Rico Auto

Rico Auto - Background

Incorporated in the year 1983, Rico Auto was converted into a public limited company in Apr.'85. RAIL manufactures and supplies high precision fully machined aluminum and ferrous components and assemblies to automotive original equipment manufacturers worldwide. Its integrated services include design, development, tooling, casting, machining and assembly across ferrous and aluminum products of engine parts, transmission, chassis and breaking system. It is in the business of manufacturing and sale of auto components for two wheelers and four wheelers.

Rico Auto - Key Parameters

|

BSE Code |

520008 |

|

NSE Code |

RICOAUTO |

|

Reuters Code |

RAUT.BO |

|

CMP (as on 06/08/2015) |

54.00 |

|

Stock Beta |

1.41 |

|

52 Week H/L |

61.35/21.30 |

|

Market Cap (Cr) |

747.77 |

|

Equity Capital (Rs cr) |

13.53 |

|

Face Value (Rs) |

1 |

|

Average Volume |

229321 |

|

|

|

|

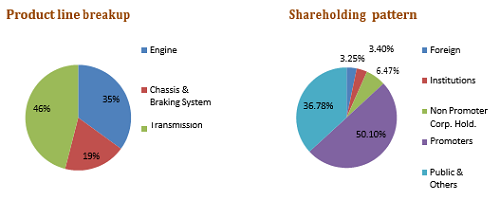

Shareholding Pattern (%) |

|

|

Promoters |

50.10 |

|

Non Institutions |

49.90 |

|

Grand Total |

100 |

Rico Auto - Investment Rationale

-

Diversified products portfolio

-

Marquee customer profile

-

Increase in demand to aid growth

-

Make in India

-

Growth potential of the domestic market

Risks and Concerns

-

Competition from unorganized sector

-

Capital intensive

-

Dependence of demand of end users

Conclusion & Recommendation

RAIL is tier-1 supplier of OEM and replacement market to many international and domestic automobile and engineering companies. After analyzing the company we expect company to outperform the auto ancillary industry with its high quality products. Make in India campaign, increase in sales and demand for automobiles will aid the growth of the company. We expect company to become debt free by the end of financial and to maintain a healthy financial position and improve its margins from the current levels aided by rise in sales.

At the current market price of Rs.54.00 the stock is trading at 18.5x FY17E EPS. Investors could buy the stock at CMP and add on dips to around Rs.44 to Rs.48 levels (~15.75x FY17E EPS) for our sequential targets of Rs.69 and Rs.81 (~23x to ~28x FY17E EPS).

Rico Auto - Financial Summary

|

Particulars (Rs. in Crs) |

FY13 |

FY14 |

FY15 |

FY16E |

FY17E |

|

Net Sales |

1481.18 |

1442.93 |

1299.45 |

1429.40 |

1600.92 |

|

Operating Profit |

169.94 |

174.27 |

323.91 |

138.91 |

159.64 |

|

PAT |

5.37 |

2.7 |

153.43 |

23.81 |

39.65 |

|

EPS (Rs.) |

0.40 |

0.20 |

11.30 |

1.75 |

2.92 |

|

PE |

136.46 |

271.40 |

4.77 |

30.77 |

17.78 |

Business Profile

Product profile

|

Engine Parts |

Chassis & Braking System |

Transmission System |

|

|

Oil Pump Assembly |

Engine Front Cover |

Wheel Hub Assembly |

Clutch Assembly |

|

Fuel System Parts |

Balance Shaft Assembly |

Brake Panel Assembly |

Differential Case |

|

Lube Oil Filter head |

Gear Housing |

Brake Disc |

Gear Shift Forks |

|

Exhaust Manifolds |

Main Bearing Caps |

Brake Drums |

Intermediate Plate |

|

Turbine Housings |

Water & Air Connections |

Caliper & Anchor |

Pressure Plate |

|

Center Housings |

Timing Cases |

TMC Tandem Master Cylinder |

Rear Case |

|

Crank Cases & Covers |

Cylinder Block (Aluminum) |

|

Transmission Case |

|

Cylinder Head Cover |

EGR Housing |

|

Front Transmission Housing |

|

Oil Pan |

Intake Manifold Cover |

|

|

Subsidiaries

-

Rico Auto Industries Inc., USA

It is engaged in the business of trading of Auto Components and providing warehousing and logistics support to our OEMs and Tier-I Customers in the North American and Brazilian Markets

-

Rico Auto Industries (UK) Limited, U.K.

