Top Ten Small-Cap Investment Ideas

Cosmo Films Limited

|

Industry |

Market Price |

Recommendation |

Target |

Time Horizon |

|

Plastics |

1076.9 |

BUY |

1,481 |

8 months |

Q3 FY 2022 Review

Cosmo Films Limited reported net revenue of ₹770.53 crores for the quarter ended December 31, 2021, as compared to ₹572.31 cores crores for the quarter ended December 31, 2020. EBIT and Profit After Tax were ₹145.15 crores and ₹104.42 crores for the quarter ended, December 31, 2021, as compared to ₹97.31 crores and ₹62.75 crores during the corresponding quarter of the previous year.

Cosmo Films Limited - Investment Summary

|

CMP (₹) |

1076.9 |

|

52 Week H/L |

563/1889 |

|

Market Cap (crores) |

2,935 |

|

Face Value (₹) |

10.00 |

|

Promoter Holding (%) |

44.09 |

|

Non-Promoter Holding (%) |

55.91 |

|

Total (%) |

100.00 |

|

Book Value Per Share |

₹469.93 |

|

EPS TTM |

₹127.02 |

Cosmo Films Limited - Overview

-

Cosmo Films Limited is engaged in the manufacturing of Bi-axially Oriented Polypropylene Limited (BOPP).

-

It has diversified in Specialty Films, Polymer Chemicals, and the digital-first, Pet Care business.

-

The company has launched the Pet Care business vertical with a simultaneous launch of the website, first mobile van, and its flagship stores during Q2FY2022, under the brand name “Zigly”.

-

The company operates across four strategically located manufacturing facilities in Maharashtra, Gujarat, and South Korea.

Beta 1.07 |

Alpha 67.64 |

Risk Reward Ratio: 1.67 |

Margin of Safety: 37% |

Cosmo Films Limited - Recommendation Rationale

-

Cosmo Films Limited is the largest exporter of BOPP Films in India and one of the largest BOPP manufacturers in the world with the capacity of 1,96,000 tons per annum.

-

The company also has global leadership in the high-value thermal lamination and industrial application films segment. It holds a dominant position in another niche of high-end specialty films such as labels, synthetic paper, and digital thermal print (DTP) films in India.

-

It has a diversified revenue profile with 62% contribution from specialty films and 38% from commodity films. Over the years, the company has developed a strong product portfolio across Packaging Films (55% of overall Revenue), Lamination Films (20%), Label Films (13%), and Industrial Films (13%).

-

The company has been gradually moving towards the value-added segment with specialty products contributing to around 62% of revenue in fiscal 2021 from 47% in fiscal 2019 supported by investment in research and development and Capex for adding value-added products. Customized requirements of clients and higher value addition catered by specialty products have resulted in sustained improvement in contribution per kilogram and operating profitability. Improved operating profitability, prudent capacity addition and ramp-up of new capacities will ensure return on capital employed remaining over 15% in the medium term.

-

In the first nine months of FY 2022, the company’s revenue increased by 37% to ₹2217.50 crores, as compared to the previous year at ₹1613.38 crores. Profit after Tax increased by 78% to ₹288.44 crores, as compared to the previous year at ₹162.45 crores.

-

The company has a good client base which includes Pepsi, Colgate, Coca-Cola, Nestle, Avery Dennison, and many more.

-

Company’s ROCE is 27.25%, ROE is 27.74% and Debt to Equity is 0.74 for FY2021.

-

We initiate coverage on Cosmo Films limited with a “BUY” and 8 months Target Price of ₹1,481.

PSP Projects Limited

|

Industry |

Market Price |

Recommendation |

Target |

Time Horizon |

|

Construction and Engineering |

520.15 |

BUY |

768 |

1 year |

Q3 FY 2022 Review

PSP Projects Limited reported net revenue of ₹48,562.01 lakhs for the quarter ended December 31, 2021, as compared to ₹39,015.86 lakhs for the quarter ended December 31, 2020. EBIT and Profit After Tax were ₹7,568.57 lakhs and ₹5,013.24 lakhs for the quarter ended, December 31, 2021, as compared to ₹6,215.62 lakhs and ₹2,870 lakhs during the corresponding quarter of the previous year.

