Sundram Fasteners Ltd.

|

Current price |

174.70 |

|

Sector |

Fasteners |

|

No of shares |

210128370 |

|

52 week high |

219.00 |

|

52 week low |

50.70 |

|

BSE Sensex |

28469.67 |

|

Nifty |

8634.65 |

|

Average Volume |

45204 |

|

BSE Code |

500403 |

|

NSE Symbol |

SUNDRMFAST |

Sundram Fasteners Limited - Company Overview

Sundram Fasteners Limited is a part of the US $5 billion TVS Group, headquartered in Chennai, India. Sundram Fasteners Ltd has established a track record of leadership over 40 years. With a diversified product line, world-class facilities in 4 countries and motivated team of talented people, Sundram Fasteners has become a supplier of choice to leading customers in the automotive and industrial segments worldwide.

The product range consists of high-tensile fasteners, powder metal components, cold extruded parts, hot forged components, radiator caps, automotive pumps, gear shifters, gears and couplings, hubs and shafts, tappets and iron powder. Over the years, the Company has acquired cutting-edge technological competencies in forging, metal forming, close-tolerance machining, heat treatment, surface finishing and assembly.

Manufacturing locations are supported by engineering and design personnel working on new product design and development. It has operations in India, China, the United Kingdom, Malaysia, Germany, and the United States. Understanding the global nature of business and the need to provide quality products on “just in time” basis to customers, the company has established supply chain logistics networks spanning several continents.

The current market capitalisation stands at Rs 3,721.37 crore. The company has reported a standalone sales of Rs 575.46 crore and a Net Profit of Rs 30.13 crore for the quarter ended Dec 2014.

Sundram Fasteners Limited - Share Holding Pattern

|

Category |

No. of Shares |

Percentage |

|

Promoters |

104,085,280 |

49.53 |

|

General Public |

55,802,805 |

26.56 |

|

NBFC and Mutual Funds |

26,830,121 |

12.77 |

|

Financial Institutions |

12,683,968 |

6.04 |

|

Foreign Institutions |

5,881,397 |

2.80 |

|

Other Companies |

4,571,033 |

2.18 |

|

Others |

273,766 |

0.13 |

Sundram Fasteners Limited - Financial Details

-

Market Cap (Rs Cr) – 3689.25

-

Company P/E (x) – 25.22

-

Industry P/E (x) – 28.07

-

Book Value (Rs) – 38.16

-

Price / BV (x) – 4.60

-

Dividend (%) – 170%

-

EPS (TTM) – 6.99

-

Dividend Yield (%) – 0.97%

-

Face Value (Rs) – 1

Industry Overview

Fasteners form a vital part of any structure as they help in joining two or more components together. Economic development in India has led to a rise in disposable income of consumers which in turn has resulted in growing demand for automobiles. This factor is expected to be one of the primary reasons driving the growth of the market. In addition, rise in construction and maintenance activities all across the world is expected to be an important factor which will boost the demand for fasteners over the forecast period. Development of fasteners which are customized for niche application segments such as railways and solar equipment is expected to open opportunities for the growth of the market within the forecast period.

Automobile industry accounts for 75 percent of the total demand of this industry followed by consumer durables and railways. With the automotive industry witnessing a significant growth rate along with increasing global demand, the future of the Indian fastener industry is very promising. Other OEM segments such as electronic and electrical, fabricated metal products and aerospace equipments were the largest application segments of fasteners and accounted for over 30% of the demand in 2011.

However, demand for fasteners is expected to be highest from construction on account of the rising construction and maintenance activities worldwide. The construction application segment is expected to grow at a CAGR of over 9% from 2012 to 2018. Automotive OEM sector is expected to show above average growth within the forecast period.

Asia Pacific accounted for the highest demand for industrial fasteners in 2012 and is expected to account for over 45% of the market by 2018. The trend is expected to continue over the next six years due to factors such as rapid industrialization and favorable economic conditions, which is expected to boost the demand for durable goods and other manufacturing and development activities.