It is engaged in the business of trading of Auto Components and providing warehousing and logistics support to our OEMs and Tier-I Customers for the European Markets.

-

Rasa Autocom Limited.

It is engaged in the business of manufacturing of high pressure and gravity die cast Auto Components. Its plant is being equipped for automation and better controls to produce high quality parts in large volume for export.

-

AAN Engineering Industries Limited.

This Company has been set-up to focus on, non-automotive components business, especially for manufacturing and supplying of technical and engineering equipment required for Defence i.e. Army, Aerospace, Navy and Homeland Security

-

Rico JINFEI wheels

Rico Jinfei Wheels Limited engages in the production and sale of aluminum alloy wheels for two wheelers primarily in India. It also exports its products to the United States, Japan, Europe, and the Middle East. Rico Jinfei Wheels Limited is a subsidiary of Rico Auto Industries Limited. As of March 30, 2015, Rico Jinfei Wheels Limited operates as a subsidiary of Rico Investments Limited.

-

Uttarakhand Automobiles ltd

Uttarakhand Automotives Limited engages in the sale of automobile parts. The company is based in Gurgaon, India.

-

RAA Autocom Ltd

RAA Autocom Limited engages in the sale of automobile parts. The company is based in Gurgaon, India. Raa Autocom Limited is a subsidiary of Rico Auto Industries Limited.

Joint Ventures

-

Magna Powertrain Rico

Shareholding: Magna Powertrain-Rico 50-50

Magna Rico Powertrain Private Limited was founded in 2008. The company's line of business includes the manufacturing of motor vehicle parts and accessories such as Oil & Water Pump (with Aluminum Housings) for Indian and Europe

-

Continental Rico Hydraulic Brakes (India) Private Limited

It manufactures calipers for the front and rear axles, drum brakes, master cylinders, brake boosters, and load sensing proportioning valves for vehicles. The company offers hydraulic brake products and services. The company was incorporated in 2008 and is based in Gurgaon, India.

Clientele

Investment Rationale

Diversified products portfolio

RAIL has a well diversified product mix which will help it to reduce the risk factor associated with one single product or single end user focused companies. It has more than thirty two products under three categories namely engine parts, chassis and braking system and transmission system. It also supplies OEM’s, Specialized parts and Replacements parts to 2-Wheelers, Passenger Vehicles, Heavy Vehicles, etc which helps to reduce market risk associated with companies who supplies its products to a companies in a particular segment in the market ie reduction in demand for four-wheelers parts can be compensated by increase in demand for two-wheelers parts.

Marquee customer profile

RAIL has fostered long-term relationships across a wide range of companies and is a preferred supplier to some of the leading companies both in India and Internationally. Rico’s global presence has been established mostly through exports, which began in the year 1994. It is a tier-1 supplier to auto OEM in the international market. Its global customers include reputed brands across developed markets. In the US, it supplies Ford, General Motors, Cummins, Caterpillar, and Detroit Diesel. In Europe, its clients include Ford, Land Rover, Jaguar, General Motors, Cummins, Caterpillar, Volvo, Perkins, and Honeywell. In Japan, supplies are made to Cummins, Nissan, Honeywell, and Matsusaka Engineering Company. The company is in the advanced stages of launching new products for other automobile OEMs both in Europe and North America. Alliances and joint ventures have been leveraged to grow in the global markets. It also helps to bring the stability factor associated with demand and purchase of products to the clients and also helps RAIL to grow along with the growth and growth prospects of the clientele.

Increase in demand to aid growth

With already completed expansions and modernization RAIL will be in a position to make the optimum utilization of the market potential and the demand for the products. The current capacity utilization stands around ~60% with the future of the automobile industry looking bright, RAIL will be able to utilize the current manufacturing capacities to the maximum and capitalize on the demand in order to increase the margins as the company doesn’t have much capital expenditure or expansion plans for the near term future. An increase in demand for the products will help subsidiaries and JV’s of RAIL to improve its performance which in turn will help RAIL to improve its overall performance.

