Ujjivan Small Finance Bank Limited Research Report

|

Industry |

Market Price |

Recommendation |

Target |

Time Horizon |

|

Bank |

29.10 |

Buy |

36 |

1-Year |

Ujjivan Small Finance Bank - Q2FY2023 Review

Ujjivan Small Finance Bank Limited reported net revenue of ₹20,482.35 crores for the quarter ended September 30, 2022, compared to ₹17,336.33 crores for September 30, 2021. Profit After Tax was ₹2,593.49 crores for the quarter ended September 30, 2022, compared to ₹1,100.59 crores during the corresponding quarter of the previous year, respectively.

Ujjivan Small Finance Bank - Investment Summary

|

CMP (₹) |

29.10 |

|

52 Week H/L |

13.50/30.50 |

|

Market Cap (crores) |

5,687 |

|

Face Value (₹) |

10.00 |

|

Promoter Holding (%) |

73.68 |

|

Non-Promoter Holding (%) |

26.32 |

|

Total (%) |

100.00 |

|

Book Value |

₹15.06 |

|

EPS TTM |

(₹2.40) |

Ujjivan Small Finance Bank - Overview

-

On October 14, 2022, Ujjivan Financial Services announced on the stock market that the Board has authorised its plan to merge with Ujjivan Small Finance Bank (Ujjivan SFB).

-

The plan is to go into force on the effective date and go into effect on the appointed date, which is April 1, 2023, or any other date that the NCLT may accept.

-

Ujjivan Small Finance Bank issued approximately 22.6 crore shares at an issue price of ₹21 per share as of September 15, 2022, in order to raise 475 crores through a qualified investment plan.

Beta: 0.97 |

Alpha: -27 |

Risk Reward Ratio: 1.35 |

Margin of Safety: 16.85% |

Ujjivan Small Finance Bank - Quarterly Summary

|

Quarterly (INR in crores) |

Jun-22 |

Mar-22 |

Dec-21 |

Sep-21 |

Jun-21 |

|

Interest Income |

993 |

905 |

818 |

708 |

645 |

|

Interest Expended |

330 |

306 |

274 |

254 |

254 |

|

|

|

|

|

|

|

|

Net Interest Income |

663 |

600 |

544 |

454 |

391 |

|

|

|

|

|

|

|

|

Other Income |

147 |

125 |

103 |

91 |

55 |

|

Total Income |

810 |

724 |

647 |

545 |

446 |

|

|

|

|

|

|

|

|

Employee Cost |

220 |

221 |

227 |

221 |

200 |

|

Other Expenses |

204 |

203 |

202 |

182 |

167 |

|

Provision and Contingencies |

-10 |

30 |

44 |

187 |

445 |

|

EBT |

395 |

271 |

173 |

-46 |

-366 |

|

Tax Expenses |

101 |

68 |

47 |

-12 |

-92 |

|

PAT |

294 |

203 |

127 |

-34 |

-274 |

Business

-

A subsidiary of Ujjivan Financial Services Limited, USFB was established on July 4, 2016. (UFSL). The RBI listed the Bangalore-based microfinance company UFSL as an NBFC-MFI.

-

Since 2005, it has been providing microloans to women who are self-employed and salaried through its joint liability group (JLG) model in urban and semi-urban areas.

-

Following the "Guidelines for Licensing of Small Finance Banks in the Private Sector" (Guidelines) that the Reserve Bank of India (RBI) announced on November 27, 2014, UFSL was one of the ten companies to receive "in-principle" clearance from the RBI on September 16, 2015, to establish a bank.

-

The RBI subsequently authorized USFB to conduct banking operations in India on November 11, 2016. As a result, USFB officially started operating on February 1, 2017; as per the terms of the Business Transfer Agreement (BTA) that was signed between UFSL and USFB on that date, all of UFSL's assets and liabilities were transferred to USFB.