PSP Projects Limited - Investment Summary

|

CMP (₹) |

520.15 |

|

52 Week H/L |

397/639.30 |

|

Market Cap (lakhs) |

1,87,601 |

|

Face Value (₹) |

10.00 |

|

Promoter Holding (%) |

70.16 |

|

Non-Promoter Holding (%) |

29.84 |

|

Total (%) |

100.00 |

|

Book Value Per Share |

₹148.86 |

|

EPS TTM |

₹22.65 |

PSP Projects Limited - Overview

-

PSP Projects Limited is the second-fastest-growing construction company in the small category in India.

-

The company provides One-Stop-Shop solution services across the construction and post-construction activities, including Mechanical, Engineering, and Plumbing (MEP) work and other interior fit-outs to private and public sector enterprises.

-

Geographically diversified with presence in six states viz. Gujarat, Rajasthan, Karnataka, Uttar Pradesh, Maharashtra, and New Delhi.

Beta 1.23 |

Alpha 2.73 |

Risk Reward Ratio: 1.92 |

Margin of Safety: 47% |

PSP Projects Limited - Recommendation Rationale

-

PSP Projects Limited has completed 179 projects to date, establishing a strong relationship with reputed clientele, and has demonstrated a track record of timely completion of projects which has helped it to secure repeat orders from its existing customers consisting of large pharmaceutical, dairy, and public sector entities.

-

The company has an order of ₹4,008 crores as of 31st December 2021.

-

Recently, the company has emerged as the lowest bidder for the project “Construction of Sports Complex” at Ahmedabad, Gujarat with a bid value of ₹563.99 crores (including GST).

-

In the first nine months of FY 2022, the company’s revenue increased by 61% to ₹1,19,341.67 lakhs, as compared to the previous year at ₹74,013.60 lakhs. Profit after Tax increased by 184% to ₹11,143.34 lakhs, as compared to the previous year at ₹3,921.05 lakhs.

-

Revenue has grown with 32.65% CAGR from FY2017-FY2021.

-

The DIIs have increased their stake from 4.95% to 5.72% in Q3FY2021.

-

FIIs have increased their stake from 1.27% to 1.71% in Q3FY2021.

-

After completion of the Surat Diamond Bourse Project (₹1575 crores), the company will be eligible for bidding up to ₹2,500 crores.

-

The company has been assigned a CARE A+ credit rating for both long-term and short-term facilities.

-

Company’s ROCE and ROE have been 25% and 16% and Debt to Equity is 0.14 for FY2021.

-

We initiate coverage on PSP Projects limited with a “BUY” and a 1-year Target Price of ₹768.

Grindwell Norton Limited

|

Industry |

Market Price |

Recommendation |

Target |

Time Horizon |

|

Abrasives |

1846.15 |

BUY |

2,600 |

9 Months |

Q3 FY 2022 Review

Grindwell Norton Limited reported net revenue of ₹49,966 lakhs for the quarter ended December 31, 2021, as compared to₹4,572 lakhs for the quarter ended December 31, 2020. EBIT and Profit After Tax were ₹9,409 lakhs and ₹7,015 lakhs for the quarter ended, December 31, 2021, as compared to ₹9,031 lakhs and ₹6,687 lakhs during the corresponding quarter of the previous year.

Grindwell Norton Limited - Investment Summary

|

CMP (₹) |

1,846.15 |

|

52 Week H/L |

2,018/814 |

|

Market Cap (Lakhs) |

20,44,056 |

|

Face Value (₹) |

5.00 |

|

Promoter Holding (%) |

58.02 |

|

Non-Promoter Holding (%) |

41.90 |

|

Total (%) |

100.00 |

|

Book Value Per Share |

₹124 |

|

EPS TTM |

₹21.60 |

Grindwell Norton Limited - Overview

-

Grindwell Norton Limited is one of the subsidiaries of Compagnie De Saint Gobain (Saint Gobain), a transnational group with its headquarters in Paris.

-

The company has made an investment of ₹15 lakhs in Cleanwin Energy Three LLP towards a Power Purchase Agreement generated through wind energy generation. The company contribution is 27.77% in Cleanwin Energy Three LLP.

