VIP Industries Ltd

VIP Industries Ltd - Company Overview

Incorporated in the year 1982, VIP Industries Ltd is world’s second largest and Asia’s largest luggage maker based in Mumbai, Maharashtra, India. VIP Industries Ltd is a market leader in the branded luggage segment with about 55 per cent market share in the organized market. It has acquired UK luggage brand Carlton in 2004. It provides travel products, hard and soft-sided luggage, bags, backpacks, duffels, shoulder bags, waist pouches, sling bags, duffel trolleys, vanity cases, office bags and satchels, suitcases, and briefcases. VIP Industries Limited company offers its products primarily under the VIP, Carlton, Footloose, Alfa, Aristocrat, Skybags, and Buddy brands. It also manufactures moulded furniture under the Moderna brand. It currently has over 200 company-managed stores and another 200 franchisees. It also works with over 2,000 multi-brand retailers to sell its products. Its sales are equally split across all four regions in India. The top 12 metros remain the most important markets for the company. However, its direct dealer network reaches top 400 towns and cities of India and it is planning to expand sales in smaller towns too. The company is planning to develop new luggage ranges with advanced design and superior aesthetics.

VIP Industries Ltd has operations across the globe in five continents. It has offices in the USA, South Asia, Middle East, Africa and Europe. The company has entered into technical collaboration with Delsey S A France for manufacturing some of their premium range suitcases & briefcases. Skybags is the fastest growing brand, growing at 70% annually for the last three years. It is expected to continue growing by 50% per year, driven by growth in new categories such as backpacks and weekend bags. To reduce the dependency on outsourcing from China, VIP has set up a wholly owned subsidiary in Bangladesh. This company started commercial operations from Q4FY14. Bangladesh facility has turned profitable from Q4FY15. It is working at utilization of ~70% which the management intends to increase to 85% and also expand its capacity over the next 3-5 years. This subsidiary contributes nearly 10% of the total revenue.

|

CMP (as on 19/12/2016) |

118.00 |

|

52 Week H/L |

156.90/85.00 |

|

Market Cap (Cr) |

1667.54 |

|

Equity Capital (Rs cr) |

28.26 |

|

Face Value (Rs) |

2 |

|

|

|

|

Shareholding Pattern (%) |

|

|

Promoters |

52.50 |

|

Non Institutions |

42.50 |

|

Grand Total |

100 |

Investment Rationales:

-

Growth potential of the travel industry

-

Increase in per-capita income

-

Brand building and promotion activities to pay dividends

-

Urbanization a game changer

-

Growth potential of online sales

-

Favorable market positioning

VIP Industries Ltd - Outlook

VIP Industries Ltd is the largest player in the domestic bag and luggage market with its high-quality products and wide market reach in both India and abroad. With the favorable demographic pattern, improvement in dynamics of the travel industry along available market opportunities, we expect VIP to perform considerably well in the medium term and long term.

Financial profile

|

Particulars (Rs. in Crs) |

FY12 |

FY13 |

FY14 |

FY15 |

FY16 |

|

Sales Turnover |

874.43 |

854.1 |

987.71 |

1063.53 |

1234.25 |

|

Operating Profit |

122.16 |

72.49 |

100.76 |

86.07 |

112.52 |

|

Net Profit |

67.61 |

31.52 |

57.64 |

46.59 |

66.46 |

|

EPS (Rs) |

4.78 |

2.23 |

4.08 |

3.30 |

4.70 |

|

PE(X) |

24.66 |

52.90 |

28.93 |

35.79 |

25.09 |

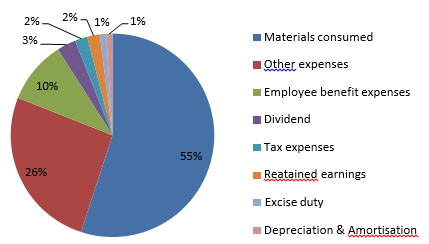

Company expense breakup(FY16)