-

On December 12, 2019, Bank completed its IPO process and was listed on the NSE and BSE.

-

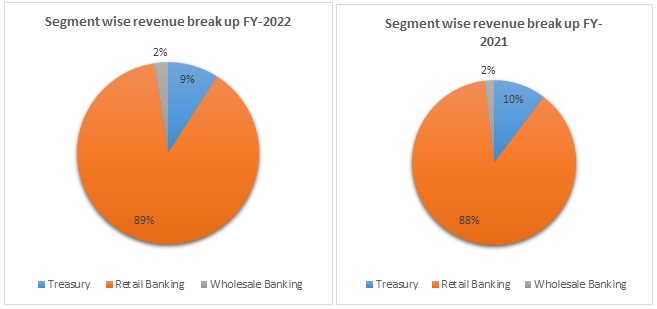

During FY 2021-22, the bank’s Business Segments are:

-

Treasury Segment:

-

The money market borrowing and lending, gains or losses on investment activities, net interest income from the bank's investment portfolio, and proceeds from the sale of PSLC make up the majority of the Treasury Segment.

-

-

Retail Banking Segment:

-

Through a branch network and other delivery mechanisms, the retail banking segment provides services to consumers.

-

Lending to and accepting deposits from retail consumers are both included in retail banking, along with tracking segment revenue and costs.

-

Interest on consumer loans, processing fees, and other related incomes make up the retail banking segment's revenues.

-

-

Corporate/Wholesale Banking:

-

Corporates and financial institutions can get loans from the wholesale banking segment. Interest on customer loans is what the wholesale banking industry uses to generate revenue.

-

The segment's principal costs include interest on money borrowed from external sources and other internal segments, as well as allocated costs for delivery channels, specialised product groups, processing units, and support groups. Additional direct costs include personnel costs, premises expenses, and other direct overheads.

-

-

-

Out of the total revenue, 9% has been generated from Treasury operations, 2% from wholesale Banking, 9%, and 89% from Retail Banking s in FY 2022 compared to 10%, 2%, and 88% in FY 2021, respectively.

Ujjivan Small Finance Bank - Revenue Trend

Ujjivan Small Finance Bank - SWOT ANALYSIS

-

Strength

-

Company with zero promoter pledge.

-

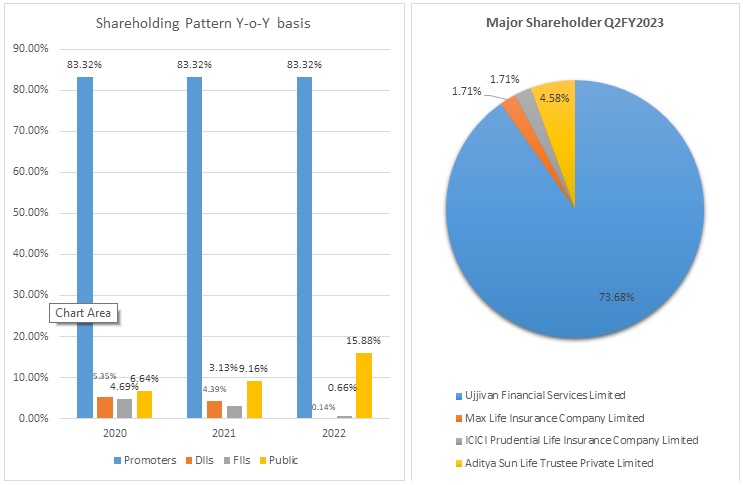

FIIS has increased its shareholding.

-

Geographically well-diversified portfolio.

-

Improving Profitability.

-

-

Weakness

-

Net profit is declining in the last two years.

-

Insufficient use of assets to generate profit.

-

Exposure to the inherent risk of the microfinance sector.

-

-

Opportunity

-

Decrease in NPA in the recent result.

-

Decrease in Provision.

-

Increasing capital expenditure by the companies.