-

The company’s manufacturing units are located in Mora (near Mumbai), Bengaluru, Tirupati, Nagpur, Bated (Himachal Pradesh), and Halol (near Vadodara).

Beta 0.88 |

Alpha 35.27 |

Risk Reward Ratio: 1.76 |

Margin of Safety: 40% |

Grindwell Norton Limited - Recommendation Rationale

-

Grindwell Norton Limited is engaged in the business of Manufacturing Abrasives, Ceramics & Plastics, and Providing IT services. Contribution from the Abrasives segment is around 55%, from the Ceramic & Plastics segment is around 33%, and from the IT segment is around 8%. Thus, the company has a balanced product portfolio, which helps them to mitigate the risk.

-

The company is virtually debt-free.

-

In the first nine months of FY 2022, the company’s revenue increased by 28% to ₹144,965 lakhs, as compared to the previous year at ₹112,539 lakhs. Profit after Tax increased by 32% to ₹20,930 lakhs, as compared to the previous year at ₹15,902 lakhs.

-

The FPI/FII have increased their stake from 4.99% to 6.10% in Q3FY2022.

-

Grindwell Norton Limited (GNL) is the market leader in the Indian abrasive market with around 26% market shares.

-

GNL has witnessed strong & positive free cash flow consistently over more than a decade irrespective of the macro environment.

-

Going forward, accelerated growth in performance plastics & ceramics and exports are expected to drive long-term incremental growth.

-

With the increasing demand for the company’s products, strong cash flow, double-digit ratio return could act as a trigger for future price performance.

-

Company’s ROCE and ROE have been 24% and 19% for the FY 2021.

-

We initiate coverage on Grindwell Norton limited with a “BUY” and a 9 months Target Price of ₹2,600.

Garware Technical Fibres Limited

|

Industry |

Market Price |

Recommendation |

Target |

Time Horizon |

|

Technical Textiles |

2,702.90 |

BUY |

3,841 |

1 year |

Q3 FY 2022 Review

Garware Technical Fibres Limited reported net revenue of ₹30,813.06 lakhs for the quarter ended December 31, 2021, as compared to ₹27,842.71 lakhs for the quarter ended December 31, 2020. EBIT and Profit After Tax were ₹5,497.17 lakhs and ₹3,806.25 lakhs for the quarter ended, December 31, 2021, as compared to ₹6,427.15 lakhs and ₹4,315.12 lakhs during the corresponding quarter of the previous year.

Garware Technical Fibres Limited - Investment Summary

|

CMP (₹) |

2,702.90 |

|

52 Week H/L |

2,283/4,030 |

|

Market Cap (lakhs) |

5,57,200 |

|

Face Value (₹) |

10.00 |

|

Promoter Holding (%) |

52.62 |

|

Non-Promoter Holding (%) |

47.38 |

|

Total (%) |

100.00 |

|

Book Value Per Share |

₹393.39 |

|

EPS TTM |

₹74.64 |

Garware Technical Fibres Limited - Overview

-

Garware Technical Fibres Limited (GTFL) is one of India’s leading players in the technical textiles sector, providing specialized solutions to the cordage and infrastructure industry worldwide.

-

Established in 1976, the company today is a multi-divisional, multi-geographical technical textile company.

-

The company manufactures and provides a world-class solution in high-performance polymer ropes, fishing nets, sports nets, safety nets, aquaculture cages, coated fabrics, agriculture netting, and geosynthetics.

-

GTFL has two manufacturing facilities at Pune and Wai (in Satara district) in Maharashtra.

Beta 0.99 |

Alpha 29.07 |

Risk Reward Ratio: 1.79 |

Margin of Safety: 42% |

Garware Technical Fibres Limited - Recommendation Rationale

-

GTFL has over four decades of experience in the cordage industry and commands a dominant share in the organized domestic market. Over a period, the company has established a healthy brand for its fishnets, ropes, and twines, among others, catering to multiple business segments including fisheries, aquaculture, shipping, and industrial sectors.