Make in India

Manufacturing in India is expected to ramp up at a greater rate than in developed markets. The ‘Make in India’ campaign focuses on the ease of doing business and is likely to move India ahead in the global manufacturing race. Globally, the sourcing of automotive components to low-cost countries is accelerating, especially in areas of machined components and assemblies. The opportunities for global growth in RAIL’s core area of business are immense. Cost competitiveness as well as its engineering and investment capabilities are increasingly meeting the global sourcing needs of automotive OEM and tier-1 suppliers. Its competitive strengths as an integrated full-service supplier and capabilities to understand customer requirements and meet tight deliveries schedule have resulted in creating confidence among global players. Leading European and North American OEM has selected RAIL as a single source supplier for critical engine and transmission components and assemblies.

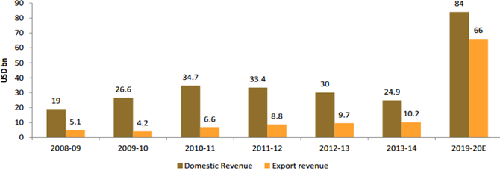

Emphasis on exports to drive growth

Currently exports of products to Automobiles companies, System Suppliers and Commercial vehicles stands at ~20% of the overall revenue. With the improvement in the global automobile industry and RAIL will be able to increase the percentage of exports on overall revenue to ~25% to ~30% levels, which can make a big impact on the overall revenue, profits, and profit margin of the company as the exports have higher margins compared with domestic sales.

Sound financials

RAIL is the tier-1 supplier of OEM, specialized parts, and replacement parts to many major automobile and engineering companies around the world. With the growth prospects of the automobile and engineering industry looking bright, we expect RAIL could outpace the industry. With new product launches, increase in demand for its products, RAIL would be able to maintain a healthy financial position and improve its margins from the current levels. With sales of the sale of its 50 percent stake in FCC Rico to its Japanese partner, FCC Co Ltd., RAIL was able to reduce a considerable amount of debt from its books and plans to become debt-free by the end of 2015-16. Improvement in the performance of JV’s and fully owned subsidiaries can make a positive impact on the company’s overall financials.

The growth potential of the domestic market

India is one of the fastest-growing economies in the world with a favorable demographic pattern, fast-growing middle class, and increase in per capita spending on vehicles will work in the favor of the growth in the domestic automobile market, and RAIL will be in pole position to capitalize on the growth in the Indian Automobile industry as it provides OEM and replacement provider for most of the major players in the domestic market. With the current facilities available along with current manufacturing facilities increase in capacity utilization will have a big positive impact on profits and margins.

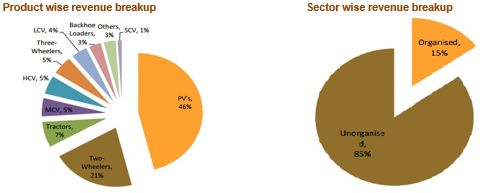

Industry Overview

The Indian auto-components industry can be broadly classified into the organized and unorganized sectors. The organized sector caters to the original equipment manufacturers (OEMs) and consists of high-value precision instruments while the unorganized sector comprises low- valued products and caters mostly to the aftermarket category.

Indian auto component industry is one of the fastest growing industries and is riding on the success of the automobile sector. Coupled with growing demand and technological advancements, the auto component industry in India has emerged as a key market in Asia as well as in the world. The country currently supplies auto components to a number of international automobile makers, such as General Motors, Toyota, Ford and Volkswagen, amongst other. This industry accounts for 22% of the country's manufacturing gross domestic product (GDP). The automobile industry in India is expected to be the world's third-largest by 2016, with the country currently the world's second-largest two-wheeler manufacturer. Two-wheeler sales are projected to rise from 15.9 mn in FY13 to 34 million by FY20E. India's domestic market and its growth potential have been a big attraction for many global automakers.