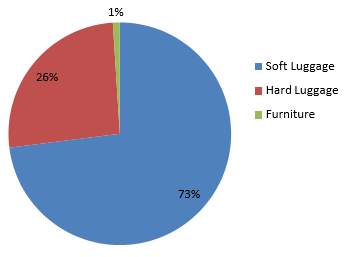

Product revenue breakup(FY16)

VIP Industries Ltd - Profit and Loss Account

|

|

FY12 |

FY13 |

FY14 |

FY15 |

FY16 |

|

INCOME : |

|

|

|

|

|

|

Sales Turnover |

874.43 |

854.1 |

987.71 |

1063.53 |

1234.25 |

|

Excise Duty |

14.17 |

16.44 |

14.89 |

15.84 |

17.8 |

|

Net Sales |

860.26 |

837.66 |

972.82 |

1047.69 |

1216.45 |

|

Other Income |

1.48 |

1.84 |

18.31 |

8.83 |

2.3 |

|

Stock Adjustments |

27.38 |

-2.37 |

29.91 |

47.6 |

55.03 |

|

Total Income |

889.12 |

837.13 |

1021.04 |

1104.12 |

1273.78 |

|

EXPENDITURE : |

|

|

|

|

|

|

Raw Materials |

441.47 |

442.92 |

562.23 |

620.34 |

717.75 |

|

Power & Fuel Cost |

12.17 |

13.43 |

13.07 |

13.45 |

14.27 |

|

Employee Cost |

81.65 |

84.74 |

93.32 |

111.71 |

125.86 |

|

Other Manufacturing Expenses |

6.85 |

6.81 |

33.54 |

30.04 |

35 |

|

Selling and Administration Expenses |

212.7 |

202.56 |

198.61 |

218.93 |

239.16 |

|

Miscellaneous Expenses |

12.12 |

14.18 |

19.51 |

23.58 |

29.22 |

|

Total Expenditure |

766.96 |

764.64 |

920.28 |

1018.05 |

1161.26 |

|

Operating Profit |

122.16 |

72.49 |

100.76 |

86.07 |

112.52 |

|

Interest |

8.99 |

7.33 |

3.96 |

3.06 |

3.23 |

|

Gross Profit |

113.17 |

65.16 |

96.8 |

83.01 |

109.29 |

|

Depreciation |

17.29 |

19.8 |

17.05 |

17.52 |

14.18 |

|

Profit Before Tax |

95.88 |

45.36 |

79.75 |

65.49 |

95.11 |

|

Tax |

19.39 |

14.96 |

24.25 |

18.94 |

29.66 |

|

Deferred Tax |

8.88 |

-1.12 |

-2.14 |

-0.04 |

-1.01 |

|

Net Profit |

67.61 |

31.52 |

57.64 |

46.59 |

66.46 |

|

Net Profit after Minority Interest & P/L Asso.Co. |

67.61 |

31.52 |

57.64 |

46.59 |

66.46 |

|

Extraordinary Items |

-0.4 |

-0.25 |

11.25 |

3.02 |

0.29 |

|

Adjusted Net Profit |

68.01 |

31.77 |

46.39 |

43.57 |

66.17 |

|

|

|

|

|

|

|

|

Dividend |

22.61 |

14.13 |

24.03 |

21.2 |

28.26 |

|

Equity Dividend (%) |

80 |

50 |

85 |

75 |

100 |

|

Dividend Per Share(Rs) |

1.6 |

1 |

1.7 |

1.5 |

2 |

VIP Industries Ltd - Balance Sheet

|

|

FY12 |

FY13 |

FY14 |

FY15 |

FY16 |

|

SOURCES OF FUNDS : |

|

|

|

|

|

|

Share Capital |

28.26 |

28.26 |

28.26 |

28.26 |

28.26 |

|

Reserves Total |

214.31 |

229.29 |

258.76 |

277.49 |

311.05 |

|

Total Shareholders Funds |

242.57 |

257.55 |

287.02 |

305.75 |

339.31 |

|

Secured Loans |

28.01 |

0.34 |

14.79 |

27.15 |

14.2 |

|

Unsecured Loans |

56.14 |

39.64 |

1.29 |

3.88 |

0 |

|

Total Debt1 |

84.15 |

39.98 |

16.08 |

31.03 |

14.2 |

|

Other Liabilities |

2.44 |

2.53 |

3.9 |

4.54 |

5.39 |

|

Total Liabilities |

329.16 |

300.06 |

307 |

341.32 |

358.9 |

|

APPLICATION OF FUNDS : |

|

|

|

|

|

|

Gross Block |