-

The share of GTFL’s premium product portfolio has been increasing during the last few years, driven by an increased focus on innovation and a customer-centric approach. The share of value-added products went up to 70-75% from around 50% during the last three to four years.

-

Exports constituted 62% of GTFL’s revenue in FY2021. The company is present in more than 75 countries with healthy positioning in developed markets such as North America and Europe, which contribute to the bulk of export revenues.

-

Coupled with its established brand name and quality products because of a better understanding of fibre technology and polymer processing, this enables GTFL to command adequate pricing power.

-

In the first nine months of FY 2022, the company’s revenue increased by 19% to ₹83,308.77 lakhs, as compared to the previous year at ₹69,914.82 lakhs. Profit after Tax increased by 5% to ₹11,088.98 lakhs, as compared to the previous year at ₹10,517.82 lakhs.

-

Company’s ROCE is 25% and ROE is 19.52% and, Debt to Equity is 0.13 for FY2021.

-

We initiate coverage on Garware Technical Fibres Limited with a “BUY” and 1-year Target Price of ₹3,841.

Borosil Renewables Limited

|

Industry |

Market Price |

Recommendation |

Target |

Time Horizon |

|

Solar Glass |

589.10 |

BUY |

931 |

1.5 years |

Q3 FY 2022 Review

Borosil Renewable Limited reported net revenue of ₹16,851.20 lakhs for the quarter ended December 31, 2021, as compared to ₹14,012 lakhs for the quarter ended December 31, 2020. EBIT and Profit After Tax were ₹6,478.99 lakhs and ₹4,573.04 lakhs for the quarter ended, December 31, 2021, as compared to ₹4,302.72 lakhs and ₹1,057.77 lakhs during the corresponding quarter of the previous year.

Borosil Renewable Limited - Investment Summary

|

CMP (₹) |

589.10 |

|

52 Week H/L |

213/747 |

|

Market Cap (lakhs) |

7,67,475 |

|

Face Value (₹) |

10.00 |

|

Promoter Holding (%) |

61.73 |

|

Non-Promoter Holding (%) |

38.27 |

|

Total (%) |

100.00 |

|

Book Value Per Share |

₹47.24 |

|

EPS TTM |

₹7.56 |

Borosil Renewable Limited - Overview

-

Borosil Renewables Limited is engaged in the business of manufacturing extra clear patterned glass and low Iron Solar Glass for application in Photovoltaic panels, Flat plate collectors, and Greenhouses.

-

During FY 2020, three transferor companies got amalgamated with the company and the scientific and industrial products and consumer products businesses of the company demerged into Borosil Limited, and post the process the company is carrying on Manufacturing of Solar glass business.

-

During FY 2020, the company successfully raised ₹200 crores through QIP, and the money raised through the issue will be utilized for its expansion from 450 tons per day to 950 tons per day. Capacity is being further expanded from 950 tons per day to 1,950 tons per day in phases by FY 2024.

Beta 2.57 |

Alpha 95.69 |

Risk Reward Ratio: 2.2 |

Margin of Safety: 52% |

Borosil Renewable Limited - Recommendation Rationale

-

Borosil Renewables Limited is engaged in the manufacturing of low-iron solar glass for application in photovoltaic panels. They are the first and the only producer of solar glasses in the country. The company’s thinner fully tempered solar glass (2mm and 2.5mm) offers a niche product for glass modules.

-

The company has a strong focus on expanding its domestic and export footprints. It derives 77% of its revenue from India and the remaining by catering exports mainly to the USA, Turkey, and Europe.

-

The company has a 40% market share in the Solar Glass segment.

-

With the increasing demand for renewable energy, demand for the company will also increase.

-

In the first nine months of FY 2022, the company’s revenue increased by 50% to ₹46,516.83 lakhs, as compared to the previous year at ₹30,829.09 lakhs. Profit after Tax increased by 424% to ₹11,946.67 lakhs, as compared to the previous year at ₹2,276.98 lakhs.

-

Company’s ROCE is 23% and ROE is 14.59% and, Debt to Equity is 0.10 for FY2021.

-

We initiate coverage on Borosil Renewables Limited with a “BUY” and 1.5 years Target Price of ₹931.