-

-

Threat

-

Increasing competition in the financial sector.

-

Ongoing uneven circumstances globally (e.g., Inflation).

-

Ujjivan Small Finance Bank - Ratio Analysis

|

|

Mar-19 |

Mar-20 |

Mar-21 |

Mar-22 |

|

Net Interest Income |

9.53% |

10.16% |

8.91% |

8.06% |

|

Gross NPA |

2.50% |

0.97% |

7.07% |

7.34% |

|

Net NPA |

0.92% |

0.20% |

2.93% |

0.61% |

|

Provision Coverage Ratio |

72.00% |

79.96% |

60.34% |

92.20% |

|

Capital Adequacy Ratio |

15.00% |

22.00% |

26.44% |

18.99% |

|

CASA Ratio |

14.00% |

17.00% |

21.00% |

27.00% |

|

ROA |

1.72% |

2.18% |

0.04% |

-1.89% |

|

ROE |

10.95% |

11.05% |

0.26% |

-15.02% |

|

Cost to Income Ratio |

76.50% |

67.40% |

67.30% |

66.00% |

Ujjivan Small Finance Bank - Financial Overview

Ujjivan Small Finance Bank - Profit and Loss Statement (₹ in crores)

|

|

Mar-18 |

Mar-19 |

Mar-20 |

Mar-21 |

Mar-22 |

|

Interest income |

1,467.88 |

1,831.61 |

2,703.60 |

2,806.07 |

2,812.80 |

|

Interest Expended |

606.86 |

725.20 |

1,070.01 |

1,077.51 |

1,039.21 |

|

|

|

|

|

|

|

|

Net Income |

861.01 |

1,106.41 |

1,633.59 |

1,728.55 |

1,773.59 |

|

|

|

|

|

|

|

|

Other income |

111.48 |

205.96 |

322.21 |

302.31 |

313.27 |

|

Total income |

972.49 |

1,312.37 |

1,955.81 |

2,030.86 |

2,086.87 |

|

|

|

|

|

|

|

|

Other expenses |

652.87 |

1,003.35 |

1,318.58 |

1,230.08 |

1,496.38 |

|

Provision and Contingencies |

312.76 |

109.80 |

287.31 |

792.49 |

1,005.08 |

|

|

|

|

|

|

|

|

PAT |

6.86 |

199.22 |

349.92 |

8.30 |

-414.59 |

|

|

|

|

|

|

|

|

EPS |

|

|

|

|

|

|

Basic |

0.05 |

1.38 |

2.29 |

0.05 |

-2.40 |

|

Diluted |

0.05 |

1.38 |

2.27 |

0.05 |

-2.40 |

|

Number of shares |

|

|

|

|

|

|

Basic |

144.00 |

144.00 |

152.54 |

172.82 |

172.83 |

|

Diluted |

144.00 |

144.00 |

154.21 |

172.82 |

172.83 |

Ujjivan Small Finance Bank - Cash Flow Statement (₹ in crores)

|

|

Mar-18 |

Mar-19 |

Mar-20 |

Mar-21 |

Mar-22 |

|

Net Profit Before Tax |

8.54 |

268.42 |

466.24 |

10.20 |

-550.36 |

|

Net Cash from Operating Activities |

2,313.71 |

477.72 |

241.72 |

2,656.68 |

2,546.70 |

|

Net Cash Used for Investing Activities |

-100.59 |

-147.86 |

-756.54 |

-1,356.45 |

-840.98 |

|

Net Cash From (Used For) Financing Activities |

-2,438.56 |

286.72 |

775.96 |

-705.95 |

-1,483.76 |

|

Net Increase in Cash and Cash Equivalents |

-225.44 |

616.58 |

261.14 |

594.28 |

221.97 |

|

Cash And Cash Equivalents at The Beginning of the Year |

686.50 |

461.06 |

1,077.64 |

1,338.78 |

1,933.06 |

|

Cash And Cash Equivalents at The End of the Year |

461.06 |

1,077.64 |

1,338.78 |

1,933.06 |

2,155.03 |

Ujjivan Small Finance Bank - Balance Sheet (₹ in crores)