281.22 |

294.01 |

291.83 |

276.57 |

278.69 |

|

Less: Accumulated Depreciation |

198.34 |

216.38 |

206.96 |

205.28 |

212.14 |

|

Net Block |

82.88 |

77.63 |

84.87 |

71.29 |

66.55 |

|

Capital Work in Progress |

0.76 |

3.86 |

0.74 |

1.09 |

1.09 |

|

Investments |

0.31 |

0.31 |

0.01 |

0.01 |

0.01 |

|

Current Assets, Loans & Advances |

|

|

|

|

|

|

Inventories |

144.12 |

145.24 |

175.62 |

226.89 |

287.42 |

|

Sundry Debtors |

124.65 |

104.1 |

95.01 |

111.1 |

149.33 |

|

Cash and Bank |

18.28 |

12.17 |

11.09 |

7.52 |

8.03 |

|

Loans and Advances |

33.2 |

36.86 |

51.32 |

49.75 |

45.36 |

|

Total Current Assets |

320.25 |

298.37 |

333.04 |

395.26 |

490.14 |

|

Less : Current Liabilities and Provisions |

|

|

|

|

|

|

Current Liabilities |

83.99 |

89.42 |

119.45 |

139.48 |

200.81 |

|

Provisions |

17.27 |

19.28 |

22.59 |

18.62 |

26.99 |

|

Total Current Liabilities |

101.26 |

108.7 |

142.04 |

158.1 |

227.8 |

|

Net Current Assets |

218.99 |

189.67 |

191 |

237.16 |

262.34 |

|

Deferred Tax Assets |

1.35 |

1.15 |

1.54 |

3.1 |

4.11 |

|

Deferred Tax Liability |

3.18 |

1.85 |

0.1 |

0 |

0 |

|

Net Deferred Tax |

-1.83 |

-0.7 |

1.44 |

3.1 |

4.11 |

|

Other Assets |

28.05 |

29.29 |

28.94 |

28.67 |

24.8 |

|

Total Assets |

329.16 |

300.06 |

307 |

341.32 |

358.9 |

Key ratios

|

|

FY12 |

FY13 |

FY14 |

FY15 |

FY16 |

|

Debt-Equity Ratio |

0.43 |

0.25 |

0.1 |

0.08 |

0.07 |

|

Current Ratio |

1.57 |

1.83 |

2.05 |

2.11 |

2.07 |

|

Turnover Ratios |

|

|

|

|

|

|

Fixed Assets |

3.22 |

2.97 |

3.37 |

3.74 |

4.45 |

|

Inventory |

6.65 |

5.9 |

6.16 |

5.28 |

4.8 |

|

Debtors |

6.61 |

7.47 |

9.92 |

10.32 |

9.48 |

|

Interest Cover Ratio |

11.67 |

7.19 |

17.16 |

22.4 |

30.45 |

|

EBITDAM (%) |

13.97 |

8.49 |

8.61 |

8.09 |

9.12 |

|

CPM (%) |

9.71 |

6.01 |

6.42 |

6.03 |

6.53 |

|

ROCE (%) |

32.79 |

16.75 |

22.39 |

21.15 |

28.09 |

|

RONW (%) |

30.47 |

12.6 |

17.04 |

15.72 |

20.61 |

|

ROE(%) |

30.51 |

12.61 |

17.27 |

16.09 |

19.71 |

|

Price Earning (P/E) |

22.05 |

29.39 |

27.57 |

31.17 |

24.42 |

|

Price to Book Value ( P/BV) |

5.82 |

3.32 |

5.15 |

4.31 |

4.37 |

|

EV/EBIDTA |

12.09 |

12.19 |

14.7 |

15.57 |

13.24 |

|

Market Cap/Sales |

1.61 |

1 |

1.49 |

1.24 |

1.2 |

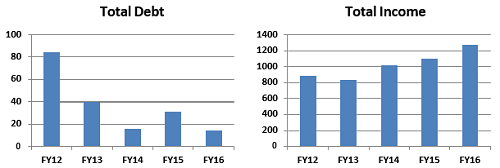

Financially company has been reducing its debt to equity, which currently stands at 0.07 compared to 0.43 in FY12.The margins of the company fell from 13.98% in FY12 to 9.12% in FY16, with the fuller utilization of capacity of Bangladesh plant the margins are excepted to pick substantially from current levels mainly due low employee and manufacturing expenses.