ESCORTS LIMITED

|

Industry |

Market Price |

Recommendation |

Target |

Time Horizon |

|

Construction and Agriculture Machinery |

1,809.80 |

BUY |

2,677 |

1-Year |

Q3 FY 2022 Review

Escorts Limited reported net revenue of ₹1,984.28 crores for the quarter ended December 31, 2021, as compared to ₹2,042.23 crores for the quarter ended December 31, 2020. EBIT and Profit After Tax were ₹272.13 crores and ₹193.71 crores for the quarter ended, December 31, 2021, as compared to ₹379.47 crores and ₹286.42 crores during the corresponding quarter of the previous year.

Escorts Limited - Investment Summary

|

CMP (₹) |

1,809.90 |

|

52 Week H/L (₹) |

1,918/1,100 |

|

Market Ca0p (Cr.) |

23,878 |

|

Face Value (₹) |

10.00 |

|

Promoter Holding (%) |

30.92 |

|

Non-Promoter Holding (%) |

69.08 |

|

Total (%) |

100.00 |

|

Book Value |

₹ 372.76 |

|

EPS TTM |

₹ 92.15 |

Escorts Limited - Overview

-

Escorts Limited is one of India’s leading engineering conglomerates, engaged in manufacturing Agri-Machinery, Construction & Material Handling Equipment, and Railway Equipment.

-

Escorts is India’s fourth-largest tractor maker with 11.3% of the market share.

-

The company is virtually net debt-free.

-

The company has allotted 93,63,726 equity shares at the price of ₹2000 per share, to Kubota Corporation. With that Kubota Corporation would be classified as a promoter of Escorts Limited.

Beta 0.8 |

Alpha 22.17 |

Risk Reward Ratio: 2.02 |

Margin of Safety: 48% |

Escorts Limited - Recommendation Rationale

-

The company’s revenue has increased by 14% Compounding Annual Growth Rate (CAGR) from FY 2017-2021.

-

The company has a diversified portfolio, which has helped them to mitigate risk.

-

The company is virtually net debt-free.

-

The company has allotted 93,63,726 equity shares at the price of ₹2000 per share, to Kubota Corporation. With that Kubota Corporation would be classified as a promoter of Escorts Limited. This will help the company to improve its technology and quality in the Tractor segment.

-

The company’s Return on Capital (ROCE) and Return on Equity (ROE) have been greater than 20% and 15% in the last 4 years (FY 2018-2021).

-

Boost up in infrastructure spending by the Government of India, could increase the demand for Escorts

-

Equipment Division and Railway Equipment Division from FY 2023.

-

We initiate coverage on GRP limited with a “BUY” and a 1-year Target Price of ₹ 2,677.

PG Electroplast Limited

|

Industry |

Market Price |

Recommendation |

Target |

Time Horizon |

|

Consumer Goods-Electronic |

650.80 |

BUY |

910 |

9-months |

Q3 FY 2022 Review

PG Electroplast Limited reported net revenue of ₹26,199.57 lakhs for the quarter ended December 31, 2021, as compared to ₹18,396.52 lakhs for the quarter ended December 31, 2020. EBIT and Profit After Tax were ₹1,144.51 lakhs and ₹553.82 lakhs for the quarter ended, December 31, 2021, as compared to ₹1,138.40 lakhs and ₹649.41 lakhs during the corresponding quarter of the previous year.

PG Electroplast Limited - Investment Summary

|

CMP (₹) |

650.80 |

|

52 Week H/L |

288/871 |

|

Market Cap (lakhs) |

1,38,095 |

|

Face Value (₹) |

10.00 |

|

Promoter Holding (%) |

65.71 |

|

Non-Promoter Holding (%) |

34.29 |

|

Total (%) |

100.00 |

|

Book Value Per Share |

₹97.73 |

|

EPS TTM |

₹5.95 |

PG Electroplast Limited - Overview

-

PG Electroplast Limited (PGEL) is the flagship company of the PG Group, and one of the leading players in India in Electronics manufacturing services (EMS). It is a diversified EMS providing Original Equipment Manufacturers (OEM) and Original Design Manufacturers (ODM) solutions for complete products and components.