Balance Sheet

|

|

Mar '14 |

Mar '13 |

Mar '12 |

Mar '11 |

Mar '10 |

|

Sources Of Funds |

|

|

|

|

|

|

Total Share Capital |

21.01 |

21.01 |

21.01 |

21.01 |

21.01 |

|

Equity Share Capital |

21.01 |

21.01 |

21.01 |

21.01 |

21.01 |

|

Reserves |

754.63 |

673.28 |

612.45 |

533.94 |

459.14 |

|

Networth |

775.64 |

694.29 |

633.46 |

554.95 |

480.15 |

|

Secured Loans |

306.09 |

338.93 |

344.19 |

649.66 |

369.39 |

|

Unsecured Loans |

291.90 |

370.28 |

351.68 |

99.95 |

198.52 |

|

Total Debt |

597.99 |

709.21 |

695.87 |

749.61 |

567.91 |

|

Total Liabilities |

1,373.63 |

1,403.50 |

1,329.33 |

1,304.56 |

1,048.06 |

|

Application Of Funds |

|

|

|

|

|

|

Gross Block |

1,380.03 |

1,231.79 |

1,133.13 |

1,010.96 |

910.89 |

|

Less: Accum. Depreciation |

597.56 |

524.16 |

460.34 |

403.15 |

350.75 |

|

Net Block |

782.47 |

707.63 |

672.79 |

607.81 |

560.14 |

|

Capital Work in Progress |

20.53 |

21.41 |

40.09 |

50.04 |

19.64 |

|

Investments |

123.16 |

132.02 |

142.63 |

142.37 |

142.39 |

|

Inventories |

290.18 |

321.18 |

323.98 |

286.93 |

209.53 |

|

Sundry Debtors |

405.77 |

432.92 |

433.52 |

364.55 |

260.37 |

|

Cash and Bank Balance |

9.21 |

10.59 |

6.71 |

8.13 |

4.65 |

|

Total Current Assets |

705.16 |

764.69 |

764.21 |

659.61 |

474.55 |

|

Loans and Advances |

217.82 |

219.55 |

189.66 |

144.07 |

121.21 |

|

Fixed Deposits |

0.00 |

0.00 |

0.00 |

0.46 |

0.38 |

|

Total CA, Loans & Advances |

922.98 |

984.24 |

953.87 |

804.14 |

596.14 |

|

Current Liabilities |

435.10 |

408.29 |

448.62 |

277.54 |

253.52 |

|

Provisions |

40.40 |

33.52 |

31.42 |

22.25 |

16.73 |

|

Total CL & Provisions |

475.50 |

441.81 |

480.04 |

299.79 |

270.25 |

|

Net Current Assets |

447.48 |

542.43 |

473.83 |

504.35 |

325.89 |

|

Total Assets |

1,373.64 |

1,403.49 |

1,329.34 |

1,304.57 |

1,048.06 |

|

Contingent Liabilities |

69.60 |

102.38 |

63.04 |

26.00 |

80.96 |

|

Book Value (Rs) |

36.91 |

33.04 |

30.15 |

26.41 |

22.85 |

Profit and Loss Account

|

|

Mar '14 |

Mar '13 |

Mar '12 |

Mar '11 |

Mar '10 |

|

Income |

|

|

|

|

|

|

Sales Turnover |

2,022.28 |

2,069.42 |

2,146.64 |

1,944.81 |

1,421.93 |

|

Excise Duty |

0.00 |

0.00 |

0.00 |

136.42 |

88.07 |

|

Net Sales |

2,022.28 |

2,069.42 |

2,146.64 |

1,808.39 |

1,333.86 |

|

Other Income |

38.72 |

27.58 |

18.07 |

-1.26 |

15.43 |

|

Stock Adjustments |

-6.63 |

-3.18 |

39.81 |

25.99 |

2.27 |

|

Total Income |

2,054.37 |

2,093.82 |

2,204.52 |

1,833.12 |

1,351.56 |

|

Expenditure |

|

|

|

|

|

|

Raw Materials |

1,107.88 |

1,192.65 |

1,290.26 |

1,064.77 |

761.60 |

|

Power & Fuel Cost |

111.45 |

119.16 |

90.37 |

86.95 |

62.29 |

|

Employee Cost |

218.23 |

201.91 |

184.24 |

158.97 |

124.27 |

|

Other Manufacturing Expenses |

0.00 |

0.00 |

0.00 |

168.16 |

113.61 |

|

Selling and Admin Expenses |

0.00 |

0.00 |

0.00 |

72.07 |

91.56 |

|

Miscellaneous Expenses |

321.97 |

295.19 |

326.48 |

59.54 |

14.99 |

|

Total Expenses |

1,759.53 |

1,808.91 |

1,891.35 |

1,610.46 |

1,168.32 |

|

Operating Profit |

256.12 |

257.33 |

295.10 |

223.92 |

167.81 |

|

PBDIT |

294.84 |

284.91 |

313.17 |

222.66 |

183.24 |

|

Interest |

58.58 |

81.35 |

92.20 |

23.90 |

27.91 |

|

PBDT |

236.26 |

203.56 |

220.97 |

198.76 |

155.33 |

|

Depreciation |

76.37 |

71.62 |

63.61 |

54.54 |

47.48 |

|

Profit Before Tax |

159.89 |

131.94 |

157.36 |

144.22 |

107.85 |

|

PBT (Post Extra-ord Items) |

159.89 |

131.94 |

157.36 |

144.47 |

107.43 |

|

Tax |

39.00 |

36.88 |

44.75 |

39.07 |

32.42 |

|

