SESA STERLITE LIMITED

Sesa Sterlite Limited - Company Profile

Founded in 1954, Sesa Sterlite is India’s largest producer and exporter of iron ore in private sector. The Company is en- gaged in business of exploration, mining and processing of iron ore. Sesa's iron ore markets/customers are primarily located in geographies of China, India, Japan, Korea, Europe and other Asian countries. Sesa Sterlite Ltd is part of Vedanta Re- sources plc, the London-listed FTSE 100 diversified metals and mining major. In August 2011, Sesa acquired 51% stake in Western Cluster Limited, Liberia. WCL has mining inter- ests / rights in the Western Cluster iron ore project in Liberia with a potential reserves and resources of over 1 bn tonnes.

As of 31 March 2012, Sesa Sterlite Ltd owns or has rights to reserves and resources of 306 million tonnes of iron ore; which has been independently reviewed and certified as per Joint Ore Re- serves Committee (JORC) stanards. On 20 September 2013, the name of Sesa Goa Limited has been changed to Sesa Sterlite Limited. The change of name is consequent to the approval of the Scheme of amalgamation and arrangement amongst Sterlite Industries (India) Limited, Madras Alumin- ium Company Limited, Sterlite Energy Limited, Vedanta Alu- minium Limited and Sesa Goa Limited.

Sesa Sterlite Limited - STOCK INFORMATION

|

STOCK PRICE |

202.35 |

|

TARGET PRICE |

210-220 |

|

SECTOR |

MINING & MINIRALS |

|

SYMBOL (AT NSE) |

SSLT |

|

ISIN |

INE205A01025 |

|

FACE VALUE (IN RS.) |

1.00 |

|

BSE CODE |

500295 |

Sesa Sterlite Limited - STOCK FUNDAMENTALS

|

MARKET CAP |

59,797.88 |

|

BOOK VALUE |

113.60 |

|

EPS - (TTM) (IN RS. CR.) |

3.47 |

|

P/E |

58.13 |

|

INDUSTRY P/E |

14.72 |

Sesa Sterlite Limited - INVESTMENT RATIONALE

Despite headwind of weaker prices of key commodities, management emphasized the focus on free cash generation through (1) capex optimization, primarily at Cairn India and Zinc International, (2) opex reduction, (3) asset sweating, (4) USD500m of additional annual margin in marketing over four years (USD250m in FY16), (5) USD800m of efficiencies in pro- curement over four years (USD300m in FY16) and production ramp up at stranded aluminum and power assets aided by the recently-acquired coal mines in the e-auction. Capital allocation will be towards high IRR projects in zinc and oil businesses. Asset sweating rather than capex will be the fo- cus on over-invested aluminum and power assets. Produc- tion outlook has improved as regulatory approvals have started to come.

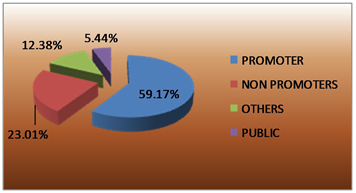

SHAREHOLDING PATTERN

OUTLOOK & VALUATION

We believe that SSLT’s low cost and diversified portfolio of commodities, new leadership, focus on asset sweating, eas- ing of regulatory environment all augur well for growth. We maintain a positive outlook on aluminum and zinc prices. Eventual merger of cash rich subsidiaries will de-stress the balance sheet and re-rate the stock. Maintain Buy on SSLT.

RESULTS (Quarterly )(Rs CR.)

|

|

DEC' 14 |

SEP' 14 |

JUN' 14 |

MAR 14 |

DEC' 13 |

|

Sales |

8,631.55 |

8,735.25 |

7,135.80 |

8,933.13 |

8,274.66 |

|

Operat- ing profit |

1,450.50 |

1,300.56 |

886.44 |

962.78 |

981.80 |

|

Interest |

851.57 |

996.42 |

985.33 |

966.26 |

946.31 |

|

Gross profit |

666.46 |

1,328.64 |

569.69 |

111.52 |

809.05 |

|

EPS (Rs) |

0.87 |

3.12 |

0.57 |

-1.10 |

2.89 |

TECHNICAL VIEW

SSLT FUTURE is looking strong on charts, long build up has been seen, we may see more upside, if it sustains above 200 levels. We advise buying around 195-200 lev- els with strict stop loss of 185 for the targets of 210-220.

|

SYMBOL |

VALUE |

ACTION |

|

RSI(14) |

73.265 |

BUY |

|

STOCH(9,6) |

70.147 |

BUY |

|

STOCHRSI(14) |

100.000 |

OVERBOUGHT |

|

MACD(12,26) |

2.410 |

BUY |

|

ADX(14) |

42.595 |

BUY |

|

WILLIAMS %R |

-8.108 |

OVERBOUGHT |

|

CCI(14) |

138.8583 |

BUY |

|

ATR(14) |

1.8714 |

HIGH VOLATILITY |

|

HIGH/LOWS(14) |

4.7893 |

BUY |

|

ULTIMATE OSCILLATOR |

66.311 |

BUY |

|

ROC |

4.899 |

BUY |

|

BULL/BEAR POWER()13 |

7.2420 |

BUY |

|

BUY: 9 SELL: 0 NEUTRAL: 2 |

SUMMARY : STRONG BUY |

|

Our Other Recommendation for Next Week

|

SCRIP |

ACTION |

CMP |

ENTRY |

SL |

TGT |

TIME FRAME |

|

TATA STEEL |

BUY |

347.5 |

340-345 |

330 |

355-370 |

ONE WEEK |

|

ASIAN PAINT |

BUY |

855.5 |

845-855 |

835 |

865-880 |

ONE WEEK |

|

VOLTAS |

BUY |

307.85 |

304-308 |

300 |

312-316 |

ONE WEEK |

|

SBIN |

BUY |

281.65 |

278-280 |

274 |

284-288 |

ONE WEEK |

|

RECL |

BUY |

346.15 |

340-345 |

332 |

352-360 |

ONE WEEK |

Performance of Previous Week

|

SCRIP |

LOT |

ACTION |

ENTRY |

SL |

TGT |

P&L |

REMARK |

CLOSE / LOW/ HIGH |

|

HCLTECH |

250 |

SELL |

940-950 |

975 |

920-900 |

5000.00 |

FIRST TGT HIT |

962.75 / 916.15 |

|

BHEL |

1000 |

SELL |

230-235 |

240 |

225-220 |

0.00 |

AT COST |

232.05 / 226.10 |

|

AUROPHARMA |

250 |

BUY |

1220-1240 |

1195 |

1260-290 |

0.00 |

NOT OPEN |

1330.35 /1271.90 |

|

BHARAT FORGE |

250 |

BUY |

1310-1325 |

1290 |

1345-375 |

5000.00 |

FIRST TGT HIT |

1326.40/1372.00 |

|

TVS MOTOR |

1000 |

SELL |

260-264 |

269 |

255-250 |

10000.00 |

BOTH TGTHIT |

340.05 / 341.50 |

|

NET PROFIT |

|

|

|

|

|

20000.00 |

|

|

Post a Comment

|

DISCLAIMER |

This report is only for the information of our customers. Recommendations, opinions, or suggestions are given with the understanding that readers acting on this information assume all risks involved. The information provided herein is not to be construed as an offer to buy or sell securities of any kind. ATS and/or its group companies do not as assume any responsibility or liability resulting from the use of such information.