-

The company is pursuing an organic growth strategy by ramping up its existing capacity and capabilities in each of its product verticals to achieve higher addition and better economies of scale.

-

PGEL has built six manufacturing units across Greater Noida in Uttar Pradesh, Roorkee in Uttarakhand, and Ahmednagar in Maharashtra and has 2000+ employees.

-

The company caters to 30+ leading Indian and Global brands.

Beta 1.97 |

Alpha 78.85 |

Risk Reward Ratio: 1.72 |

Margin of Safety: 39% |

PG Electroplast Limited - Recommendation Rationale

-

The Company has a strong market position in the plastic components segment, which contributed 55% to total revenue in fiscal 2021 followed by room ACs and washing machines at 15% and 11%, respectively. It supplies to various industries such as consumer electronics, sanitaryware, and mobile handsets. The promoters’ experience of more than 30 years in the consumer durables industry, the company's established position, and their healthy relationships with customers will continue to support the business.

-

The group supplies to leading brands such as LG Electronic India Pvt Ltd, Whirlpool India Ltd, Carrier Midea India Pvt Ltd, Voltas, Sansui, Godrej, and Orient Electric Ltd.

-

PG Technoplast Private Limited (Subsidiary of PG Electroplast Limited) qualified under the production-linked incentive (PLI) scheme for white goods (ACs and LED lights) in November 2021. Under this scheme, PGTL has entitled to Rs 198 crore of PLI incentives over five years based on Rs 321 crore of committed capital investment till fiscal 2027. Investments under the PLI scheme will be done at the Supa and Noida plants.

-

The company has begun manufacturing LED Televisions in December 2021 for two customers at its Greater Noida facility. It has an installed capacity of 5,00,000 units of televisions with screens sizes of 70 inches.

-

In the first nine months of FY 2022, the company’s revenue increased by 60% to ₹59787.97 lakhs, as compared to the previous year at ₹37,363.70 lakhs. Profit after Tax increased by 716% to ₹1,218.33 lakhs, as compared to the previous year at ₹68.79 lakhs.

-

Company’s ROCE is 11.70% and ROE is 6.03% and, Debt to Equity is 0.81 for FY2021.

-

We initiate coverage on PG Electroplast Limited with a “BUY” and 9 months Target Price of ₹910.

PCBL Limited

|

Industry |

Market Price |

Recommendation |

Target |

Time Horizon |

|

Chemicals |

99.78 |

BUY |

187 |

1.2 Year |

Q3 FY 2022 Review

PCBL Limited reported net revenue of ₹1,156.14 crores for the quarter ended December 31, 2021, as compared to ₹769.40 crores for the quarter ended December 31, 2020. EBIT and Profit After Tax were ₹179.04 crores and ₹115.52 crores for the quarter ended, December 31, 2021, as compared to ₹189.19 crores and ₹125.55 crores during the corresponding quarter of the previous year.

PCBL Limited - Investment Summary

|

CMP (₹) |

99.78 |

|

52 Week H/L |

175/277 |

|

Market Cap (crores) |

3,781 |

|

Face Value (₹) |

2.00 |

|

Promoter Holding (%) |

51.38 |

|

Non-Promoter Holding (%) |

48.62 |

|

Total (%) |

100.00 |

|

Book Value Per Share |

₹112 |

|

EPS TTM |

₹18.20 |

PCBL Limited - Overview

-

PCBL Limited is the largest manufacturer in India with a wide product portfolio having customized offerings for applications in tyres, performance chemicals, and specialty chemicals.

-

PCBL is the largest carbon black manufacturer in India and a strong global player with a significant customer base in 40 plus countries.

-

The company owns and operates 4 strategically-located manufacturing in Mundra, Palej, Kochi, and Durgapur.

-

The company also produces specialty carbon black which are used as pigmenting, UV stabilizing, and conductive agents in a variety of common and specialty products, including plastics, printing & packaging, and coatings.

Beta 1.37 |

Alpha 1.18 |

Risk Reward Ratio: 3.37 |

Margin of Safety: 88% |

PCBL Limited - Recommendation Rationale

-

PCBL Limited is the no.1 exporter of carbon black from India.