The Indian auto industry is highly competitive with the presence of a large number of global and Indian auto companies. The auto sector alone contributes nearly 84.3% of the total turnover (OEM) and the rest belongs to the replacement market. The auto component sector clocked a turnover of USD 35.1 bn in FY14, recording a CAGR of 7.8% during the period of 2008-2014, and is projected to become the fourth largest automobile producer globally by 2020 with a turnover over USD 150 bn by FY20, according to Automotive Component Manufacturing Association of India (ACMA).

Currently, India is ranked 22 among global component exporting countries. China is at the third spot on the list led by Germany and the US. Indian auto component sector exports grew by 16.7% to USD 10.2 bn (Rs.614.9 bn) in FY14 from USD 9.7 bn (Rs.526.9 bn) in FY13. Europe is the leading marketplace with 38% contribution, while the US topped the list of top export destinations. Low labour costs, availability of skilled labour and high quality consciousness among Indian vendors have spurred the growth of auto component exports from India. Moreover, over the last few years, the structure of the customer base in the global markets has also undergone a major change. According to a joint study by ACMA and McKinsey, India will jump to 9th spot in exports by 2020 and the next imperative for the Indian auto component industry reveals that Indian suppliers still account for just 1% of overall global exports of USD 1,006 bn – indicating a significant upside opportunity for exports.

Revenue Breakup

The study findings suggest that globalization in the auto-suppliers industry is likely to increase. Indian auto component industry can be broadly segmented into six major segments. Engine and drive transmission parts together contribute about 50% of the auto component industry production. Engine parts, which constitute 31% of the production, mainly comprise of pistons, engine valves, carburetors, fuel injection systems, camshafts, crankshafts and cooling systems. Drive transmission parts, which constitute 19% of the total production, include axle assembly, steering parts and clutch assembly.

Indian component manufacturers are well positioned to capture overseas opportunity in the coming 2-3 years The domestic industry’s focus on exports has been part of industry’s initiatives to counter the cyclicality in the domestic auto sector. Europe accounted for 38% of exports followed by Asia at 25% and North America at 21%. Exports to Europe increased by 14.5% over the previous fiscal, while exports to Latin America and Asia registered a growth of 16.5% and 5.4% respectively. The key export items include engine parts, transmission parts, brake system & components, body parts, exhaust systems, turbochargers etc. Indian auto component makers are well positioned to benefit from globalization of the sector as exports potential could be increased by up to four times to USD 40 bn by 2020 from current USD 1 bn.

Peer group comparison

|

Sl. No. |

Name |

CMP (Rs.) |

P/E |

MC (Rs. Cr.) |

DY (%) |

CMP/BV |

|

1 |

347.45 |

29.8 |

30641.62 |

0.69 |

9.25 |

|

|

2 |

24669.7 |

74.5 |

77462.86 |

0.18 |

10.6 |

|

|

3 |

169.7 |

3.92 |

3738.49 |

0.25 |

0.48 |

|

|

4 |

146.25 |

20.2 |

12431.25 |

1.24 |

3.27 |

|

|

5 |

882.4 |

36 |

15071.39 |

0.33 |

8.87 |

|

|

6 |

177.1 |

26.8 |

4922.49 |

0.05 |

1.94 |

Risks and Concerns

Dependence of demand of end users

Being an OEM and replacement supplier to many companies scattered around various geographies, RAIL’s performance relies on the performance, and demand and growth of the companies which RAIL supply its products.

Capital intensive

Being a capital intensive industry RAIL is exposed to the fluctuations in the price of raw materials which are used for the producing its products and it can make difference in the profit margins.

Competition from the unorganized sector

There are more than five thousand small scale players in the Indian auto ancillary industry RAIL face tough competition from the unorganized players in the industry. As unorganized players are able to provide a wide range of product in OEM, replacement and specialized segment in the domestic and international market