|

|

Mar-18 |

Mar-19 |

Mar-20 |

Mar-21 |

Mar-22 |

|

CAPITAL AND LIABILITIES: |

|

|

|

|

|

|

Capital |

1,640.04 |

1,640.04 |

1,928.22 |

1,928.31 |

1,928.31 |

|

Employees’ Stock Options Outstanding |

0.00 |

0.00 |

21.42 |

43.72 |

42.20 |

|

Reserves and Surplus |

6.90 |

179.59 |

1,238.08 |

1,246.71 |

832.12 |

|

Deposits |

3,772.52 |

7,379.44 |

10,780.48 |

13,135.77 |

18,292.22 |

|

Borrowings |

3,852.85 |

4,166.09 |

3,953.27 |

3,247.32 |

1,763.56 |

|

Other Liabilities |

200.58 |

377.05 |

489.77 |

778.62 |

746.05 |

|

Total |

9,472.87 |

13,742.21 |

18,411.24 |

20,380.45 |

23,604.46 |

|

|

|

|

|

|

|

|

ASSETS: |

|

|

|

|

|

|

Cash and Balances with Reserve Bank of India |

249.63 |

446.46 |

1,224.87 |

1,711.53 |

1,682.25 |

|

Balances with Banks and Money at Call and Short Notice |

245.20 |

648.00 |

118.42 |

865.97 |

485.85 |

|

Investments |

1,232.48 |

1,526.62 |

2,396.14 |

2,516.45 |

4,152.93 |

|

Advances |

7,336.21 |

10,552.45 |

14,043.64 |

14,493.95 |

16,303.17 |

|

Fixed Assets |

198.35 |

284.45 |

300.48 |

280.73 |

249.39 |

|

Other Assets |

211.00 |

284.23 |

327.69 |

511.83 |

730.87 |

|

Total |

9,472.87 |

13,742.21 |

18,411.24 |

20,380.45 |

23,604.46 |

Industry Overview

-

With a market share of 1.14% in advances and 0.71% in deposits as of March 31, 2022, Small Finance Banks (SFBs) are still a minor player in the banking industry, but their effective deposit mobilisation and outreach to the underbanked have helped them increase their share.

-

With a strong emphasis on liabilities franchise, SFBs have significantly increased their credit deposit ratio, accomplished significant loan book diversification, and seen great growth in advances. In the medium to long term, it is anticipated that the non-microfinance portfolio's portion will rise significantly.

-

When compared to private sector banks, which grew at a CAGR of 18% over the four years ending March 31, 2022, the advances book of SFBs rose at a rate of about 40%.

-

If capitalization increases, the industry's growth rate is anticipated to surpass that of FY22. In Q2FY23, SFB capital raising accelerated and is anticipated to continue.

-

What is Small Finance Bank:

-

Small Finance Banks are a particular type of bank established by the RBI with the assistance of the Government of India to promote financial inclusion by primarily providing basic banking services to underserved and underrepresented groups, such as unorganized businesses, small and marginal farmers, micro and small industries, and small business units.

-

These banks can engage in all fundamental banking activities, such as lending and accepting deposits, just like regular commercial banks.

-

SFBs must adhere to strict requirements. At least 75% of the funds must be lent to the priority sector.

-

Moreover, loans up to Rs. 25 lakhs should make up at least 50% of the lending portfolio.

-

The RBI released the Small Finance Bank rules in November 2014 following the statement made during the Union Budget for the fiscal year 2014–15. Only 10 of the 72 businesses from various segments who filed for the license were given it on November 24, 2014.

-

-

SFBs are setting the standard for small loans to self-employed individuals whose credit histories are insufficient to determine their trustworthiness.