Reported Net Profit |

120.89 |

95.06 |

112.60 |

105.18 |

75.43 |

|

Total Value Addition |

651.65 |

616.26 |

601.10 |

545.68 |

406.72 |

|

Equity Dividend |

35.72 |

29.42 |

29.42 |

26.27 |

18.91 |

|

Corporate Dividend Tax |

4.20 |

4.82 |

4.67 |

4.36 |

3.17 |

|

Per share data (annualised) |

|

|

|

|

|

|

Shares in issue (lakhs) |

2,101.28 |

2,101.28 |

2,101.28 |

2,101.28 |

2,101.28 |

|

Earning Per Share (Rs) |

5.75 |

4.52 |

5.36 |

5.01 |

3.59 |

|

Equity Dividend (%) |

170.00 |

140.00 |

140.00 |

125.00 |

90.00 |

Dividend and Bonus History

Index and Company Price Movement Comparison

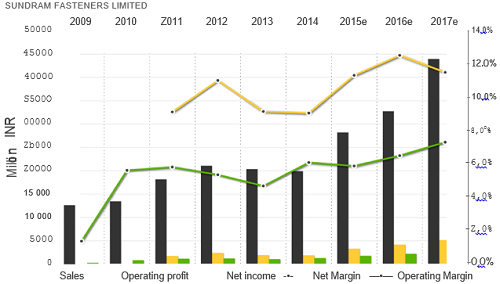

Company Forecast

Technical Indicators

|

Symbol |

Value |

Action |

|

RSI(14) |

75.469 |

Overbought |

|

STOCH(9,6) |

76.941 |

Buy |

|

STOCHRSI(14) |

52.559 |

Neutral |

|

MACD(12,26) |

36.330 |

Buy |

|

ADX(14) |

80.079 |

Overbought |

|

Williams %R |

-22.825 |

Buy |

|

CCI(14) |

84.8056 |

Buy |

|

ATR(14) |

26.7893 |

High Volatility |

|

Highs/Lows(14) |

33.7929 |

Buy |

|

Ultimate Oscillator |

51.526 |

Buy |

|

ROC |

298.210 |

Buy |

|

Bull/Bear Power(13) |

80.7140 |

Buy |

Important Ratios (YoY)

-

PBIT – 8.67 v/s 8.86

-

RoCE – 16.63 v/s 15.10

-

RoE – 15.1 v/s 13.2

-

Net Profit Margin – 5.83 v/s 4.53

-

Return on net worth – 15.58 v/s 13.69

-

D/E Ratio – 0.77 v/s 1.02

-

Interest Cover – 3.90 v/s 2.61

-

Current Ratio – 0.98 v/s 1.05

-

Reserves – 754.63 cr v/s 694.29 cr

-

PAT – 120.89 cr v/s 95.06 cr

-

Total assets – 1373.64 cr v/s 1403.49 cr

-

Net sales – 2022.28 cr v/s 2069.42 cr

-

Book Value – 36.91 v/s 33.04

Simple Moving Average

|

Days |

BSE |

NSE |

|

30 |

185.06 |

185.28 |

|

50 |

190.69 |

190.96 |

|

150 |

170.63 |

170.82 |

|

200 |

152.77 |

152.92 |

Investment Rationalize

-

Leading player in Indian fasteners industry with TVS group as promoters and clientele includes major Indian companies such as Ashok Leyland, BEML, Bajaj, Tata, TVS, M&M, Maruti suzuki and international players such as Volvo, GE, GM, Volkswagen, Ford, Mitsubishi Motors, Bosch, Caterpillar, JCB, Siemens, etc.

-

Sundram Fasteners Ltd has reduced its debts and increased its production capacity, which will help the company when the demand for products picks up.

-

Reduction in crude oil prices and improvement in economic cycle will help the company as the sales of automobiles and the demand for the products increases.

-

Sundram Fasteners Ltd was able to perform well in adverse circumstances and current order book from major players ensures the consistent in foreseeable future.

-

Improvement in economic situations in American and European countries will add significantly to the companies revenue as more than 38% of the revenue comes from exports.

-

Reduction in prices in raw materials and manufacturing expenses will increase the profit margin of the company and Sundram Fasteners have a good dividend history.

-

Price to Sales Ratio of the company stands at 1.82, which means company is reasonably priced, and the past consistent performance and future growth prospects ensures the company is reasonably priced.

-

Increase in revenue from fully owned subsidiaries will add to the companies profits.

Post a Comment

|

DISCLAIMER |

This report is only for the information of our customers. Recommendations, opinions, or suggestions are given with the understanding that readers acting on this information assume all risks involved. The information provided herein is not to be construed as an offer to buy or sell securities of any kind. ATS and/or its group companies do not as assume any responsibility or liability resulting from the use of such information.