Financials

Q1FY16

|

Particulars (in Rs. Crs.) |

4thQtr 201503 |

4th Qtr 201403 |

VAR % |

4thQtr 201503 |

3rdQtr 201412 |

VAR % |

|

Gross Sales |

226.59 |

352.65 |

-35.7 |

226.59 |

348.44 |

-34.97 |

|

Excise Duty |

0.00 |

0.00 |

0.00 |

0.00 |

0.00 |

0.00 |

|

Net Sales |

226.59 |

352.65 |

-35.7 |

226.59 |

348.44 |

-34.97 |

|

Other Operating Income |

18.05 |

15.61 |

15.6 |

18.05 |

8.23 |

119.32 |

|

Other Income |

6.44 |

11.4 |

-43.5 |

6.44 |

217.42 |

-97.04 |

|

Total Income |

251.08 |

379.66 |

-33.9 |

251.08 |

574.09 |

-56.26 |

|

Total Expenditure |

245.35 |

332.66 |

-26.2 |

245.35 |

334.7 |

-26.70 |

|

PBIDT |

5.73 |

47 |

-87.8 |

5.73 |

239.39 |

-97.61 |

|

Interest |

4.25 |

17.67 |

-75.9 |

4.25 |

17.94 |

-76.31 |

|

PBDT |

1.48 |

29.33 |

-95 |

1.48 |

221.45 |

-99.33 |

|

Depreciation |

17.73 |

23.61 |

-24.9 |

17.73 |

22.97 |

-22.81 |

|

PBT |

-16.25 |

5.72 |

-384.1 |

-16.25 |

198.48 |

-108.19 |

|

Tax |

-9.26 |

4.05 |

-328.6 |

-9.26 |

38.28 |

-124.19 |

|

Reported Profit After Tax |

-6.99 |

1.67 |

-518.6 |

-6.99 |

160.2 |

-104.36 |

|

Minority Interest After NP |

0.19 |

0.00 |

0.00 |

0.19 |

0.00 |

0.00 |

|

NP after Minority Interest & P/L Asso.Co. |

-7.18 |

1.67 |

-529.9 |

-7.18 |

160.2 |

-104.48 |

|

PBIDTM(%) |

2.53 |

13.33 |

-81 |

2.53 |

68.7 |

-96.32 |

|

PBDTM(%) |

0.65 |

8.32 |

-92.2 |

0.65 |

63.55 |

-98.98 |

|

PATM(%) |

-3.17 |

0.47 |

-774.5 |

-3.17 |

45.98 |

-106.89 |

Profit and Loss Account (consolidated)as per rough estimates

|

Particulars (in Rs. Crs.) |

FY13 |

FY14 |

FY15 |

FY16E |

FY17E |

|

Gross Sales |

1481.18 |

1442.93 |

1299.45 |

1429.40 |

1600.92 |

|

Excise Duty |

0.00 |

0.00 |

0.00 |

0.00 |

0.00 |

|

Net Sales |

1481.18 |

1442.93 |

1299.45 |

1429.40 |

1600.92 |

|

Other Operating Income |

24.82 |

37.17 |

46.85 |

57.68 |

67.30 |

|

Other Income |

52.67 |

26.08 |

226.92 |

26.08 |

30.56 |

|

Total Income |

1558.67 |

1506.18 |

1573.22 |

1513.16 |

1698.79 |

|

Total Expenditure |

1388.73 |

1331.91 |

1249.31 |

1374.24 |

1539.15 |

|

PBIDT |

169.94 |

174.27 |

323.91 |

138.91 |

159.64 |

|

Interest |

69.12 |

67.38 |

52.76 |

0.00 |

0.00 |

|

PBDT |

100.82 |

106.89 |

271.15 |

138.91 |

159.64 |

|

Depreciation |

87.07 |

94.32 |

84.6 |

99.32 |

103.54 |

|

PBT |

13.75 |

12.57 |

186.55 |

39.59 |

56.10 |

|

Tax |

8.38 |

12.83 |

32.93 |

15.78 |

16.45 |

|

Fringe Benefit Tax |

0.00 |

0.00 |

0.00 |

0.00 |

0.00 |

|

Deferred Tax |

0.00 |

-2.96 |

0.00 |

0.00 |

0.00 |

|

Reported Profit After Tax |

5.37 |

2.70 |

153.62 |

23.81 |

39.65 |

|

Minority Interest After NP |

0.00 |

0.00 |

0.19 |

0.00 |

0.00 |

|

Net Profit after Minority Interest & P/L Asso. Co. |

5.37 |

2.70 |

153.43 |

23.81 |

39.65 |

|

Extra-ordinary Items |

5.23 |

0.04 |

0.00 |

0.00 |

0.00 |

|

Adjusted Profit After Extra-ordinary item |

0.14 |

2.66 |

153.43 |

23.81 |

39.65 |

|

|

|

|

|

|

|

|

EBITA Margin |

11.47% |

12.08% |

24.93% |

9.72% |

9.97% |

|

PAT Margin |

0.36% |