-

One percent of the Schedule Commercial Banks' total assets come from the group of small finance banks (SFBs). The total deposits and credit of SFBs increased by 32.7% and 23.1%, respectively, throughout the four quarters of 2021–2022.

-

While term deposits saw an increase of 15.7% (y-o-y) in March 2022, SFBs have been aggressively boosting their CASA deposits, raising their percentage of total deposits from 18.4% in March 2019 to 33.9% in March 2022.

-

SFBs' strong balance sheet expansion has raised concerns about asset quality from a low base. Their restructured standard advances portfolio is still above pre-pandemic levels but below the peak of September 2021.

-

These developments are influenced by SFB concentration in specific customer segments and geographic areas. However, their CRAR, which is greater than the wider group of SCBs, is still an acceptable 19.3% in March 2022.

-

At the end of March 2022, the gross non-performing assets (NPAs) of SFBs were 5%, down from above 6% in September 2021. Additionally, their net NPAs decreased from about 3.0% in September 2021 to 2.2% in March 2022.

Ujjivan Small Finance Bank - Concall Overview (Q2FY2023)

-

Gross advances increased 8% from the first quarter of FY2023 and 44% from September '21. This fits with the bank's prediction of 30% growth for the fiscal year.

-

Strong deposit growth was seen in Q2FY2023, with additional deposits totaling Rs. 1,947 crores, up 11% from Q1FY2023 and up 45% from Q2FY2022. Retail, which currently accounts for 61% of all deposits, saw the most rise. Bank continue to use alternative avenues for liquidity, such as term loans, securitization, and IBPC. This quarter, the bank also raised sub-debt and new stock, bringing the CRAR to 26.7%.

-

This quarter, Bank added 15 branches. In the second part of the year, the bank will add a similar number.

-

For the fiscal year 2023, the bank aims to maintain a cost-to-income ratio that is safely below 60%. The cost-to-income ratio for H1 FY2023 is 55%. Additionally, the Bank has guided a prudent 2.3% return on assets for FY2023.

Ujjivan Small Finance Bank - Technical Analysis

-

Stock is on a bullish trend on a monthly, weekly, and daily charts basis with a support level of ₹20 and a resistance level of ₹31.

-

One can accumulate this stock at current levels.

Ujjivan Small Finance Bank - Peers Comparison

|

|

FY-2022 |

|||

|

|

GNPA |

NPA |

ROA |

ROE |

|

AU Small Finance Limited |

2% |

0.50% |

1.63% |

15.03% |

|

Equitas Small Finance Bank Limited |

4% |

2.47% |

1.04% |

11.31% |

|

Ujjivan Small Finance Bank Limited |

7% |

0.64% |

(1.89%) |

(15.02%) |

Ujjivan Small Finance Bank - Recommendation Rationale

-

Strong AUM growth of 44% YoY/8% QoQ was recorded by Ujjivan Small Finance Bank, while net credit growth was 29% YoY/6% QoQ. The MFI, SME, and affordable housing segments took the lead in this primarily. The growth of deposits was also strong, increasing by 45% YoY and 11% QoQ. NIM increased by 20bps to 9.8% due to higher growth and loan yields.

-

Through 590 branches and 16,620 workers dispersed across 249 districts, 24 states, and union territories in India, the bank serves 69 lakh customers. As of September 30, 2022, the total amount of gross advances was 20,938 crores, with a deposit base of 20,396 crores. Thus, the bank has a well-diversified geographical portfolio.

-

Ujjivan Small Finance Bank has significantly reduced GNPA/NPA from 11.08%/3.33% to 4.4%/0.04% in the last five quarters.

-

Bank’s Net Interest Margin and Net Profit is consistently improving over the last five quarters.

-

Bank’s cost-to-income ratio has reduced from 82% in Q2FY2022 to 52% in QFY2023.