VIP Industries Ltd - Cash flow statement

|

|

FY12 |

FY13 |

FY14 |

FY15 |

FY16 |

|

Cash Flow Summary |

|

|

|

|

|

|

Cash and Cash Equivalents at Beginning of the year |

5.62 |

13.41 |

9.16 |

8.3 |

5.14 |

|

Net Cash from Operating Activities |

84.07 |

73.71 |

50.26 |

13.59 |

53.38 |

|

Net Cash Used in Investing Activities |

-20.46 |

-14.93 |

-1.81 |

-2.88 |

-8.31 |

|

Net Cash Used in Financing Activities |

-55.82 |

-63.03 |

-49.31 |

-13.87 |

-44.78 |

|

Net Inc/(Dec) in Cash and Cash Equivalent |

7.79 |

-4.25 |

-0.86 |

-3.16 |

0.29 |

|

Cash and Cash Equivalents at End of the year |

13.41 |

9.16 |

8.3 |

5.14 |

5.43 |

VIP Industries Ltd - Industry overview

India is one of the major markets of luggage bags across the world. It is a highly fragmented market of Rs3000-4000 crore, which consist of both unorganized and organized segment, with a dominance of the former in the overall industry. The organized market has been dominated by VIP and Samsonite. The major brands which have been promoted by VIP over the years include VIP, Carlton, Skybags, Alfa, Aristocrat and Verve. In addition to these brands, there are several other players in the organized segment, such as Safari, Giordano, Bulchee, Fiorelli, Blue and Blues, Timex, Kipling, Remova, Jansport which have been seeking to establish a strong position in the market in the last few years. The growing desire for a fashionable luggage bag has prompted the luggage suppliers in the country to constantly innovate in order to meet evolving lifestyles and trends.

The luggage market of India is undergoing a lot of innovation and development in the context of increasing the convenience of people. Innovation has led to the coming up of water-proof luggage and “ the smart luggage” called luggage. Plugging provides various facilities like charging of phone, weighing scale and inbuilt speaker.

The luggage market is mainly driven by the growth in the Indian travel industry as with more people travelling, the luggage they carry will increase proportionally. The more people earn, the more they spend on recreational activities like travelling. Luggage is an indispensable part of travelling and now it is becoming a status symbol too. Moreover, the increase in urban population and increase in per-capita income has led to increased demand for products from the luggage industry.

The global luggage market is expected to increase from $30,967.0 million in 2014 to reach $43,356.0 million in 2020, growing at a CAGR of 5.5%. The global luggage market is mainly driven by changing lifestyles and increasing urbanization, which is further creating opportunities for luggage sales among high net-worth individuals. The growing interest of people in tourism is an important driver boosting the global luggage market demand. The Asia-Pacific luggage market is expected to witness the fastest CAGR of 6.7% during 2015 - 2020. Evolving technologies in the luggage industry are also expected to boost the luggage market growth.

Investment Rationales

Growth potential of travel industry

The travel industry in India, which comprises both domestic (85% of the market) and international inbound travel (15%) is estimated at $27.5bn and has grown at a CAGR of 12% from $19.7 bn in 2013.