0.19% |

11.82% |

1.67% |

2.48% |

Balance Sheet (consolidated) as per rough estimates

|

Particulars (in Rs. Crs.) |

FY13 |

FY14 |

FY15 |

FY16E |

FY17E |

|

SOURCES OF FUNDS: |

|

|

|

|

|

|

Share Capital |

13.53 |

13.53 |

13.53 |

13.53 |

13.53 |

|

Reserves & Surplus |

330.51 |

335.28 |

437.47 |

491.31 |

502.39 |

|

Minority Interest |

0.00 |

0.00 |

3.66 |

0.00 |

0.00 |

|

Loan Funds |

408.51 |

266.47 |

146.1 |

0.00 |

0.00 |

|

Deferred Tax Liability |

40.42 |

37.46 |

11.63 |

18.14 |

6.80 |

|

Other Liabilities |

10.25 |

11.48 |

12.68 |

15.80 |

17.89 |

|

Total Liabilities |

803.22 |

664.22 |

625.07 |

538.78 |

540.61 |

|

APPLICATION OF FUNDS: |

|

|

|

|

|

|

Fixed Assets |

726.40 |

704.99 |

432.91 |

432.91 |

432.91 |

|

Intangible Assets |

2.57 |

2.09 |

0.28 |

0.91 |

0.30 |

|

Loans |

0.00 |

0.00 |

0.00 |

0.00 |

0.00 |

|

Investments |

0.00 |

0.00 |

48.5 |

0.00 |

0.00 |

|

Current Assets, Loans & Advances |

452.29 |

420.80 |

329.81 |

335.12 |

285.77 |

|

Inventories |

174.70 |

158.49 |

108.6 |

113.62 |

127.25 |

|

Sundry Debtors |

160.13 |

166.98 |

146.58 |

149.95 |

134.55 |

|

Cash & Bank Balance |

11.05 |

10.72 |

5.40 |

3.49 |

3.96 |

|

Other Current Assets |

7.30 |

14.92 |

10.42 |

16.30 |

18.04 |

|

Loans & Advances |

99.11 |

69.69 |

58.81 |

51.76 |

43.79 |

|

Current Liabilities & Provisions |

417.77 |

505.83 |

253.33 |

346.01 |

314.80 |

|

Current Liabilities |

383.77 |

467.29 |

216.74 |

306.07 |

272.98 |

|

Provisions |

34.00 |

38.54 |

36.59 |

39.94 |

41.82 |

|

Net Current Assets |

34.52 |

-85.03 |

76.48 |

37.12 |

31.67 |

|

Other Assets |

39.73 |

42.17 |

66.90 |

68.75 |

76.03 |

|

Total Assets |

803.22 |

664.22 |

625.07 |

538.78 |

540.61 |

Technical View

-

On monthly charts, the stock has given a breakout above Rs.41.70 levels and is currently trading at Rs.54.00.

-

Going forward, for the medium term, we feel the stock to get support around Rs.44 and Rs.48 levels, which can be used for averaging the stock.

-

It is currently trading above its 30, 50,100 and 200 Day EMAs and has been holding the same level for some weeks. This is a bullish signal.

-

Weekly traded volumes have shown a strong jump over the last couple of months, which is also a good sign.

-

Momentum oscillator RSI is pointing upwards and is at ~65 which means there is further upside possible.

Conclusion and Recommendation

We are positive on RAIL over the long term and hence recommend a BUY at CMP of RS.54.00 and further add on declines between Rs.44 to Rs.48 for a target of Rs.69 to Rs.81 with stop loss maintained at Rs.41.70.

Post a Comment

|

DISCLAIMER |

This report is only for the information of our customers. Recommendations, opinions, or suggestions are given with the understanding that readers acting on this information assume all risks involved. The information provided herein is not to be construed as an offer to buy or sell securities of any kind. ATS and/or its group companies do not as assume any responsibility or liability resulting from the use of such information.