-

The company is the largest carbon producer in India and 7th largest in the world.

-

In the first nine months of FY 2022, the company’s revenue increased by 80% to ₹3227.59 crores, as compared to the previous year at ₹1792.79 crores. Profit after Tax increased by 81% to ₹338.08 crores, as compared to the previous year at ₹186.18 crores.

-

With the improving sentiments and situation in the automobile industry, demand for tyres is improving, with that demand for the company’s product is also improving. The company has also started focusing on specialty carbon black where the margin is more on products is more.

-

The DIIs have increased their stake from 2.11% to 4.77% in Q3FY2021.

-

FIIs have increased their stake from 6.51% to 9.07% in Q3FY2021.

-

The company has a good client base which includes MRF, J.K.Tyres, TVS Tyres, CEAT, Goodyear, Michelin.

-

Company’s ROCE and ROE is greater than 15% and Debt to Equity is 0.3 for FY2021.

-

We initiate coverage on PCBL limited with a “BUY” and a 1.2 years Target Price of ₹187.

RACL Geartech Limited

|

Industry |

Market Price |

Recommendation |

Target |

Time Horizon |

|

Auto Ancillary |

527 |

BUY |

800 |

1 year |

Q3 FY 2022 Review

RACL Geartech Limited reported net revenue of ₹7,482.41 lakhs for the quarter ended December 31, 2021, as compared to ₹6,523.95 lakhs for the quarter ended December 31, 2020. EBIT and Profit After Tax were ₹1,245.5 lakhs and ₹752.24 lakhs for the quarter ended, December 31, 2021, as compared to ₹1427.19 lakhs and ₹908.62 lakhs during the corresponding quarter of the previous year.

RACL Geartech Limited - Investment Summary

|

CMP (₹) |

527 |

|

52 Week H/L |

216/754 |

|

Market Cap (lakhs) |

56,783 |

|

Face Value (₹) |

10.00 |

|

Promoter Holding (%) |

53.40 |

|

Non-Promoter Holding (%) |

46.60 |

|

Total (%) |

100.00 |

|

Book Value Per Share |

₹100.20 |

|

EPS TTM |

₹22.23 |

RACL Geartech Limited - Overview

-

RACL Geartech Limited (formerly Raunaq Automotive Components Limited) was incorporated in 1983 and is engaged in the business of manufacturing transmission gears and shafts for automotive and industrial applications.

-

The company has renowned Original Equipment Manufacturers (OEMs) in the auto as well as industrial segment as its long-standing customers

-

The company’s business risk profile has improved over the years by adding new customers increasing its product portfolio and entering into a new segment of automobile industry. The addition in customer base was supported by the supply of quality products while adhering to international standards laid down by the international quality assessment team.

Beta 1.20 |

Alpha 72.64 |

Risk Reward Ratio: 2.02 |

Margin of Safety: 52% |

RACL Geartech Limited - Recommendation Rationale

-

Company manufactures high precision products (various types of transmission gears and shafts) for the premium segment and has reputed global majors such as BMW, Kubota, Piaggio, Yamaha, KTM, BRP Rotax, etc. are its key customers.

-

Export sales of the company have been increasing consistently and it formed around 76% of total gross sales during FY2021 (PY: 70% of total gross sales).

-

The company was initially promoted by the Raunaq Group. However, due to financial difficulties the company was referred to Board for Industrial and Financial Reconstruction (BIFR) in 2001. Post-restructuring and with a new management team under the leadership of Mr. Gursharan Singh (CMD), RACL Geartech Limited came out of the BIFR purview in November 2007. The company has improved itself in terms of the ‘Business’ & ‘Financial Condition’ under the leadership of Mr. Gursharan Singh.

-

In the first nine months of FY 2022, the company’s revenue increased by 47% to ₹20,100 lakhs, as compared to the previous year at ₹13635.13 lakhs. Profit after Tax increased by 17% to ₹1899.85 lakhs, as compared to the previous year at ₹1622.13 lakhs.

-

Company’s ROCE is 22.21% and ROE is 21.74% and, Debt to Equity is 0.80 for FY2021.