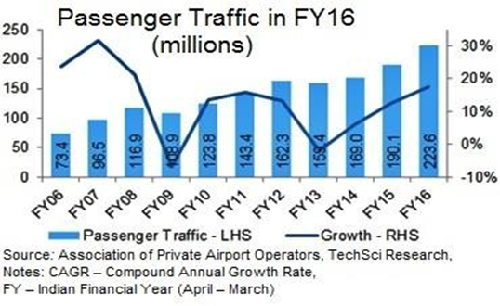

Air Travel

India is the fastest-growing domestic air travel market but is five times smaller than China and nine times smaller than the United States, in terms of market size, according to an International Air Transport Association report. India is the ninth-largest civil aviation market in the world with market size of $16 billion and aims to become the 3rd largest market by 2020 and the largest by 2030. This is possible due to a host of factors, including increased competition, low-cost carriers, modern airports which are expanding, improved technology in both airside and city side operations, foreign direct investment (FDI) and increased emphasis on regional connectivity. India is forecast to become the third-largest aviation market by 2020. Domestic air passengers are expected to jump from the current 70 million to 300 million by 2022, and to 500 million by 2027.

Railways

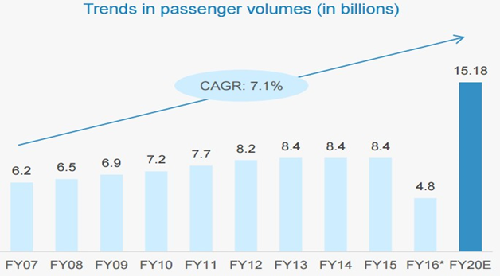

The Indian Railways is among the world’s largest rail networks. The Indian Railway passenger is growing at a healthy rate. In the next five years, the Indian railway market will be the third-largest, accounting for 10 percent of the global market. Train travel remains the preferred means of long-distance travel for the majority of Indians, a fact reflected by the volume and growth of passengers over the years Increase in the demand for passenger trains is supported by urbanization, improving income standards, etc. Passenger volumes witnessed a CAGR of 3.9 per cent to during 2007 – 15. Passenger traffic is expected to increase to 15.18 billion by FY20 Annual passenger volumes increased at a CAGR of 7.1 percent during FY07–20E. According to the 12th Five-Year Plan, passenger volumes would expand at a CAGR of 8.3 percent during FY13–17.

Indians are starting to take their travel seriously, people are traveling through the year; they are taking many shorter breaks, making business trips, looking at the destinations that are a few hours’ distance away. They are also going for more experiential holidays. Budget travel is on the rise, and people are willing to compromise on accommodation and travel expenses. People are looking for more adventure and more destinations to fulfill their adventurous streak. The analysis on the total holiday budget paints a positive picture for travel this year, with travelers twice as likely to be increasing vacation budgets year on year as cutting spending. The average travel spent, per person, has increased from Rs. 1,086 in 2011 to Rs 3,764 this year. On average, Indians planned to increase their total holiday travel budget by 30% percent; from Rs 12,585 in 2011 to Rs 33,368 in 2015. In 2016 a proportion of travelers planning to travel more, and this number shall increase across almost all markets.

The Indian travel sector is flourishing the domestic travel grew by 9.7% in 2015, while expenditure increased by 7.6%. Business travel as one of the top growth sectors in India, growing at the same rate as high technology services 10.7% and only slightly behind land and pipeline transport 11.2% and real estate and business activities 11.0%. The rising middle class and increasing disposable incomes continued to support the growth of domestic and outbound travel. Outbound trips totaled 19.9 million in 2015, up by 8.7%. Inbound trips grew at a CAGR of 6.8% during the historic period (2010-2015). The Indian travel market has managed to continue its growth run over the past many years. Attracting travelers across segments like business, leisure, medical, etc, India has established its presence in the global travel market. For instance, it is predicted that the total addressable travel market in India will be US$ 40 billion by 2020.

With the substantial increase in air and rail travel in India along with other travel segments is expected to increase in demand for bags and luggage in the different segments and VIP is excepted to be a major beneficiary.

