLATOR |

32.459 |

BUY |

|

ROC |

-4.443 |

BUY |

|

BULL/BEAR POWER()13 |

-28.6440 |

BUY |

|

BUY: 0 SELL:10 NEUTRAL: 1 |

SUMMARY : STRONG SELL |

|

Our Other Recommendation for Next Week

|

SCRIP |

ACTION |

CMP |

ENTRY |

SL |

TGT |

TIME FRAME |

|

M&M |

SELL |

1257.95 |

1260-1280 |

1300 |

1240-1220 |

ONE WEEK |

|

LIC HOUSING |

SELL |

439.95 |

440-445 |

450 |

435-428 |

ONE WEEK |

|

TITAN |

SELL |

375.30 |

380-385 |

392 |

372-362 |

ONE WEEK |

|

POWER GRID |

SELL |

135.55 |

136-138 |

142 |

132-128 |

ONE WEEK |

|

MARUTI |

BUY |

3392.75 |

3350-3400 |

3300 |

3450-3500 |

ONE WEEK |

Performance of Previous Week

|

SCRIP |

LOT |

ACTION |

ENTRY |

SL |

TGT |

P&L |

REMARK |

CLOSE/LOW/HIGH |

|

PNB |

250 |

BUY |

1100-1125 |

1060 |

1160-1200 |

00.00 |

NEAR COST |

1103.55 / 1148.15 |

|

ITC |

1000 |

BUY |

391.35 |

383 |

398-408 |

10000.00 |

FIRST TGT HIT |

398.50 / 402.75 |

|

AMBUJA CEM |

1000 |

BUY |

236.95 |

227 |

242-248 |

-5000.00 |

SL TRG |

227.50 / 240.90 |

|

DLF |

2000 |

BUY |

161.70 |

156 |

166-170 |

12000.00 |

FIRST TGT HIT |

153.20 / 166.25 |

|

RELCAP |

500 |

SELL |

518.90 |

540 |

510-490 |

-7500.00 |

SL TRG |

527.40 / 545.50 |

|

RADICO KHITAN |

500 |

BUY |

99.00 |

92 |

105-110 |

-5000 |

SL TRG |

88.85 / 102.90 |

|

NET PROFIT |

|

|

|

|

|

4500.00 |

|

|

Post a Comment

|

DISCLAIMER |

This report is only for the information of our customers. Recommendations, opinions, or suggestions are given with the understanding that readers acting on this information assume all risks involved. The information provided herein is not to be construed as an offer to buy or sell securities of any kind. ATS and/or its group companies do not as assume any responsibility or liability resulting from the use of such information.