-

FIIs and DIIs have increased their shareholding in Q2FY2023 by 3.07%/9.15% compared to Q1FY2023.

-

The bank has successfully finished QIP, clearing the route for SEBI clearance; it is currently working to obtain remaining regulatory/NCLT permission to finish the merger process within the next 12 months. Taking into account the profit increase, high growth outlook, and asset quality improvement.

Valuation

-

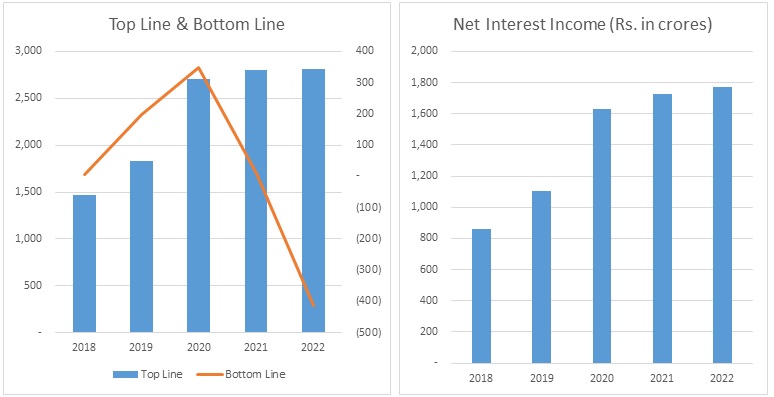

The Bank’s Net Interest Income has increased at a CAGR of 20% from FY 2018-2022

-

Banks’’s net profit was reduced in FY2021 and made a loss in FY2022 due to covid-19 and high-cost funds.

-

In FY 2023, the bank has improved its financial performance due to improvements in collection effectiveness and asset quality. ROA and ROE are expected in improve too. Bank has efficiently raised the capital from QIP to maintain a capital buffer from time to time.

-

We anticipate the company could generate higher Net Interest income for the following FY 2023, comparable to the prior year, based on the company's present performance in FY 2022.

-

We used data from the last five years (2018-2022) to anticipate revenue for the fiscal years 2023–2027.

Ujjivan Small Finance Bank - Estimated Income Statement (₹ in crores)

|

|

Mar-23 |

Mar-24 |

Mar-25 |

Mar-26 |

Mar-27 |

|

|

2023-E |

2024-E |

2025-E |

2026-E |

2027-E |

|

Interest income |

3,797 |

5,126 |

6,921 |

9,343 |

12,613 |

|

Interest Expended |

1,112 |

1,190 |

1,273 |

1,362 |

1,458 |

|

Net Interest Income |

2,685 |

3,937 |

5,647 |

7,981 |

11,155 |

|

|

|

|

|

|

|

|

Other income |

345 |

379 |

417 |

459 |

505 |

|

Total income |

3,030 |

4,316 |

6,064 |

8,439 |

11,660 |

|

|

|

|

|

|

|

|

Other expenses |

1,595 |

2,153 |

2,907 |

3,924 |

5,297 |

|

Provision and Contingencies |

570 |

769 |

1,038 |

1,401 |

1,892 |

|

PAT |

865 |

1,394 |

2,120 |

3,114 |

4,470 |

-

We initiate coverage on UJJIVAN Small Finance Bank Limited with a “Buy” and a 1-year Target Price of ₹36.

Disclaimer: This report is only for the information of our customers Recommendations, opinions, or suggestions are given with the understanding that readers acting on this information assume all risks involved. The information provided herein is not to be construed as an offer to buy or sell securities of any kind.

Post a Comment

|

DISCLAIMER |

This report is only for the information of our customers. Recommendations, opinions, or suggestions are given with the understanding that readers acting on this information assume all risks involved. The information provided herein is not to be construed as an offer to buy or sell securities of any kind. ATS and/or its group companies do not as assume any responsibility or liability resulting from the use of such information.