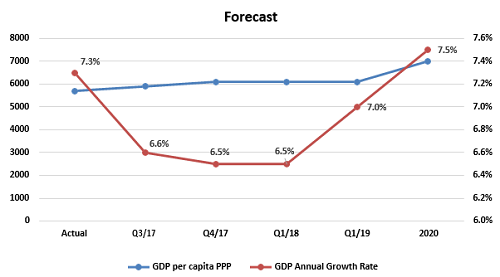

Increase in per-capita income

Economic growth in India gained momentum in the second quarter of the fiscal year 2016, but dynamics remained lopsided. GDP increased 7.3% annually in the July to September period, which came in above the 7.1% rise recorded in the first quarter. The International Monetary Fund (IMF) and the Moody’s Investors Service have forecasted that India will witness a GDP growth rate of 7.5 percent in 2016, due to improved investor confidence, lower food prices, and better policy reforms. Besides, according to the World Bank, the Indian economy will likely grow at 7.6 per cent in 2016-17, followed by further acceleration to 7.7 per cent in 2017-18 and 7 per cent in 2020.This growth is mainly driven by increase in manufacturing activities, growth the working women population and fast growing middle class. India’s global middle class, meanwhile, at around 70 million people, or ~5.5% of the population, is much smaller and it is expected to grow steadily over the next decade, reaching 200 million by 2020. With the increase in per capita income and change in spending habits is excepted to have a positive impact on VIP due the large product portfolio and availability products to cater the need of product demand on different price ranges.

Brand building and promotion activities to pay dividends

VIP is making serious efforts to create more brand awareness and reach in the market by spending 6% of Net Sales as branding, promoting and advertising activities. It has roped in film stars namely Alia Butt and Varun Dhawan, who are among the fashion icons in the country, to help build brand awareness and style quotient of the products among the targeted customers in a substantial manner. As the population of India becomes more brand conscious day by day, all these branding and aggressive marketing strategies will come in handy for the company going forward.

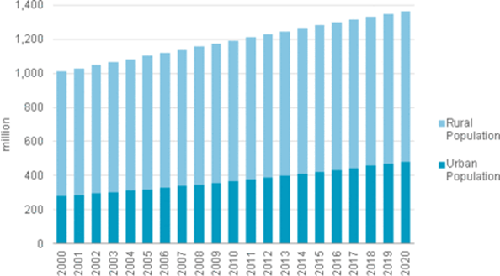

Urbanization a game changer

India had the second highest urban population in the world and will be amongst the fastest growing urban populations globally between 2013 and 2020 in absolute terms. This urbanization trend holds significant investment and consumer market potential. By 2030, India’s urban population is forecast to reach 631 million, an increase of 2.6% per year over the 2013-2030 period compared to the 1.1% annual rise expected in the total population. The urban population will account for 41.8% of the total population by 2030. India’s urban population grew by 2.8% annually between 2000 and 2012, compared to the 1.6% per year rise in the total population, thanks to rapid economic growth and strong rural- urban migration in order to look for better job opportunities and improving lifestyles. However, the country’s urban population accounted for only 31.6% of the total population in the same year compared to the global average of over 50.0% of the total population. With the incarese in urban population, favorable demographic pattern and their ever increasing demand, VIP is excepted to become a major beneficiary. With the demographic patterns forecast being positive for the next two decades and substantial increase in per capita income add to the surety on the growth prospects of the company to a great extend and it also reduces the risk associated with the growth of the company.

Favorably market positioning

VIP industries is the largest player of the luggage segment in the domestic markets with a market share of ~55% in the domestic market. The company has also come up with the multiple brands to attract different customers from various age groups and various segments. The travel industry is also growing rapidly in India which will benefit the organization to get higher growth. Strong brand value and large distribution network help VIP to penetrate the domestic market across the geographies. This help to increase customer reach of the retail segment and help to maintain the leading market share in the competitive environment. Luggage as a fashion accessory is also influencing luggage suppliers to provide modern, lightweight luggage items suitable for continuous use. Luggage as a fashion accessory has become popular over the last few years, especially in developed and mature markets such as that in the U.S. which has led to increase in demand for luggage, especially business and travel related luggage. VIP with its favorable market positioning is well placed to capitalize on the growth potential of the market.

Growth potential of online sales

The share of online sales in overall revenue is less than 5% and the revenue from online sales showed a jump of more than 300% in the last quarter. The products of VIP are available in all major e-commerce portals such as Amazon, Snapdeal, Myntra and many more. This will help VIP to tap the huge growth potential of the fast growing digital and online platforms as more and more people are interested in shop online than going to shops and outlets mainly due to offers, sales campaigns and availability of EMI services in this platform and the availability of wide product range in this platform.