-

We initiate coverage on RACL Geartech Limited with a “BUY” and 1-year Target Price of ₹800.

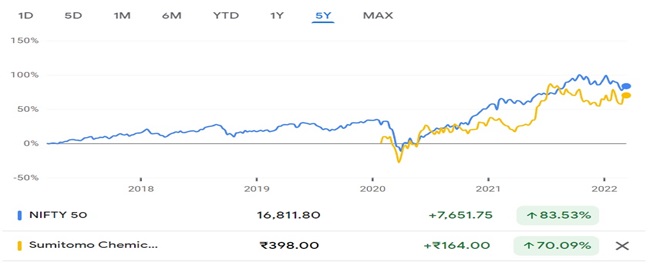

Sumitomo Chemical India Limited

|

Industry |

Market Price |

Recommendation |

Target |

Time Horizon |

|

Pesticides & Agrochemicals |

394 |

BUY |

522 |

6 months |

Q3 FY 2022 Review

Sumitomo Chemical India Limited reported net revenue of ₹7,071.75 million for the quarter ended December 31, 2021, as compared to ₹5,609.14 million for the quarter ended December 31, 2020. EBIT and Profit After Tax were ₹1212.73 million and ₹307.32 million for the quarter ended, December 31, 2021, as compared to ₹724.09 million and ₹167.68 million during the corresponding quarter of the previous year.

Sumitomo Chemical India Limited - Investment Summary

|

CMP (₹) |

394 |

|

52 Week H/L |

268/459 |

|

Market Cap (million) |

19,61,158 |

|

Face Value (₹) |

10.00 |

|

Promoter Holding (%) |

75 |

|

Non-Promoter Holding (%) |

25 |

|

Total (%) |

100.00 |

|

Book Value Per Share |

₹30.88 |

|

EPS TTM |

₹6.92 |

Sumitomo Chemical India Limited - Overview

-

Sumitomo Chemical India Limited (SCIL) is one of the leading players in the industry which has a balanced portfolio of technical as well as formulation products along with backward integration for some products.

-

The company is known for domestic marketing of proprietary products of its Japanese parent Sumitomo Chemical Company Limited (SCCL) in agrochemicals, animal nutrition, and environmental health business segments.

-

With the integration of Excel Crop Care Limited, the company has moved up several notches in the pecking order of the Indian crop protection industry.

-

SCIL has also marked its presence in Africa and several other geographies of the world.

Beta 0.79 |

Alpha 19.28 |

Risk Reward Ratio: 1.58 |

Margin of Safety: 32% |

Sumitomo Chemical India Limited - Recommendation Rationale

-

A diversified product portfolio including insecticides, weedicides, fungicides, fumigants and rodenticides as well as plant growth nutrition products, bio-rationals and plant growth regulators, well-balanced technical and formulations manufacturing capabilities, and access to SCCL’s proprietary products has helped SCIL establish itself as one of the major players in this space.

-

Product portfolio is well diversified with the company’s agrochemical products covering multiple crop segments.

-

With over 13,000 distributors, SCIL’s distribution network covers close to 85% of mainland India, providing geographic diversity. Further, close to 20% of the revenue (in the first 9 months of fiscal 2022) is generated from export markets, partially offsetting the risk related to demand cyclicality in the domestic market.

-

Significant improvement in the working capital cycle leading to material improvement in liquid cycles.

-

In the first nine months of FY 2022, the company’s revenue increased by 14% to ₹23,995.44 million, as compared to the previous year at ₹21,106.22 million. Profit after Tax increased by 20% to ₹3,488.92 million, as compared to the previous year at ₹2,913.08 million.

-

Company’s ROCE is 28.84% and ROE is 22.41% and, Debt to Equity is nil for FY2021.

-

We initiate coverage on Sumitomo Chemical India limited with a “BUY” and 6 months Target Price of ₹522

Post a Comment

|

DISCLAIMER |

This report is only for the information of our customers. Recommendations, opinions, or suggestions are given with the understanding that readers acting on this information assume all risks involved. The information provided herein is not to be construed as an offer to buy or sell securities of any kind. ATS and/or its group companies do not as assume any responsibility or liability resulting from the use of such information.