Sound financials

The top line of the company has grown at more than 7% in last 5 years on consolidated basis and debt has came down substantially from Rs.84.15 crore in FY12 to Rs 14.2 crore in FY16 from . We believe that VIP industries will continue with its growth momentum. VIP is highly expected to become a debt free company at the end of the current financial year. Rise in exports and increase in sales of premium products will benefit companies overall revenue and margins. As there is no major expansion plans scheduled for the near future, we feel that the company’s financials will not face any major headwinds in the near term.

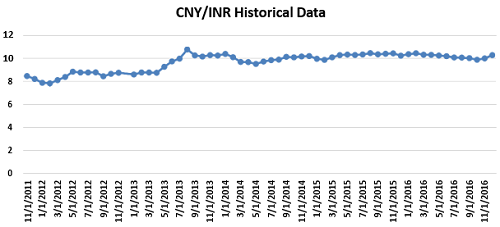

Rupees – Yuan exchange rate

VIP Industries Ltd derives ~30% of sales through hard luggage, which is manufactured in-house. The remaining 70% comes from soft luggage, which is primarily imported from China. The exchange rate of CNY/INR is excepted to favor Rupees in forcible future. Rupees is to forecasted to regain strength mainly due to stable economy, decreasing inflation and increase in GDP growth which may direct Chinese fund flow to India. With the prices of crude excepted to trade in the range of $50-$60 per barrel in the coming future can work in favor of VIP as crude oil derivatives such as Polypropylene and Polycarbonate are major raw materials. This can make positive impact on the manufacturing and cost expenses along with improvement in margins.

Carlton acquisition helps to make global inroads

VIP Industries Limited operates in the UK through Carlton Travel Goods Limited. Carlton is a fully owned subsidiary of VIP Industries.VIP acquired Carlton in April 2004 to gain access to European markets. Carlton handles all the UK operations of VIP and markets the products of both VIP and Carlton across the whole of Europe. Carlton's production activities have been shifted to its Nashik plant in India so as to enhance the plant's utilisation capacity. Carlton products are designed in the UK and warehoused at three locations across the UK and Europe. The marketing and sales department of Carlton Travel Goods approves its designs.The company has its sales offices in London, Dubai, Mumbai and Hong Kong. Carlton has technical excellence in the manufacture of trendy luggage. VIP is targeting at establishing Carlton as a 'premium' brand and replicating its success in the UK to the rest of the world. Carlton has many premium and super-premium brands in its product portfolio such as ebony, sonic and ergo.VIP has also acquired a licence from Delsey, a premium brand luggage manufacturer from France, which will help it to market its premium range of products across the globe, particularly in Europe. It has won several awards for its innovative designs from big institutions such as British Design and Art Direction, the UK; Laboratorie National D'Essai, France; Geprifte Sicherheit, Germany; and Stichthing Ivha, the Netherlands. Carlton is excepted to help VIP to create global foot print and to become a major player in world bags and luggage market.

Nifty 50 and VIP price comparison

Conclusion and Recommendation

VIP Industries is a dominant player in the Indian bag and luggage industry with wide market reach and diverse product portfolio. VIP works on asset-light model as it outsources a significant portion of its products to China/Bangladesh. Globally, China is the hub for soft luggage sourcing. VIP Industries Ltd has enough capacity to cope with elasticity of demand and supply. Along with increase in per capita income in India, change in consumption pattern along with the synergy of using capacity of scale in Bangladesh subsidiary, pickup in demand of high margin products along with GST and favorable forecast of crude oil prices, we expect company to outperform the industry in the both medium term and long term future.

Post a Comment

|

DISCLAIMER |

This report is only for the information of our customers. Recommendations, opinions, or suggestions are given with the understanding that readers acting on this information assume all risks involved. The information provided herein is not to be construed as an offer to buy or sell securities of any kind. ATS and/or its group companies do not as assume any responsibility or liability resulting from the use of such information.